You don't get a credit! And you don't get a credit! The impact of IRA’s new clean vehicle credit

On Tuesday, President Biden signed into effect the Inflation Reduction Act. In the last two weeks, I’ve looked at the climate-related credits and the methane emissions reduction fee in the bill. This week, I thought I might be returning back to the topic of carbon footprinting and away from the thrilling world of tax policy…but the question around the EV adoption was nagging me so much that I needed to look into it. So here we go.

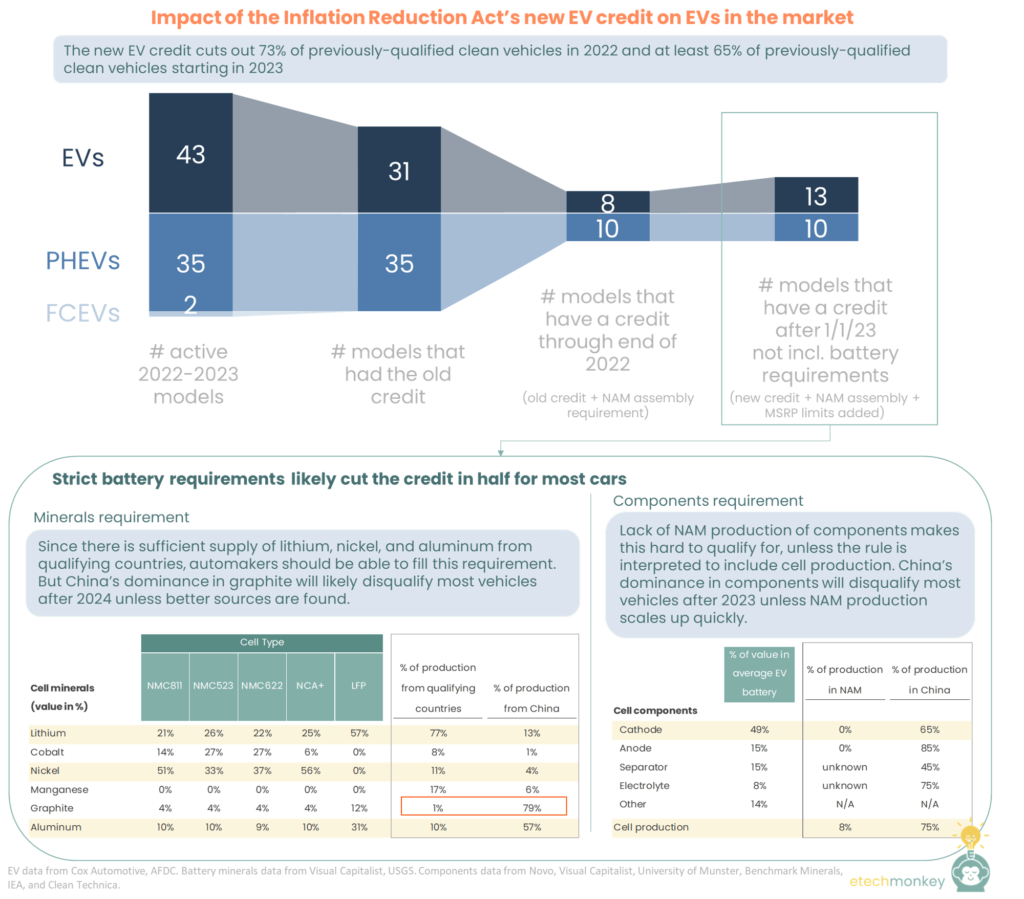

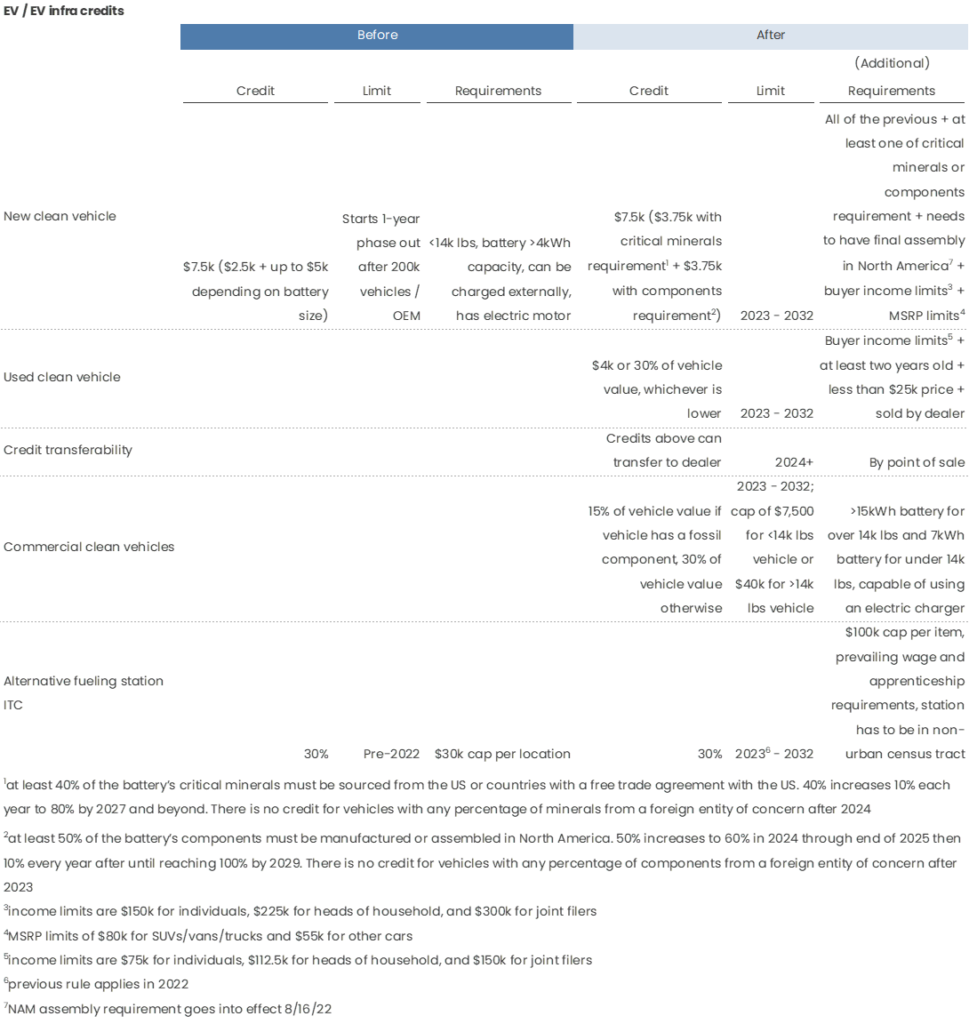

For the most part the IRA is extremely positive, but as mentioned before, the EV credit is the one credit that seems regressive compared to the previous credit, limiting the credit with North American assembly, battery sourcing, buyer income, and MSRP requirements. Summary below:

Overall, some concerning effects about the new credit:

The bill cuts out 73% of previously-qualified EVs/PHEVs in 2022 and at least 65% of previously-qualified EVs/PHEVs starting Jan 1, 2023. The remaining EVs/PHEVs are (unsurprisingly) mostly American.

Out of the 80 EVs and PHEVs that we know are actively being produced for 2022 and 2023, 66 or 83% qualified for the credit (all or some portion of $7,500 depending on battery size and whether the manufacturer’s cap was met) under the old EV credit rules. The ones excluded previously were all of the GM and Tesla vehicles, which have already passed their 200,000-car manufacturer’s cap + the two fuel cell EVs in production – the Toyota Mirai and Hyundai Nexo – which weren’t included in the EV credit but had their own fuel cell vehicle credit that expired at the end of 2021.

