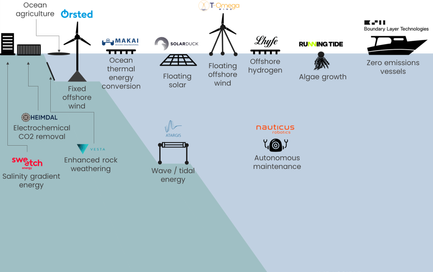

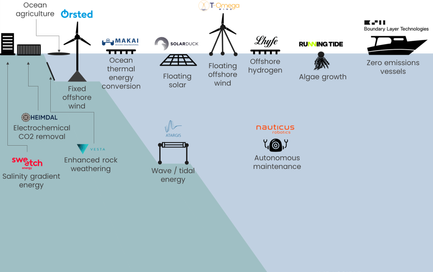

After looking at the breadth of ocean-based climate solutions last week and having a better understanding around the potential of the ocean, I thought it might be informative to look at wave energy more specifically.

Four things that are worth noting about the wave energy space:

- The resource is huge. As mentioned last week, wave energy has the potential to be a critical asset for clean power generation. Wave energy alone can fulfill 67% of current US electricity demand (2,640 TWh / 3,930 TWh) and 140% of current world electricity demand (32,000 TWh / 22,848 TWh). By 2050, those numbers will be 51% (2,640 TWh / 5,138 TWh) and 71% (32,000 TWh / 45,000 TWh). If looking at just the population of people along coastlines, wave energy can potentially fill all of that power demand.

- It’s incredibly technical. Because waves have both an amplitude and period, the capture of their associated kinetic energy requires much more than simply having the waves pass through a turbine. Designs need to transfer the motion of a wave, something that is non-linear in multiple directions, into movement that is linear/unidirectional for a generating system like a turbine, all with energy loss minimized as much as possible. This is very difficult with fluids that move as chaotically as the water in the open ocean. Minute Earth explains it well here.

In addition to the technical challenges of actually capturing the energy, there’s the design challenge of building a device that is resilient against storms, biofouling, and corrosion. A device that is optimized for kinetic energy capture may not be optimized for the occasional violent wave or high wind event. A device that is optimized to do both may have an expensive and impractical maintenance schedule. (Luckily, automation and IoT have helped wave energy converter developers set up systems that respond immediately to potentially disastrous circumstances and alert those onshore of any components that need maintenance.)

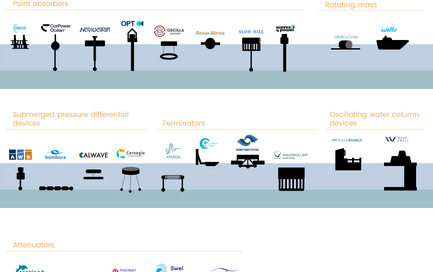

All of these engineering challenges need to also be addressed with a design that is cost efficient, further increasing the difficulty. - The combination of the above has created a large ecosystem of creative and diverse wave energy converter designs. The Liquid Grid lists out 130+ different wave energy converters, the vast majority of which are being developed by separate companies. Most fall into seven categories (point adsorbers, terminators, oscillating water columns, attenuators, oscillating wave surge, submerged pressure differential, and rotating mass) but designs can be very different even within each category. For example, though both ExoWave and AW-Energy are classified as oscillating wave surge, one uses moving cones while the other uses a large moving panel. I’ll take some time next week to map out the different wave energy startups with active designs, but for now, know that they are quite diverse in their approaches.

