Taking a left turn here this week to talk about family planning and emissions.

The reversal of Roe vs. Wade was a huge event for American politics and threw the abortion debate back into the spotlight. 27% of voters now say that their candidate must share their views on abortion, a record high, while 16% or voters say abortion is not a major issue, a record low.

For most people, the abortion rights issue is a deeply personal one. Abortion is seen as an infringement on a personal belief system, a symbol of the government’s protection of a personal human right, or a personal healthcare need (almost a quarter of women in the US will experience an abortion sometime in their life). It’s a sensitive and divisive subject, one that’s most often discussed as a social issue or, in some cases, a women’s issue.

It’s not just a social issue though. Family planning has documented effects on other parts of society, including workforce demographics, poverty, economic growth, childhood education, and public health. Its presence or absence can drastically influence how societies grow longer term, which can color how systems that work around that growth should be built. Climatetech, I suspect, is one of those systems. I’m writing on this topic today to better understand how to think about family planning relative to our climate problem.

Here's what I found:

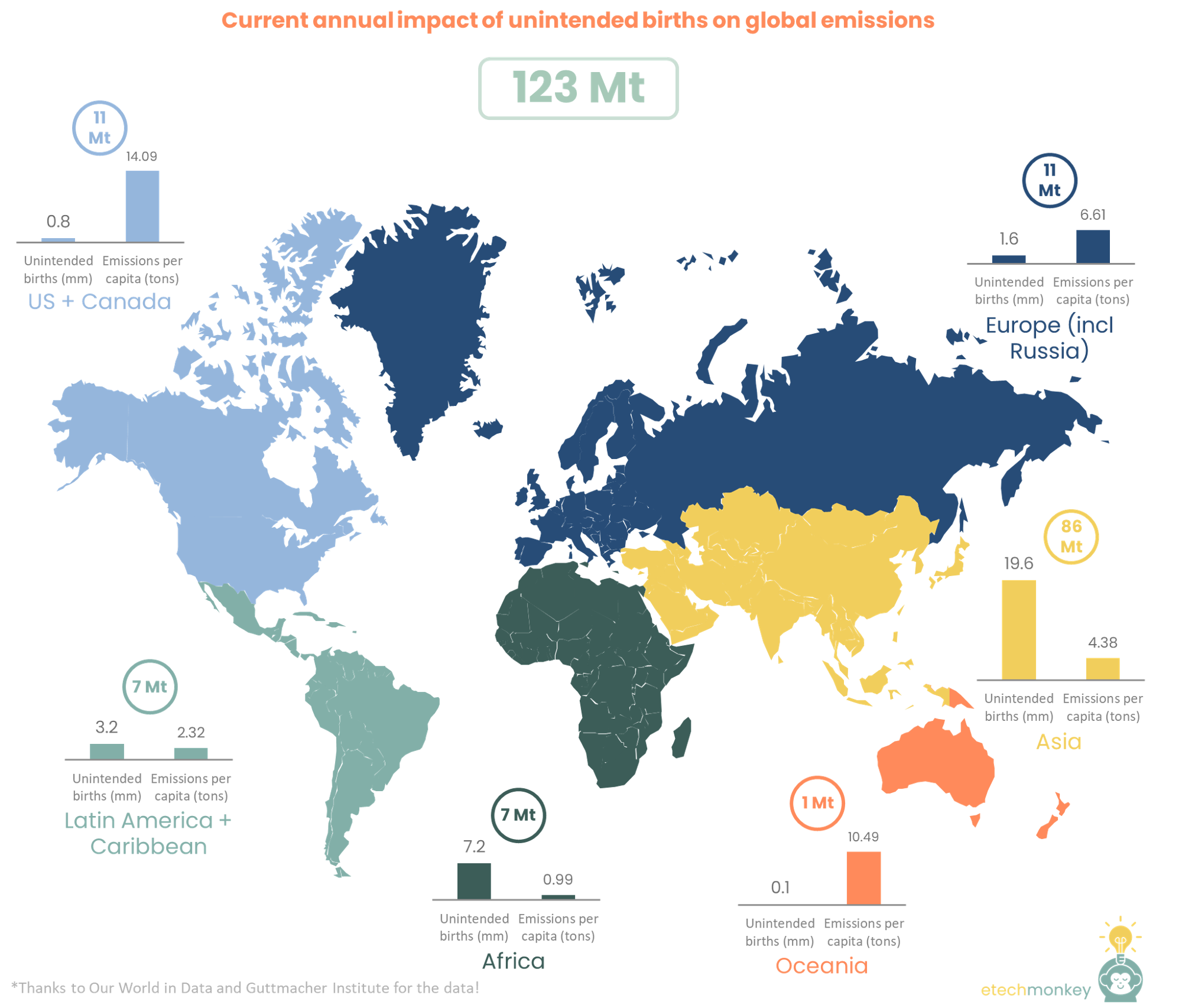

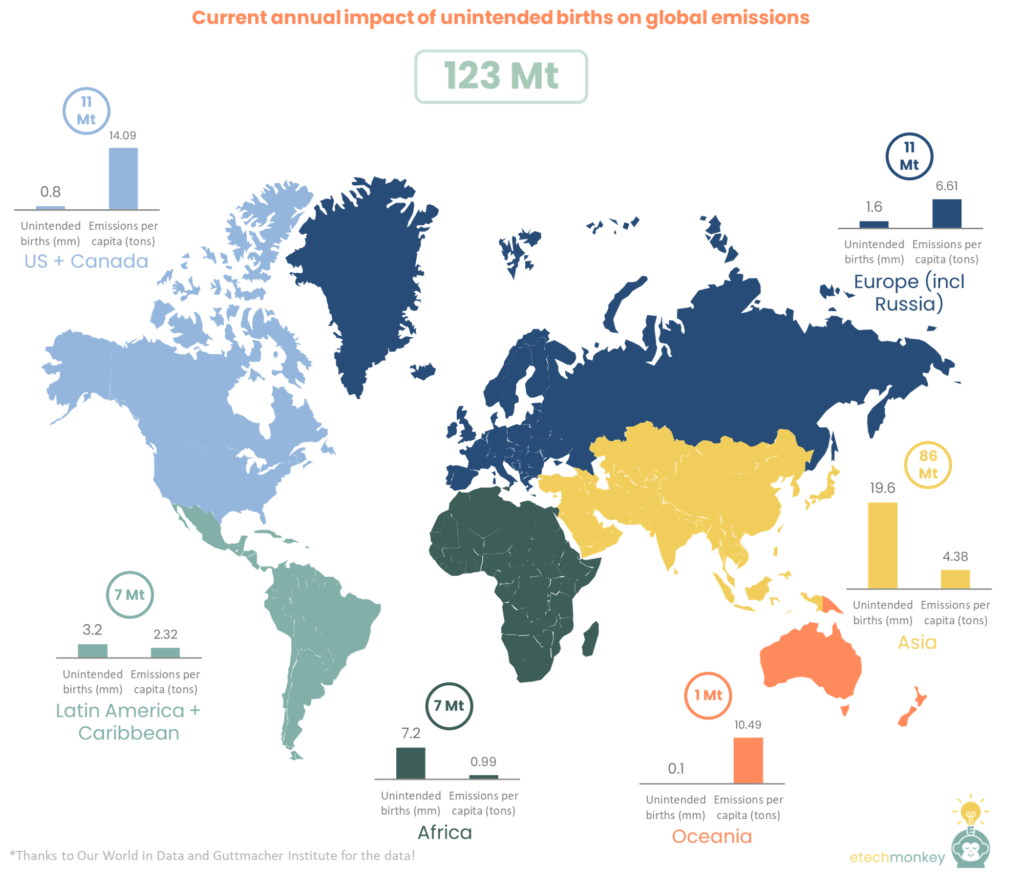

I think when I came into this topic, I had the notion (perhaps because I spent a lot of time with the Project Drawdown estimates from the last few weeks) that family planning would have a huge impact on emissions. But the reality is that while the numbers aren’t insignificant, they are modest compared to the potential impact of new technology solutions, especially ones that target our underlying industrial systems. We can use it as an effective solution, especially as it addresses other social and economic goals in parallel, but it definitely cannot be the focal point for an effective climate strategy.

Another point worth mentioning is that family planning has already come a long way, especially in developed nations where emissions per capita are highest. If we stop paying attention to family planning and let fertility rates run unchecked, there could be multiplicative effects on emissions far greater than that of developing nations. So it’s definitely something we need to make sure to maintain at sufficient levels to allow our emissions problem to not grow too large for us to handle (though many might say we’re already there).

To continue with the circular economy theme, this week I’m covering different technologies that have emerged in recycling.