Now, with the new clean vehicle credit:

- The NAM assembly rule went into effect the moment that Biden signed the bill, which immediately excluded 50 cars from getting any credit. So only 30 cars, or 38% of EVs/PHEVs, still qualify for the existing old credit through the end of 2022 + the new credit starting in 2023

- What that means is that through the end of 2022, only 18 cars actually have a credit, since out of the 30 cars mentioned above, 12 still have the manufacturer’s cap in effect until the end of 2022. So we go from 66 cars with a credit down to 18, a reduction of 73%

- Starting in 1/1/2023, most of the other rules take effect. This includes lifting the manufacturer’s cap + adding MSRP limits + adding battery critical minerals and components requirements to scale the credit instead of battery size. Lifting the manufacturer’s cap adds back 12 cars but the MSRP limits removes 7, giving us a net gain of 5 cars. So now 23 cars have the credit NOT including the battery requirements. Going from 66 down to 23 is a reduction of 65%.

Assuming the battery requirements are met, those 23 cars consist of:

- Chevy Bolt EV

- Chevy Bolt EUV EV

- Chevy Blazer EV

- Chevy Silverado EV

- Cadillac Lyriq EV

- Ford Mustang Mach-E EV

- Nissan Leaf EV

- Rivian R1S EV

- Rivian R1T EV

- Tesla Model 3 EV

- Tesla Model Y EV

- Tesla Cybertruck EV

- VW ID.4 EV

- Audi Q5 PHEV

- BMW 3-Series PHEV

- BMW X5 PHEV

- Chrysler Pacifica PHEV

- Ford Escape PHEV

- Jeep Grand Cherokee PHEV

- Jeep Wrangler PHEV

- Lincoln Aviator PHEV

- Lincoln Corsair PHEV

- Volvo S60 PHEV

That’s 18 American cars (5 GM cars + 5 Ford cars + 3 Stellantis / Chrysler cars + 3 Teslas + 2 Rivians) or 78% of the list.

For EV purists, here are the numbers with EVs only:

Out of 43 total cars, 31 or 72% qualified for the old credit (again, 12 had already met the manufacturer’s cap). With the NAM assembly requirement, only 8 cars have a credit through the end of 2022 (assuming VW produces this year’s ID.4s in its new Tennessee factory), a reduction of 74%. With the caps lifted and MSRP requirements added in, and assuming the battery requirements are met, 13 cars will qualify for the new credit starting 1/1/23, a reduction of 58%.

It's possible that more cars will qualify as they ramp up their US factories over time. But this will take at least a couple of years for factories to be built and/or for existing factories to be configured for EV/PHEV production.

The battery minerals requirement is actually achievable near-term, but it will likely push battery pricing and also bias EV battery producers to LFP cells.

For the EVs/PHEVs that do qualify for the credit with the MSRP and NAM assembly requirements, there is still the question of whether they also fulfill the critical minerals and components requirements to receive either half (with one requirement fulfilled) or full credit (with both requirements fulfilled).

The critical minerals requirement states that in 2023, 40% of the value of the battery’s critical minerals must be sourced from the US or countries with a free trade agreement with the US. The percentage goes up to 50% in 2024, 60% in 2025, 70% in 2026, and 80% for 2027 and beyond.