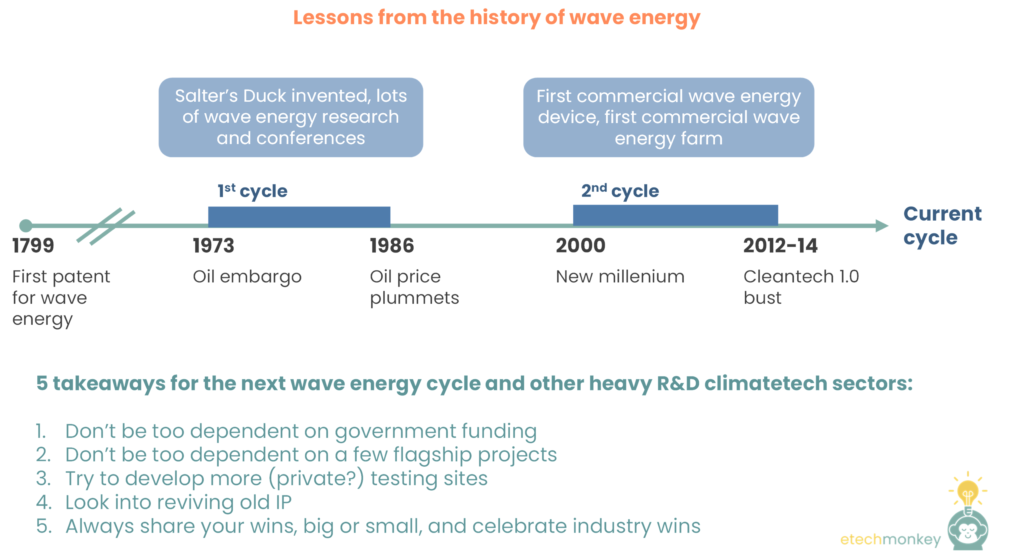

- History has been unkind. Wave energy actually has been around for as long as other renewable technologies like solar and wind, with its first patent tracing back to the late 18th century. Its failure to commercialize as quickly as other technologies can be attributed in part to unfortunate historical dynamics.

First, the competition with wind energy placed pressure on wave to commercialize too quickly during the 1970s oil embargo. Prior to the 1970s, wave energy had actually been on a steady rise. Hundreds of patents had been filed for new wave energy converters throughout the early 20th century and significant advances were made by Yoshio Masuda, the father of modern wave power, in the 1940s and 50s.

The oil embargo of the 1970s spurred a step change in interest in renewables, including wave energy. On the one hand, it incentivized many countries like the UK and Norway and academic institutions like the University of Edinburgh and MIT to start seriously participating in wave energy research. On the other hand, it led to rapid investment in technologies that achieved first commercial, leaving slower-developing technologies behind. For wind, these commercialization milestones were hit in a short period of time. Between the oil embargo in 1973 and the end of high oil prices in the early 1980s, the first US wind farm was put online (1975), the first multi-megawatt turbine was produced (1978), the first commercial wind farm was deployed in New Hampshire (1980), the levelized cost of wind reached $0.38/kWh (1980), several commercial turbine manufacturers were founded (1980 – 1986), and more than a dozen other wind farms were deployed in the US.

For wave, the story played out a big differently. Though exciting developments occurred during this time period, including the invention of famous wave energy converter Salter’s Duck in 1974, the emergence of critical studies for wave energy design, and the establishment of many wave energy-dedicated international conferences in the late 1970s/early 1980s, no technology ever made it beyond the small-scale prototyping stage (even Salter’s Duck). By the mid-1980s, lower and lower oil prices and competing nuclear energy programs led to wave energy programs being shut down and funding being pulled from key technologies. Unfortunately, because wave never hit first commercial, technology development stopped once macro tailwinds disappeared. And because wind had already hit its stride, those that were keen on continuing renewables investment flocked to the winning horse. For wave energy, the window of opportunity vanished before momentum hit.

Wave energy got its second run in the new millennium, but again, market forces led to pre-mature conclusion. 2000 saw the world’s first commercial wave power device in Scotland by a company called Wavegen. This was followed by a number of other key milestones for wave by Pelamis and Aquamarine Power. In 2004, Pelamis tested a full-scale prototype at a wave test site in Scotland and later, in 2008, deployed a 2.25MW commercial farm in Portugal, the first of its kind. Similarly, Aquamarine Power deployed two full-scale prototypes (315kW and 800kW) in 2009 and 2012, respectively. But again, both companies eventually failed because of market timing. Pelamis’ farm was shut down due to technical problems with the generators and lack of funding from the financial crisis to redeploy them. Pelamis later went under in 2014 after failing to acquire more funding (a product of the cleantech 1.0 bust). Aquamarine, despite two successful prototypes and a recently won government award, failed in its 2014/15 raise, resulting in the shutdown of the company. Thus a combination of unfortunate timings around two major macro busts (recession and cleantech 1.0 blowup) cooled down developments in wave energy yet again.