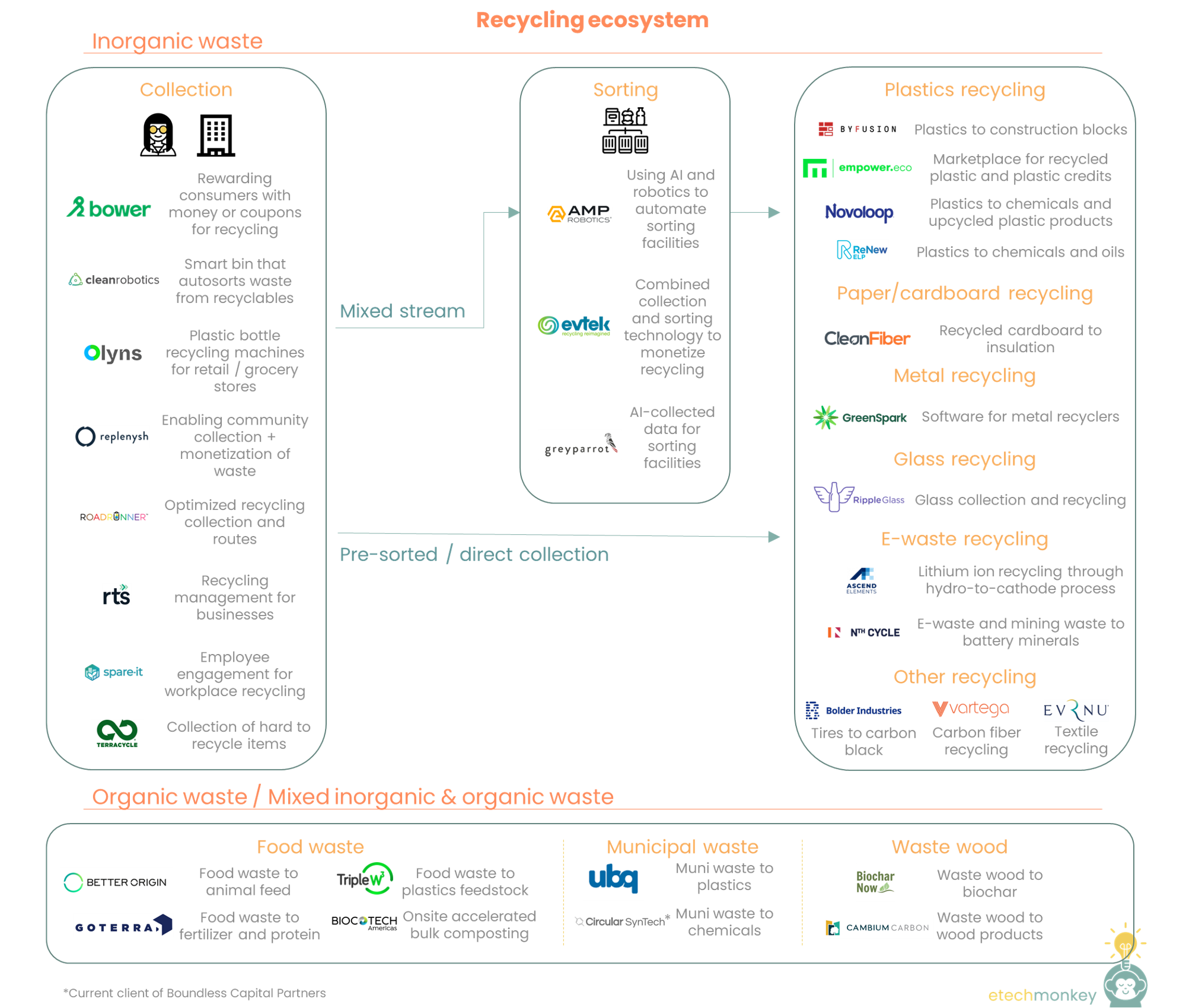

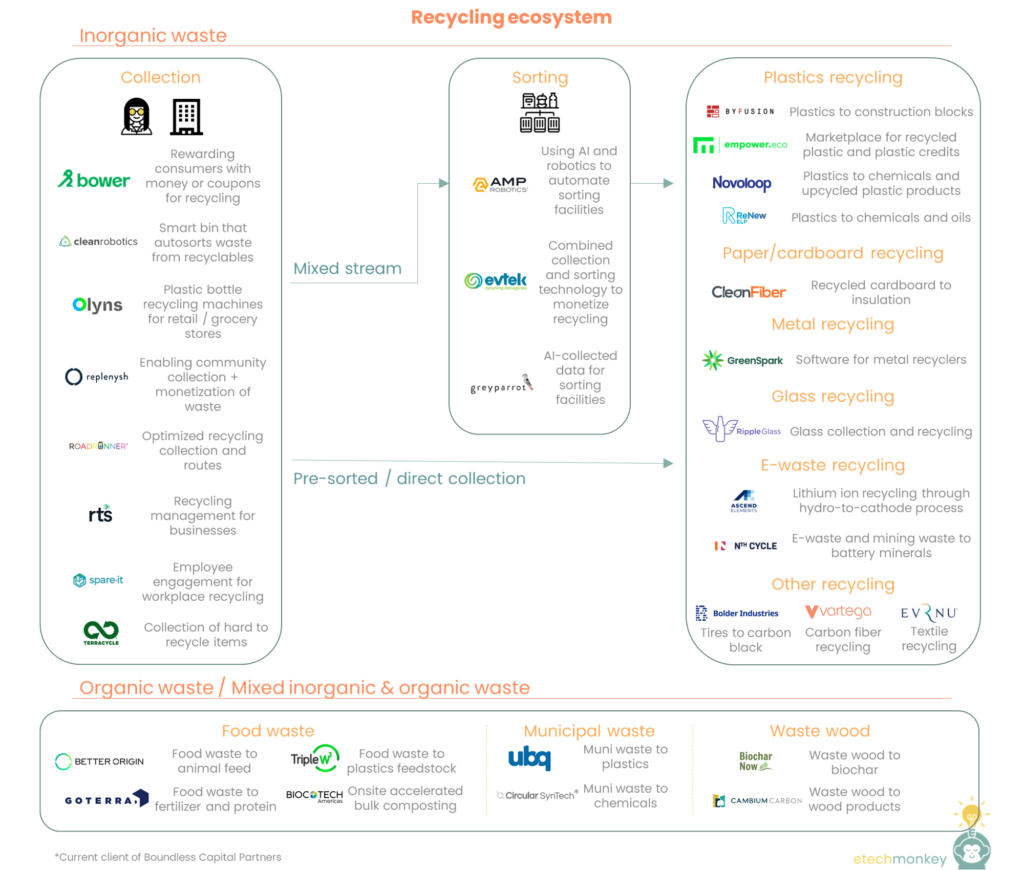

The landscape can be divided into two parts: inorganic waste and organic waste. Inorganic waste includes your typical recyclables (cardboard, plastic, glass) and other waste that is harder to break down in a landfill (textiles, carbon fiber). Organic waste is waste that contains organic compounds like food waste, biodegradable materials, wood, waste plants, etc.

When we think of recycling, we usually think of inorganic waste. Since it can’t be easily broken down by microbial organisms, inorganic waste must be 1) collected & transported to a sorting center, 2) sorted into different bales of material, and 3) shipped off to specialized processing facilities for recycling into new materials or products. Each one of these steps has a variety of startups attached to them:

(Note that the companies mentioned are not vetted or sorted. This is just a list I compiled of advertised technologies from various companies)

Recycling organic waste is also a very important part of the recycling ecosystem. Organic waste can generally be divided into food/ag waste, municipal waste, and waste wood (wastewater sometimes get included in this too, but I think water warrants its own topic).

All of this just covers a fraction of the innovation we need in recycling. Making anything valuable from discarded material is a hugely creative task and will require the scrappiest of entrepreneurs, pun intended.

*Circular SynTech is a client of Boundless Capital Partners, of which I am an advisor.

Today I want to talk about…recycling!

Recycling is often more so described as “cleantech” instead of “climatetech” because the conversation typically revolves around its impact on surrounding ecology – less trash = less wildlife in danger = better for biodiversity. It’s not commonly talked about in the context of reducing emissions, and in fact, many in the climatetech universe consider recycling to be a potential distraction away from climate goals. Consider these headlines:

But recycling does have a tangible and positive impact on emissions. It helps avoid both the process emissions from virgin materials (by sourcing those materials from recycled material) and the emissions from decomposition of landfill waste (by diverting landfill waste to recycling centers).