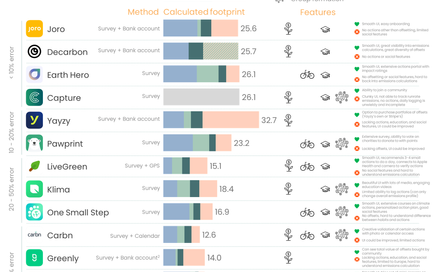

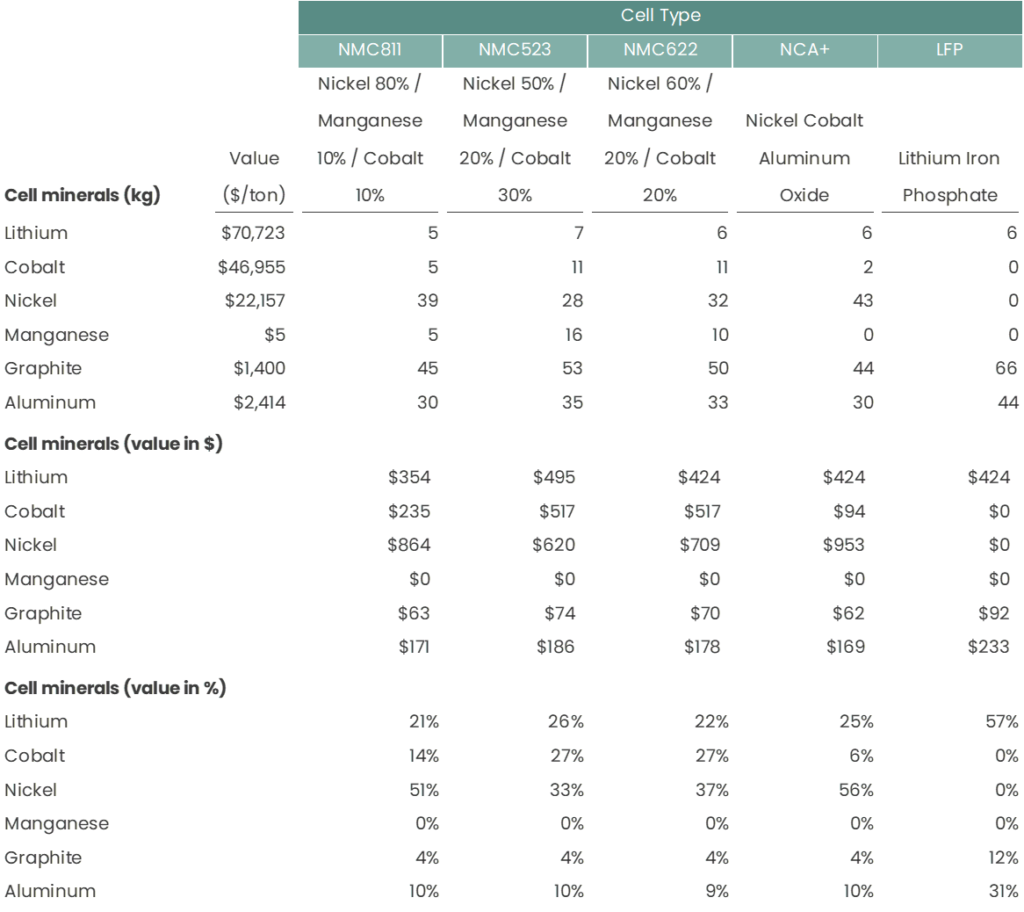

Though the list of critical minerals in the bill is long, only six are material to EV battery composition: lithium, cobalt, nickel, manganese, graphite, and aluminum. The requirement states that the percentage is based on “value” of the critical minerals, which will probably be further clarified by the IRS, but we’ll take to mean market price of each mineral for now. Taking the average composition of minerals in each cell type and multiplied by the market price of each mineral, we get the following matrix:

Different battery chemistries have different value mixes and supply chain challenges. For NMC811 and NCA+, the 40% requirement can be fulfilled by sourcing just nickel from the right countries. For NMC523 and NMC622, the 40% requirement can be filled with lithium + nickel or lithium + cobalt or nickel + aluminum. For LFP, lithium alone can fill the requirement. (This is all assuming for simplicity’s sake that each mineral will be sourced from one location. It’s probably more likely that each mineral will come from a bunch of different locations. The IRS has their work cut out for them to figure out the accounting around all of this.)