These four characteristics of wave energy – the fact that the market is huge, the problem is hard, the technologies are diverse, and the history is long – make it an interesting case study for other hard tech climatetech spaces, especially those that are going through a similar Cambrian explosion of technology. There are lessons that we can take from looking at this area for not only the future of wave energy development but for the future of other climatetech sectors with a similar profile.

Here's what I observed:

- The wave energy industry depended too much on government funding. One issue with why the first cycle for wave failed was that technologies were dependent on ephemeral wave energy programs set up by governments whose agendas eventually pivoted. While government funding has led the way on development thus far, history shows us that in order to keep this current cycle going, we need investment from private dollars not subject to capricious political budgets.

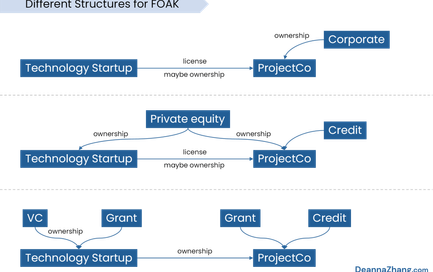

- The industry was balanced on too few demonstration projects, leading to large losses for the entire industry when those projects went bust. This is especially evident in the second cycle, when wave energy’s renaissance was led by only two major flagship projects: Pelamis and Aquamarine Power. The loss of both of those in a short time period was a huge blow to the wave energy industry. In the future, we need to make sure funding is distributed across many different flagship projects for the overall health of the industry.

The other takeaway from this point is that licensing out the technologies to developing entities can help reduce the risk that a technology will die when a company dies. Perhaps we need to be pushing for more licensing models across R&D-heavy climatetech sectors to better the chances of an industry’s longevity. - Having access to sufficient testing sites with infrastructure that made up the balance of plant was critical for companies being able to iterate their technologies before first commercial. There are more testing sites for wave energy than ever these days, thanks to entities like the Oregon State University, University of New Hampshire, EMEC, The Marine Institute, and many more. But there is still a need for more testing sites, especially ones that can be near potential demand sources for wave energy, like aquaculture, desalination plants, or hydrogen production, in order to properly test load requirements. Going to public or philanthropic sources of funding for these testing sites can be a long journey (PacWave took 10+ years). Is there a way we can incentivize private parties and corporates with pre-permitted sites to offer more testing facilities?

- Revival of old IP is a worthwhile strategy, especially in industries like this that require significant R&D. Long science can sometimes pay off but can also result in lost IP when market forces prevent commercialization. Our technology / VC-heavy ecosystem places a significant premium on new IP, but perhaps it’s worth checking to see what IP may have been unfairly lost in the past and creating an early stage investment ecosystem that supports old IP revival.

- Lack of momentum can have outsized impacts on funding potential. As we saw with wind after the oil embargo, a series of milestones achieved in a short period of time is what allowed it to persist through a competitive oil price environment in the 80s. Lack of that momentum is what led to wave cycle 1’s demise.

There’s a micro and macro lesson here. On an individual company level, demonstrating consistent momentum can make or break your future funding rounds. In practical terms, that means making sure to announce wins – big and small — on a regular basis.

Similarly, on an industry level, demonstrating consistent momentum can lead to more funding and longer support for everyone in the space. That’s why celebrating wins from other companies in the industry, even competitors, can be net positive.

Would love to hear if there are other lessons from those that lived and breathed this cycle or that have seen this play out in other sectors.

Look forward to diving into the wave energy market map next week. Stay tuned!

CERAWeek Reflections, FOAK Happy Hour Diagrams, and New Blog (no more Etechmonkey!)