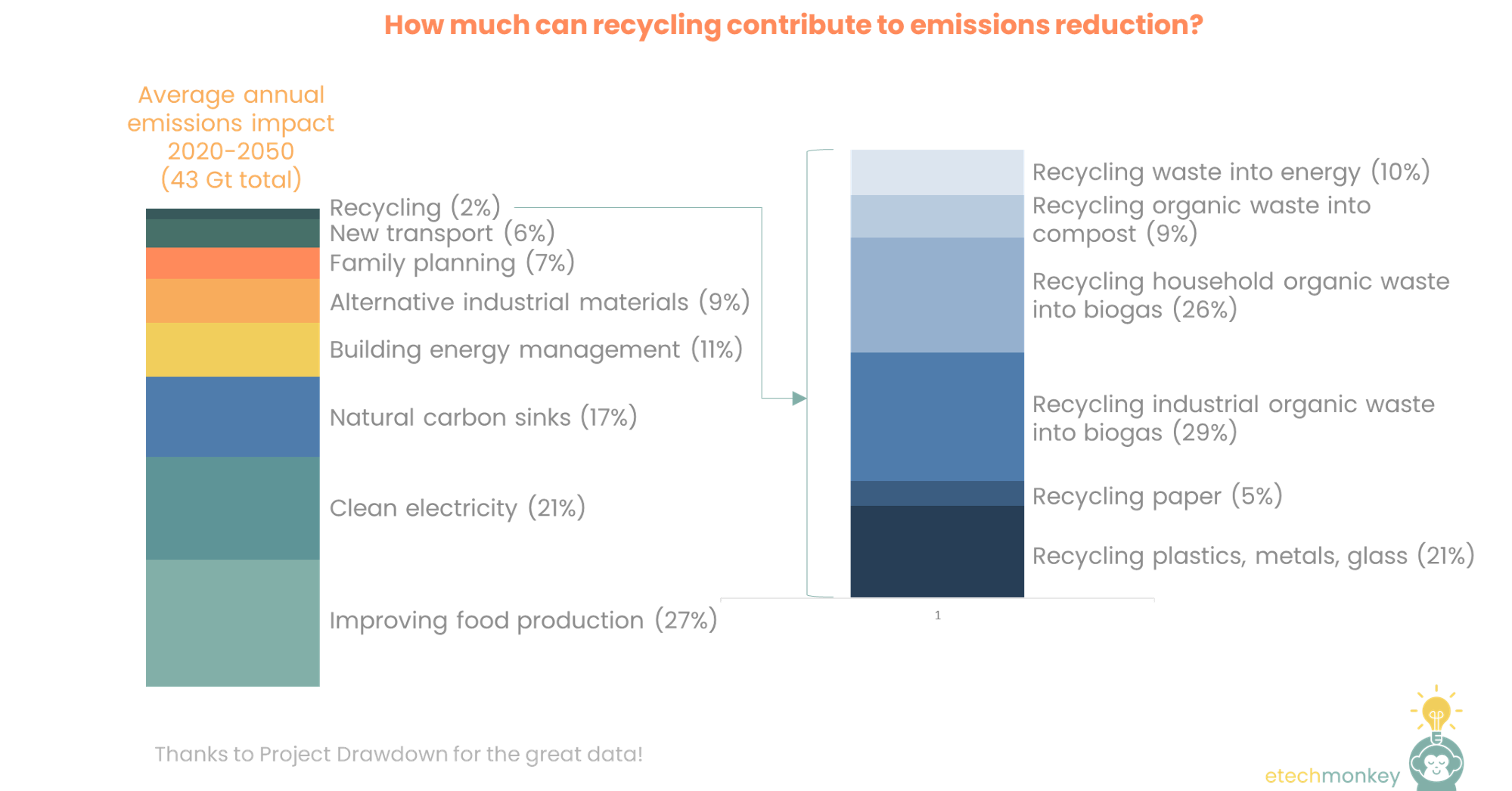

At the surface level, the quantity of this potential emissions reduction is small. Project Drawdown calculates ~0.2 Gt/year average impact (5.5-6 Gt over 30 years) assuming household and commercial recycling rates more than double to ~65-68% by 2050. But that estimate doesn’t cover potential impacts from recycling paper (~0.04 – 0.07 Gt/year), “recycling” organic waste like food scraps into compost (~0.07 – 0.1 Gt/year), digesting industrial scale organic waste from ag and wastewater into biogas (~0.2 – 0.3 Gt/year), digesting household organic waste into biogas for cooking (0.15 – 0.32 Gt/year), landfill gas capture (~0 – 0.07 Gt/year), and other waste-to-energy (~0.07 – 0.1 Gt/year), which all add up to about another 0.7 Gt/year impact. So all in all, the practice of recycling – in the broadest sense of the word – can reduce annual emissions by nearly 1 Gt.

And that’s only the direct impact of recycling to emissions. There are also indirect impacts which are harder to quantify.

The point is recycling does have an impact on the climate and we should care about it for climate reasons in addition to the much-discussed ecological and “courteous neighbor” reasons. It’s not a solution set we should deprioritize because of its arms-length relationship with direct emissions. Recycling is firmly within climatetech.

Next week, I plan to chart out the different types of recycling (and related circular economy) technologies. Stay tuned!