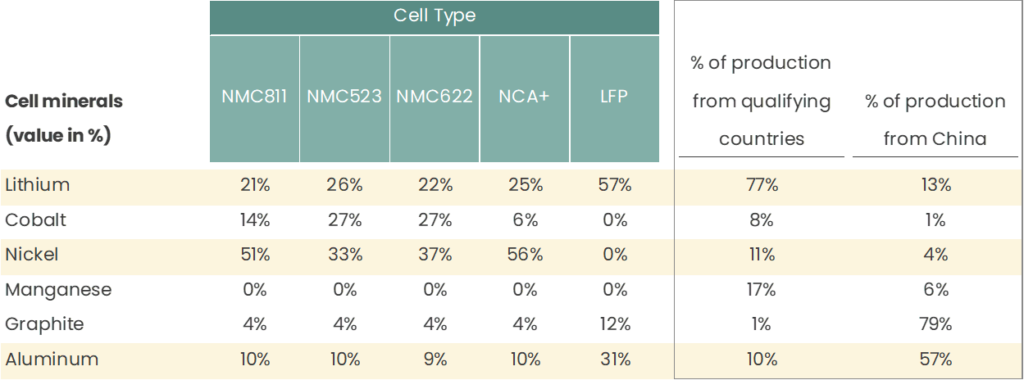

If we take a look at the production of each of these minerals by country, we can tell how challenging it might be to source these minerals from the US or the qualifying free trade countries. Lithium is by far the easiest mineral to source with 77% of production in countries with free trade with the US (Australia, 52%, and Chile, 25%). Next is manganese with 17% of its production in qualifying countries (Australia, 16%, and Mexico, 1%). Nickel has 11% (Australia, 6%, Canada, 5%, and the US, 1%). Aluminum has 10% (Canada, 5%, Australia, 2%, Bahrain, 2%, and the US, 1%). Cobalt has 8% (Australia, 3%, Canada, 3%, and Morocco, 1%). Finally, graphite has a measly 1% (Canada).

First off, thank goodness for Australia. Without Australia’s lithium production and their free trade agreement with the US, most EVs would be screwed.

Second, if we combine this sourcing info with the minerals value matrix above, we can guess that most companies will be relying on lithium + nickel or lithium + nickel + aluminum sourcing to fulfill the requirement. 38% of lithium demand is for EVs at this point, so with 77% of production in the right places, there should be more than enough lithium supply now from the right countries to fill the requirement. The same can be said for nickel, though it’ll be more of a squeeze: nickel for EVs only compose 3% of the nickel market so vs. 11% of production, there should be enough supply for now (it’s probably enough of a shift for prices to go up though). Finally, aluminum is extremely abundant and presents little issue. Current aluminum demand for batteries represents <1% of aluminum production so vs. the 10% production number, manufacturers should have options.

The point is - theoretically, there’s enough production to source battery minerals from qualifying supply sources. Whether manufacturers are already doing that and if not, how long it takes for them to shift to the right supply sources, is a different question. Also, since most EV batteries are NMC, if shifting supply drives nickel pricing up, we may see overall EV pricing go up as well.

Finally, because of LFP batteries’ abundance of minerals concentrated in lithium and aluminum, it’s possible we see an accelerated shift to LFP by automakers to ease supply chain burdens and do more business with US-friendly countries. Tesla already uses LFP batteries in its Model 3 and Model Y base models and will probably qualify for this part of the credit as a result.

Graphite will be an issue for most EVs after 2024

A caveat to the above statement is that part of the battery minerals requirement is that no minerals or components will be sourced from a foreign entity of concern (China, Russia, Iran, or North Korea) in 2024+ (2025+ for minerals, 2024+ for components). For graphite, this is a big issue.

82% of graphite currently comes from a foreign entity of concern (79% from China, 3% from Russia, and 1% from North Korea). That’s vs. 33% of graphite that’s used for battery production. And because of graphite’s dominance in battery anodes, anode production is also concentrated in foreign entities of concern (mainly China with 85%), placing the components requirement in danger too.

If we don’t find another source of graphite, it’s possible that the majority of EVs will lose the credit either after 2024 because of the graphite sourcing or after 2023 because of anode sourcing.

