Oil and Tobacco

The oil and gas industry has a problem. Capital is leaving in droves. The industry is on the receiving end of increasingly negative social commentary and facing calls to pivot to greener energy sources. The workforce is losing talent left and right. And at the same time, there is immense pressure for companies to become profitable and start generating cash flow.

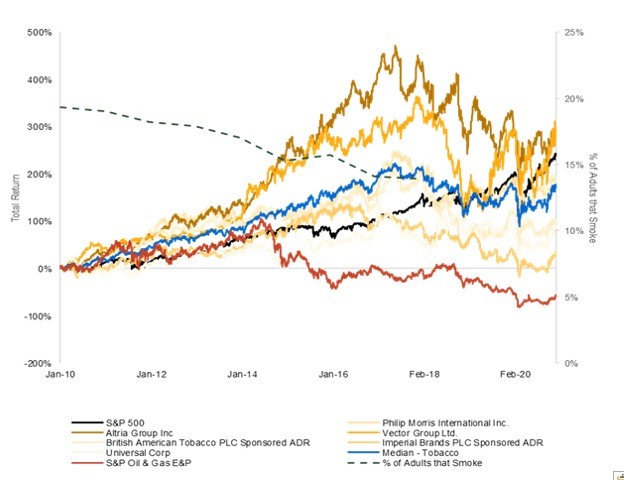

One of the best examples of an industry that’s gone through a similar struggle is the tobacco industry. The 1980s and 90s were a time of reckoning for tobacco, as the medical industry vilified cigarettes, investors faced multiple divestment campaigns, and regulatory bodies sought reparations in the form of litigation, an effort that culminated in ~$365B paid out via the Master Settlement Agreement in 1998. In response, the tobacco industry diverted its efforts to international markets, where social campaigns were considerably weaker, hiked up prices to become more profitable, cut costs, and heavily consolidated. They also made efforts to branch into growthier adjacent products like e-cigarettes and marijuana, albeit with varying success. Three decades later, the tobacco industry has transformed itself from an industry doomed to wither into oblivion into a relatively stable cash flowing machine, throwing off an average ~7% dividend to investors like Allianz desperate for yield. Total return has been stellar compared to the S&P up until 2018 (see Figure 1), when tighter FDA regulations around nicotine content and menthol cigarettes tumbled prices. Nevertheless, the tobacco industry continues to attract contingents of yield investors despite the continuing decline in smoking. It’s not quite a success story, but in the long game, it’s certainly beating expectations.

The analogy one can draw with the oil and gas industry is pretty clear, though not a perfect one. One lesson is that the playbook of demonstrating consistent yield is enough to draw back investor interest against relatively formidable social policy. An offshoot of this lesson is that consolidation and cost cutting are productive measures to achieve that end goal, and ones that should not be ignored as just a phase by those that have seen the industry in better times or believe that a resurgence in the commodity might change any of that. The yield paradigm is here to stay if we are look to tobacco as an example.

Of course, where the seams come loose is in the differences in capital intensity and end consumer between the O&G and tobacco industries. The oil and gas industry is highly capital intensive and produces commodities, which are not as easy to immediately increase profitability on by raising prices. The B2B model of the energy industry solves for the lowest cost product that achieves desired performance levels vs. the B2C model of the tobacco industry that can overcome this with brand favoritism and product differentiation. And while arguably both oil and gas and cigarettes are sold to a more or less captive consumer base (one from a necessity and one from a perceived necessity), the difference here is that the onus for transitioning away from a tobacco addiction is placed on the consumer, while the onus for transitioning away from an oil and gas “addiction” is placed on industry and the oil and gas companies themselves.

This nuance is important in that it demonstrates what a disconnect from consumers can do to create a heavier burden on the producing company. In not providing the necessary tools for a consumer to be able to transition easily, the oil and gas industry is continuing to set itself up for the narrative that the consumer is not to blame. So maybe the lesson here is that there needs to be greater integration between the oil and gas companies and the products that actually use the oil and gas – like vehicles or stoves. Becoming consumer facing could dramatically change the social dynamic and connect the industry with its most vocal opponents to solve the consumption problem together.

It's worth emphasizing that this comparison is NOT saying that oil and gas should be treated like a poison. Oil and gas enable and improve many vital operations around the world, while tobacco is detrimental to human health and welfare on an absolute basis. There are many existing technologies today that can turn oil and gas into a sustainable energy source, while the same can’t be true for tobacco (e-cigarettes tried). That’s exactly why the tobacco industry’s growth today is clearly a hopeful sign. The oil and gas industry has many more options than the tobacco industry to turn around its narrative.

A final lesson from the tobacco saga is that it does pay out to pursue the right growth initiatives. International markets, with a less developed social policy and greater product need, are an obvious target for both industries. And engaging in “smoke free” products with higher growth potential is possible and can be accretive for both the narrative and business itself, though this initiative certainly doesn’t come without risk, most recently demonstrated in the rise and fall of Juul. So the takeaway for oil and gas companies is to continue to seek energy transition opportunities in earnest…but with the expectation that the road will be long and rocky. Some experiments will inevitably fail, but most will certainly be worth doing.