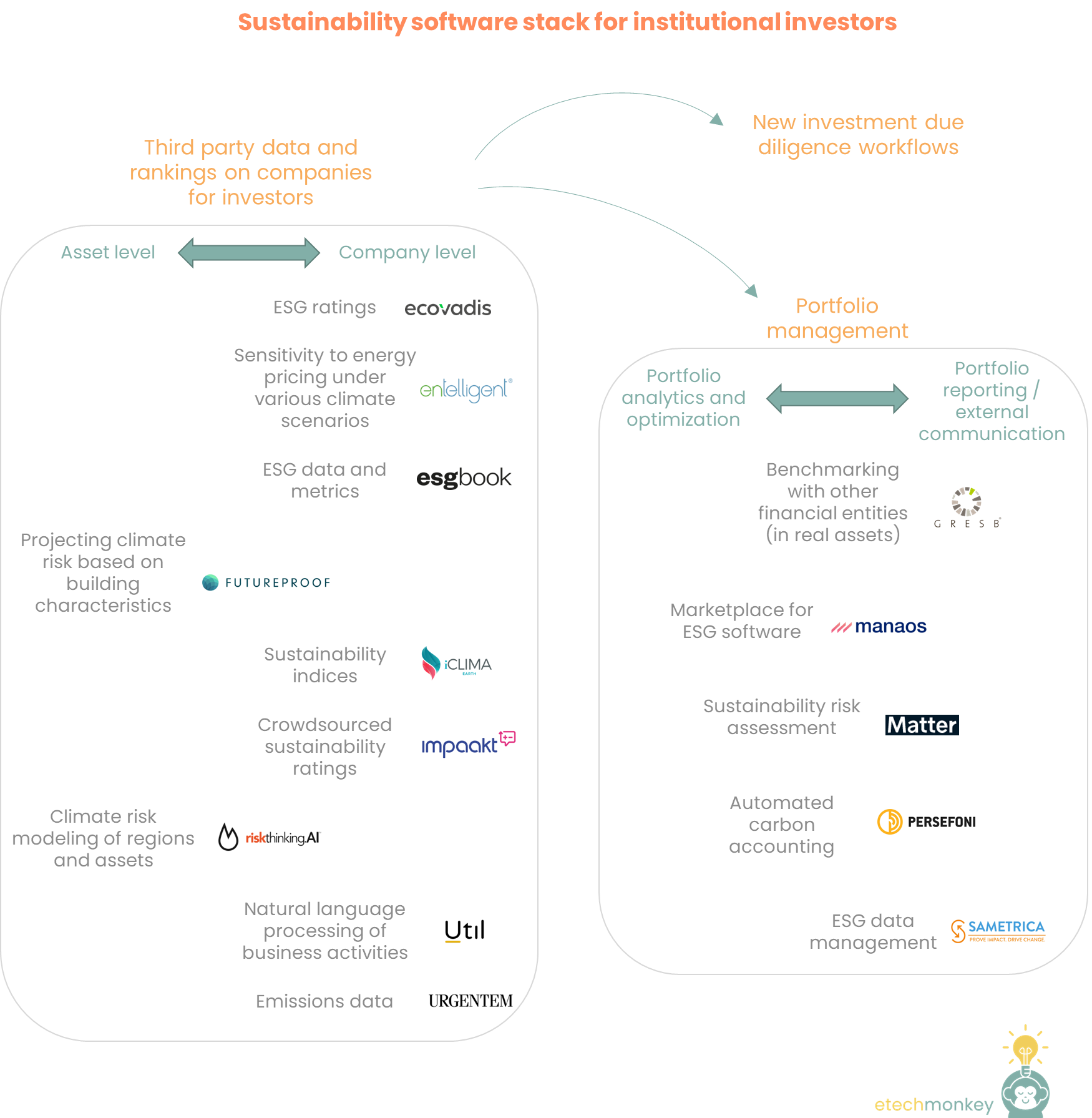

After researching the sustainability stack for corporates last week, I thought it might make sense to look at what a similar stack looks like for investors.

Incorporating ESG, and the closely related sister topic of sustainability, for investors has exploded, largely thanks to a combination of regulation, growing consensus around ESG’s role in long term risk management, and peer/parent pressure. ESG-mandated assets have more than doubled in the last five years to represent ~40% of all managed assets globally. By 2025, that number is projected to be closer to 60%.

Anyone who has worked around sustainability or ESG knows that there is a healthy amount of confusion present in almost all aspects of its incorporation in investing. A big question continues to be what information in this area is relevant to investors, with what’s widely considered relevant information (e.g. impact on environment, impact on community) notorious for being hard to distill down into usable metrics. ESG reporting provisions, which are supposed to help guide these metrics, are incredibly fragmented (over 600 exist as of 2021). And getting any of this information cleanly and regularly continues to be an IT challenge for most firms.

All of this has encouraged startups to develop new tools for investors to manage sustainability and ESG.

The software stack for investors can be divided into two parts: 1) third party data on companies that is compiled for use by investors, which feed into 2) overarching portfolio management tools. Both areas have a robust number of companies working on solutions within them, though the number of startups in general aimed at selling to investors seems markedly lower across the board than the number of startups aimed at selling to corporates (which is interesting because ESG is supposed to be an investor-facing framework, perhaps a factor of how stingy investors usually are with what software they purchase). Here’s how it lays out in more detail:

(Note that the companies mentioned are not vetted or sorted. This is just a list I compiled of advertised software applications from various companies)

A few observations:

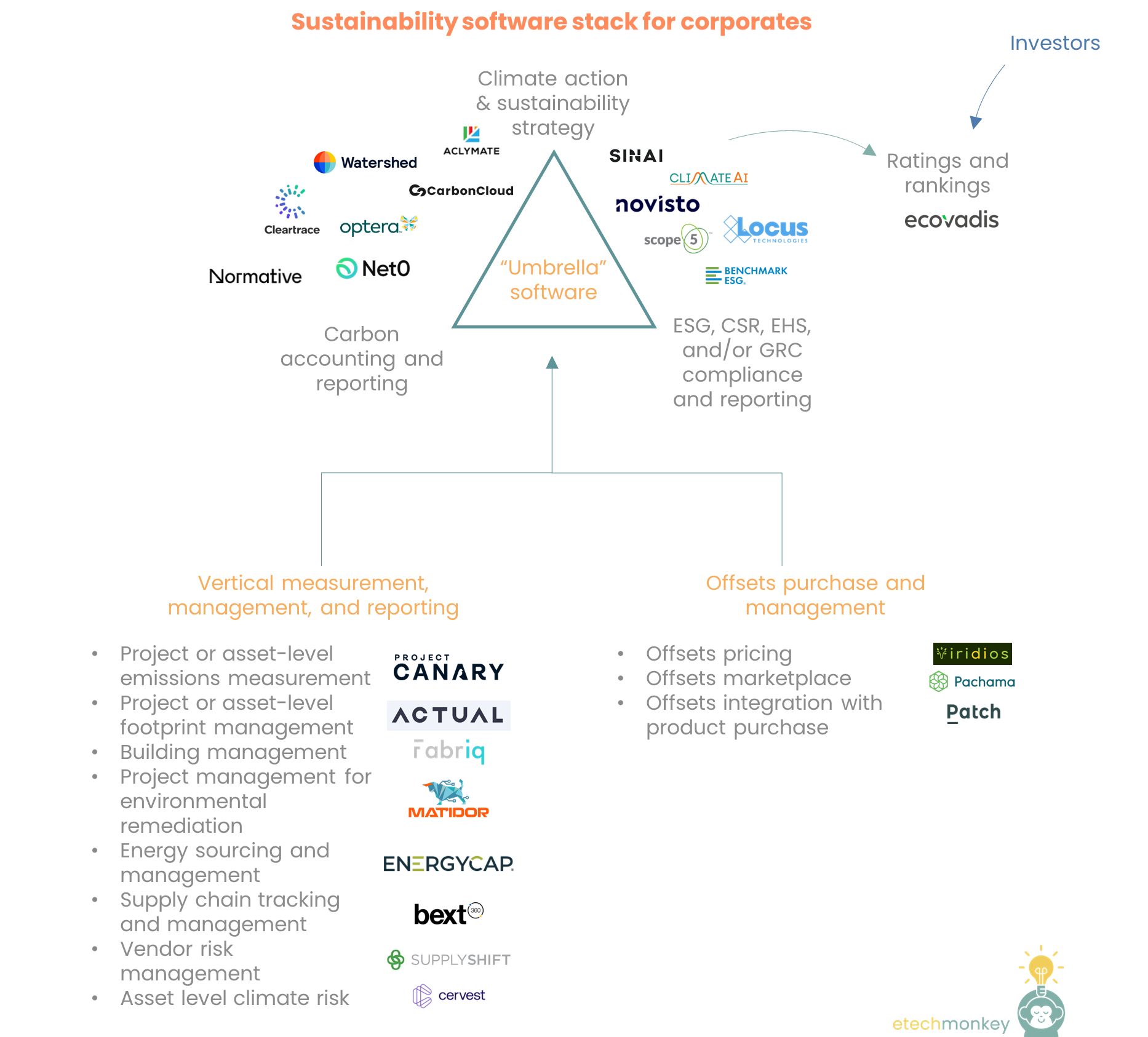

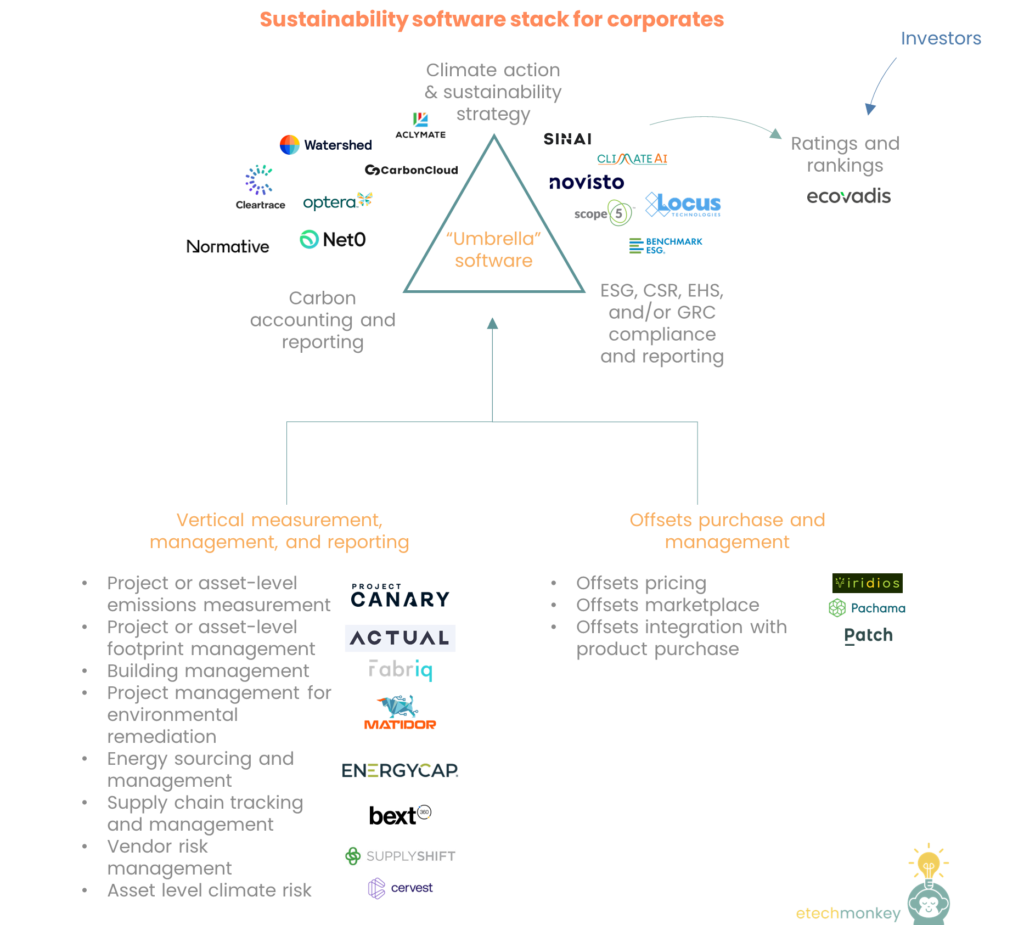

It’s been interesting to observe the vast array of digital technologies available to help build out a company’s sustainability strategy. What initially started as a space largely dominated by consulting firms and ratings agencies (e.g. Bloomberg, Sustainalytics, and MSCI) has now grown to be a thriving software-driven ecosystem.