The battery components requirement is trickier to get near-term

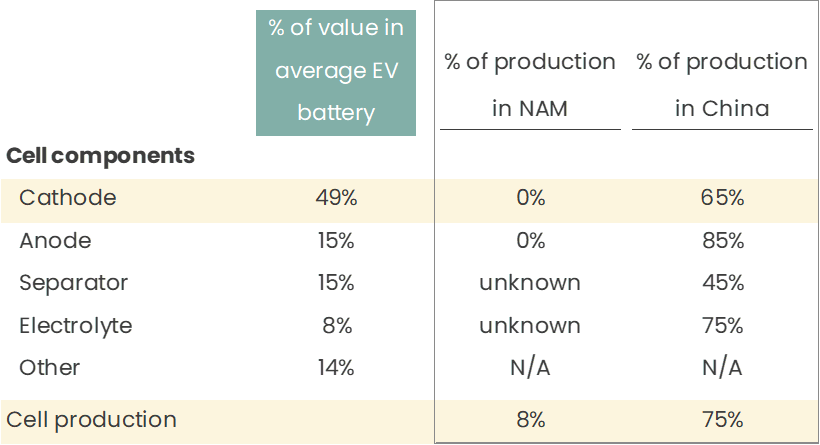

IRA requires that at least 50% of battery components to be manufactured or assembled in North America. This increases to 60% in 2024 – 2025, 70% in 2026, 80% in 2027, 90% in 2028, and 100% in 2029 and after.

65% of cathodes, 85% of anodes, and 76% of battery pack cells are manufactured in China, which does not bode well considering any included components from China after 2023 will disqualify cars from receiving the credit.

The percentage that the credit will be based on is also, similar to the minerals requirement, tied to the “value” of the components. It’s a bit more difficult to figure out what “value” means in this context and if the IRS will reach into individual supply agreements to figure out pricing for each component (hard to imagine that being practical). It seems like several sources (Novo, Visual Capitalist, University of Munster, Benchmark Minerals) point to the cathode being anywhere from 30 – 67% of the cost (depending on cathode pricing), the anode another 15%, the separator anywhere between 10 – 20%, and the electrolyte 5 – 10%. To get to the 50% requirement, manufacturing at least the cathode domestically seems necessary. Though there have been some announcements (Tesla, GM, Redwood, Lithium Werks) on large scale domestic cathode production, most facilities are in the earlier stages of development, which leaves at least 2 years of limited options for OEMs to qualify for this credit.

The flip side of this is depending on the interpretation of “manufactured or assembled,” it’s possible that all that matters is that the components are assembled in North America. If that’s the case, then there are existing options. Several OEMs already have cell production in the US (GM, Ford, Tesla), with many more battery cell factories on the way.

So in summary, for the 23 cars that will qualify for the credit after 1/1/23, I’m…

- optimistic that most will meet the minerals requirement near term

- not so optimistic that most will meet the components requirement near term

- not so optimistic that graphite won’t disqualify almost all cars by 2024

…which translates to the average credit being $3,750 until 2024, when most credits will turn to $0 because of foreign graphite/graphite anode production.

Hope I’m wrong and the IRS issues guidelines that totally turn over these interpretations, qualifying more cars.

A few more observations:

This credit favors existing automakers and handicaps emerging ones

The sucky thing about this credit is that it removes the credit for some automakers at the critical launch point vs. later on when the cars have had enough consumer traction to grow on their own.

The two fastest growing EVs this year behind the Tesla Model 3 and the Model Y are the Hyundai Ioniq5 and Kia EV6, both relatively new EVs that have launched in the last year or so and both no longer qualifying for the credit. With an average EV premium of ~$10k, the lack of credit will this price point out of the reach of many consumers that have been considering these cars. Personally, I myself have been looking for a good AWD EV and am struggling a bit to justify paying $51k for an AWD Kia EV6 vs. a $38k fully loaded AWD Kia Sportage (I don’t even get surround view or a sunroof in the former). That sentiment is echoed across many different forums that I follow (r/electricvehicles, r/KiaEV6, r/Ioniq5) and I suspect that this will reflect poorly in Q3 and Q4 sales numbers going forward.

