Diving into investor sustainability software

After researching the sustainability stack for corporates last week, I thought it might make sense to look at what a similar stack looks like for investors.

Incorporating ESG, and the closely related sister topic of sustainability, for investors has exploded, largely thanks to a combination of regulation, growing consensus around ESG’s role in long term risk management, and peer/parent pressure. ESG-mandated assets have more than doubled in the last five years to represent ~40% of all managed assets globally. By 2025, that number is projected to be closer to 60%.

Anyone who has worked around sustainability or ESG knows that there is a healthy amount of confusion present in almost all aspects of its incorporation in investing. A big question continues to be what information in this area is relevant to investors, with what’s widely considered relevant information (e.g. impact on environment, impact on community) notorious for being hard to distill down into usable metrics. ESG reporting provisions, which are supposed to help guide these metrics, are incredibly fragmented (over 600 exist as of 2021). And getting any of this information cleanly and regularly continues to be an IT challenge for most firms.

All of this has encouraged startups to develop new tools for investors to manage sustainability and ESG.

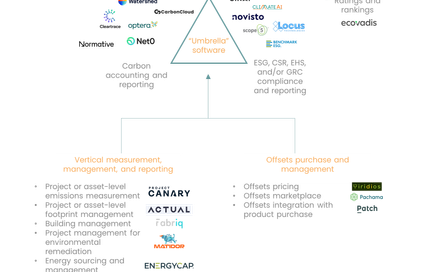

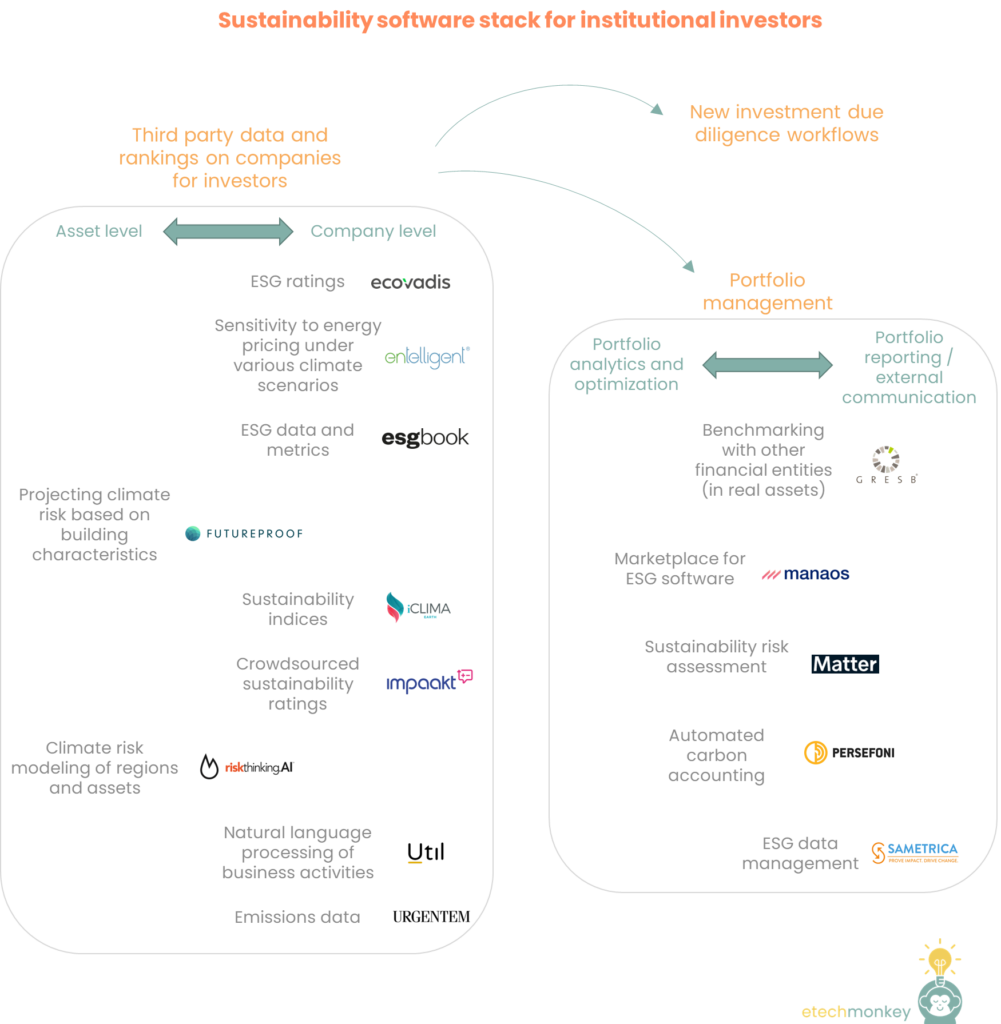

The software stack for investors can be divided into two parts: 1) third party data on companies that is compiled for use by investors, which feed into 2) overarching portfolio management tools. Both areas have a robust number of companies working on solutions within them, though the number of startups in general aimed at selling to investors seems markedly lower across the board than the number of startups aimed at selling to corporates (which is interesting because ESG is supposed to be an investor-facing framework, perhaps a factor of how stingy investors usually are with what software they purchase). Here’s how it lays out in more detail:

(Note that the companies mentioned are not vetted or sorted. This is just a list I compiled of advertised software applications from various companies)

- Third party data on companies for investors can be divided into asset-level data or corporate-level data.

- Asset-level data includes the climate risk of real estate based on building location and structural characteristics (FutureProof) or other physical and transition risks calculated from various climate models (riskthinking.AI).

- Corporate-level data includes ESG metrics (ESG Book) and emissions / targets data (Urgentem). It can also include company ratings, which can be based on ESG questionnaires (EcoVadis), sensitivity to energy prices under various scenarios (Entelligent), natural language processing of publications on business activity impacts (Util), or crowdsourced reviews (Impaakt). It can also include sustainability indices (iClima), though most of them are not startup-produced.

- Portfolio management encompasses portfolio analytics / optimization, which is the use of data to monitor sustainability at the portfolio level, and portfolio reporting, which is the capture of relevant summary data to be shared to LPs, stakeholders, or regulatory bodies. These functions are highly intertwined and many companies offer solutions for both.

- More heavily weighted on the portfolio analytics side include Persefoni, which can automate carbon footprint calculations at the portfolio level through linking to financial transaction data. Persefoni can help investors report carbon numbers but has to integrate with other software for broader ESG disclosure and reporting. Matter is similar in its balance between analytics and reporting – it does portfolio-level risk assessments by flagging potential sustainability issues and also has an API that investors can use to report certain numbers to their stakeholders.

- GRESB and Sametrica I consider more weighted on the external communication side. GRESB does do portfolio analysis, but its primary product is the benchmarking and scoring of investors vs. their peers (and only in the infra/real assets sectors). SAMETRICA, on the other hand, is more reporting heavy because its primary function is to help an investor gather proprietary ESG data from portfolio companies, organize that data into appropriate frameworks, and make it easy for an investor to report that data.

- One startup that doesn’t neatly fit into either category but works “behind the scenes” is Manaos, which offers an open marketplace for ESG software. Investors can use this marketplace to easily trial different ESG packages on their portfolio, which can be important for understanding how different software packages run analytics a little differently from one another.

A few observations:

- I was surprised by the lack of software to incorporate ESG or sustainability into the workflows of evaluating new investments. Perhaps just having the ESG data itself is sufficient for now while ESG is more of a prescreening binary “yes it qualifies” or “no it doesn’t” for new investments, but I would expect these metrics to have a meaningful but highly complex impact on modeled risk-adjusted returns. Once that relationship is more established and calculable, perhaps there will be software developed to help analysts incorporate this data in valuation work.

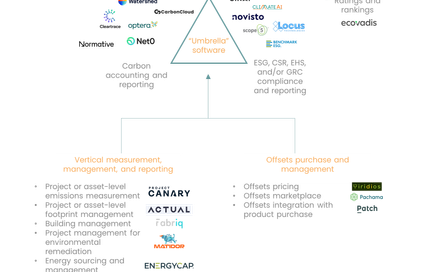

- Similar to how there were a plethora of “umbrella” sustainability software companies on the corporate side, there are a large number of companies working on ESG data management for investors (i.e. what SAMETRICA does above). Like on the corporate side, I would expect a) further consolidation of these companies and b) further differentiation by sector focus.

- The vast array of methodologies to calculate ESG and sustainability metrics for investors was impressive, ranging from using geospatial analysis to NLP on unstructured data to complex climate modeling. I believe more creative approaches will be rewarded as investors continue to explore new, differentiated datasets to find the ones that will be most relevant to their portfolios.

- Third party data seems highly concentrated around public companies due to the availability of information (in fact 5/7 of the companies listed in the company level third party data section above only offer products for investors of public companies, the two exceptions being EcoVadis and Impaakt). More companies in the future will probably start offering private company ESG ratings, which means utilizing non-traditional data sources. ERM, for example, just recently announced a product targeting the private markets that uses “intelligent web-crawlers, APIs from an ecosystem of data providers, and alternate data sources.”