The problem is exacerbated for startup companies. Rivian is set to barely qualify for the credits with their base models but their higher margin near-term deliveries will exceed the MSRP caps. Fisker and Polestar both don’t fulfill the NAM assembly requirement and won’t get the credit. For a startup OEM, slower sales in the beginning has an outsized negative impact on further growth, limiting their ability to generate cash flow to reinvest in further growth or raise more money from investors. An incumbent OEM has 1) the advantage of being able to eat some of the losses of a lackluster launch with their other product lines and 2) the advantage of an existing brand and consumer traction to support their EV growth.

With the new credit favoring existing automakers with the resources to pivot production, source more expensive materials, and/or have enough traction to not need the credit, the startup OEMs have higher hurdles ahead.

This credit also excludes a good portion of buyers likely to buy an EV

The bill imposes income limits of $150k / single and $300k / joint filers to qualify for the credit. While this is reasonable, it does mean that an estimated 42% of EV buyers are now excluded from qualifying for the credit.

Money matters, especially in America…52% of Americans state that cost is a major barrier to getting an EV. 53% of Americans surveyed would NOT pay more for EVs vs. 22% of consumers globally.

A tax credit helps. 35 - 48% of Americans state that they’re much more likely to get an EV with a tax credit.

Again, like most of the requirements in this new credit, it’s hard to say how much the income limits will affect EV adoption…but 42% is a lot of people to exclude. And your average American seems reluctant to overpay for an EV unless it comes with a tax credit. We can only hope that more Americans will see the value of getting an EV despite the cost and/or OEMs will start lowering prices to appeal to the American buyer.

EV adoption in the US will probably slow down

A quick perusal of Reddit provides plenty of anecdotal evidence that consumers are rethinking EVs with the (lack of) new credit, but how much will this actually slow down EV adoption?

The good news is that most of the recent US transactions are from cars that will continue to have the credit going forward (or at least some credit, depending on the minerals and components requirements). 66% of 1H 2022 y/y growth in EV/PHEV sales were driven by 16 cars that will qualify for the new credit (mostly Tesla and some Jeep and Ford PHEVs).

That does leave 34% of growth without a credit though…and that 34% of growth represents 43 car models. This portion of the pie has also been growing much more quickly, boasting a CAGR of 119% vs. the credit-carrying group’s CAGR of 57% over the last 10 quarters.

Many estimates have EVs growing to ~30 – 50% of US new car sales by 2030. At the low end, that represents an additional 4 million car sales vs. 2021 numbers. If the credit-carrying category keeps up a 28% annual growth rate until 2030, we can theoretically reach this number without needing other models. And so far, that category has been posting CAGRs much higher, so maybe we’re ok.

But if we assume that the projections slow Tesla growth to a more mature growth rate, as EVAdoption has done, then we’ll more likely need 3.5 million cars from other OEMs by 2030. 2.5 - 2.8 million of those cars will likely be from non-credit carrying cars. If the lack of EV credit slows down adoption of these cars by 5% a year, we’ll be looking at closer to 25% of new car sales by 2030 instead of the currently projected 30%. If it slows down adoption by 10% a year, that’s 22% of new car sales by 2030.

So yes, this credit will probably have a negative impact on EV adoption. The numbers CAN be compensated by more aggressive growth assumptions for Tesla, GM, and the other automakers that do qualify for the credit, but that’s only if these automakers can deliver on production and sell more to consumers with lower incomes.

Basically - we’ve either crippled our adoption by a few percentage points OR placed a large portion of our bets on a few companies to help deliver on 2030 projections.

TLDR; the new EV credit, while likely to help boost domestic manufacturing and sales of US car brands, does so at the expense of EV adoption. It will make EVs more expensive for the consumer by limiting supply chain, handicapping competition, and removing the credit for a good chunk of EV buyers.