VCs are enamored with funding corporate sustainability software (or climate-driven software of any kind). Over $570mm have been invested in climate reporting software in the first half of 2021, which, while only ~1% of all climatetech investment in this period, was spread over a larger number of early stage deals. A similar report by CTVC highlights that Carbon, the bucket of companies that includes carbon tracking and accounting software, experienced significantly more growth Y-o-Y in number of companies funded and new unique investors than other sectors. At face value, this is one of the few subsectors in climatetech that VC is well primed for: it’s easily scalable, capital light, has a huge market size (any company that cares about sustainability, which is everyone these days), and directly benefits from the large number of corporate dollars going into transition.

There are several different flavors of corporate sustainability software:

(Note that the companies mentioned are not vetted or sorted. This is just a list I compiled of advertised software applications from various companies)

A few observations:

Some other resources for those that want to look further:

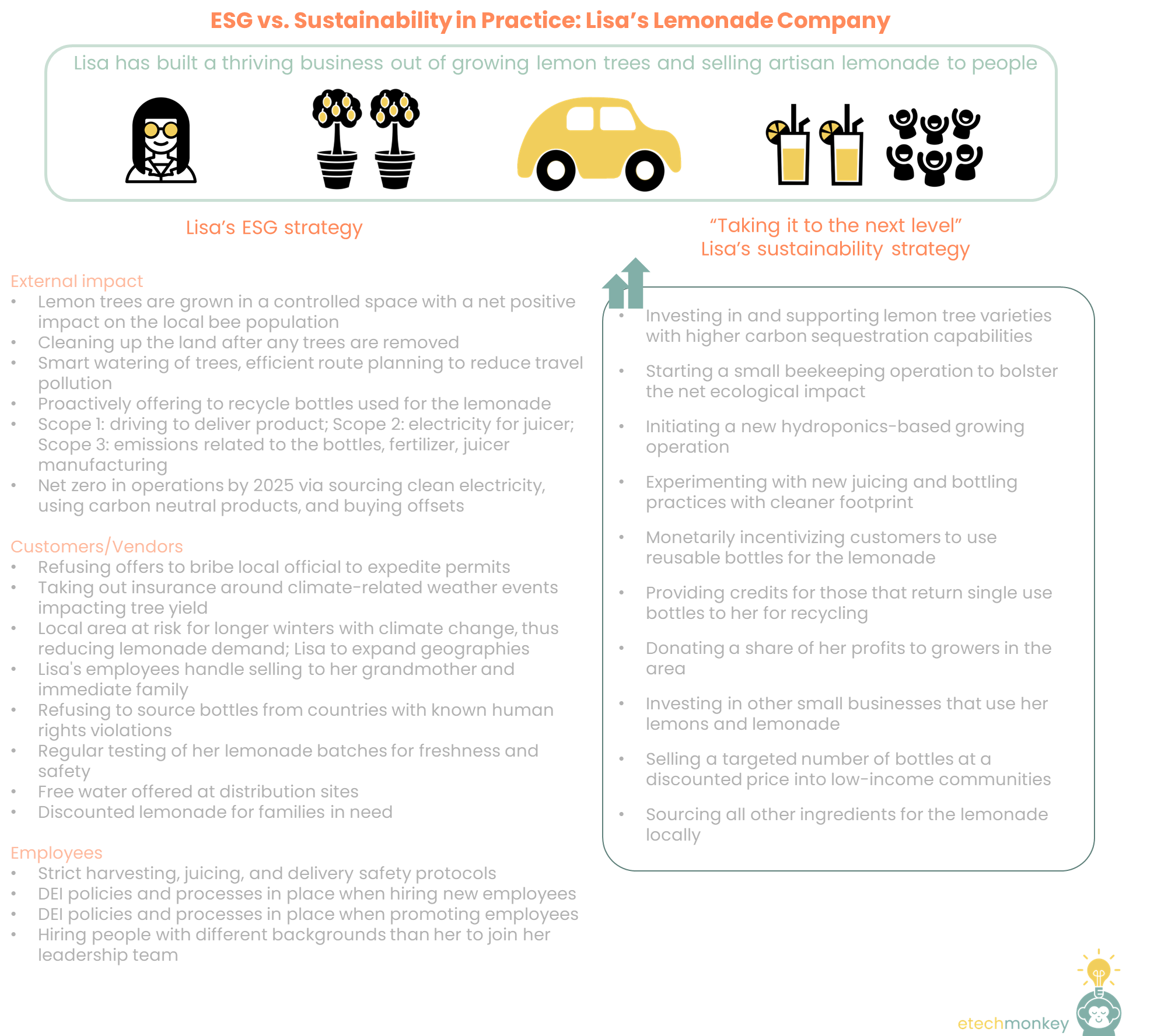

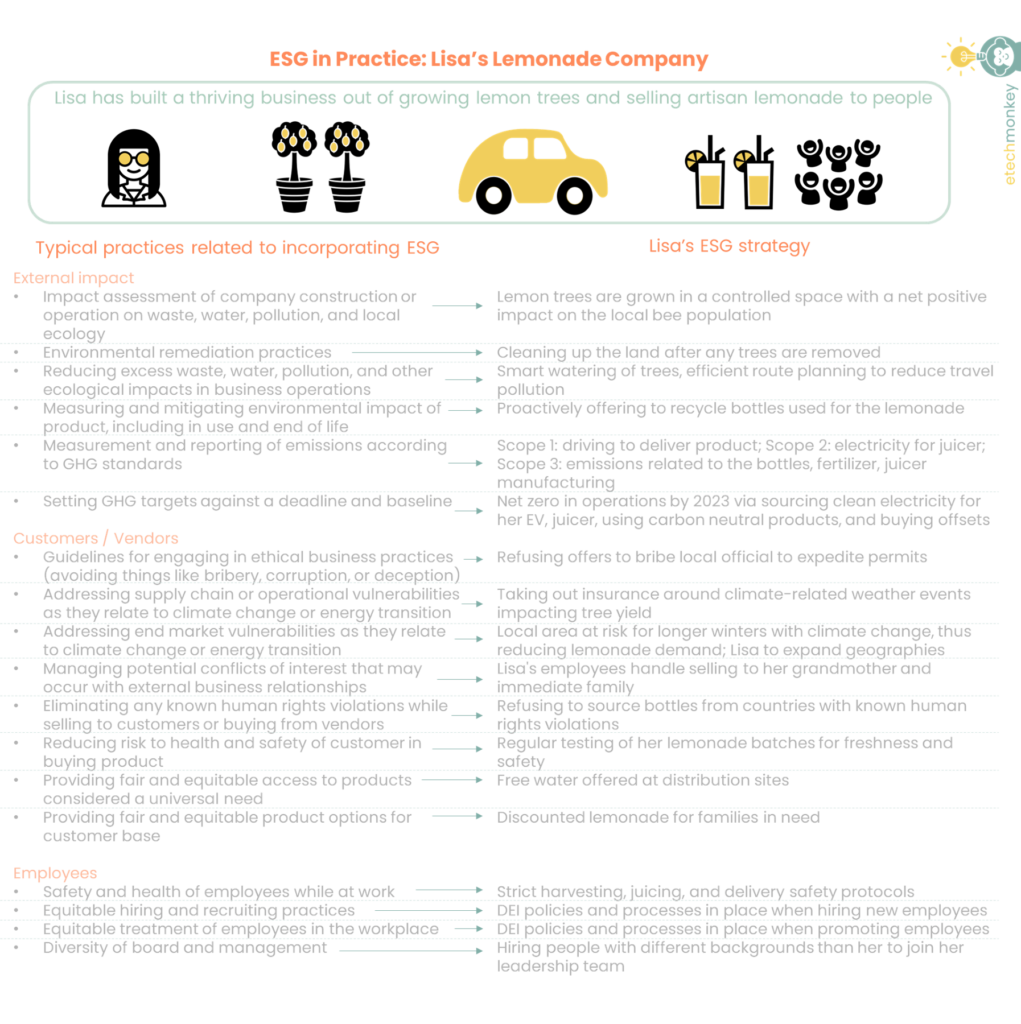

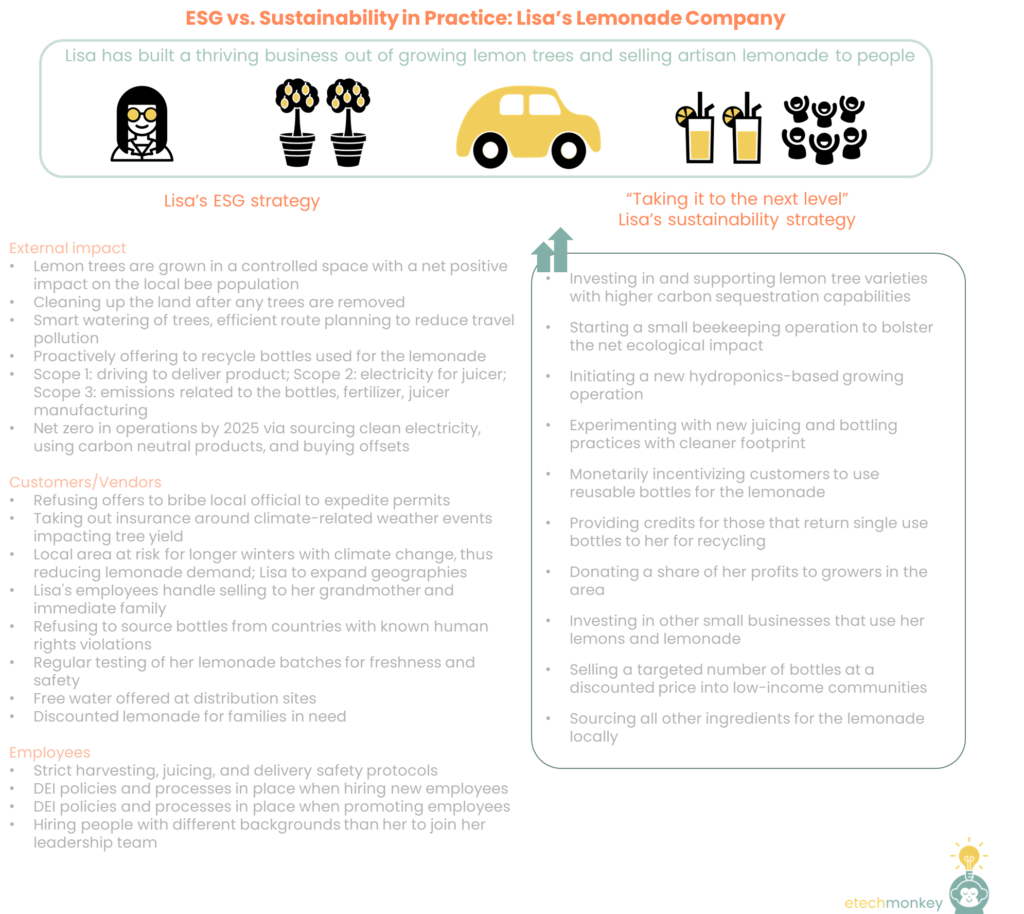

ESG is often brought up in the same context as sustainability (and climate and energy transition). In many cases, it’s use interchangeably with sustainability to refer to an organization's desire to “go green.” Take for example these recent articles about ESG:

Which almost all exclusively refer to the climate movement. These aren’t necessarily wrong. Many aspects of ESG do overlap with transition or sustainability strategy. It’s often said that ESG is really “big E, little S and G,” which is to say that, out of the three letters of ESG, “E,” or environmental, is often seen and received as the most important.

Using ESG almost synonymously with energy transition or sustainability does one of two things though. 1) It does a disservice to the other aspects of ESG that are not climate-focused and 2) It can actually be hurtful to growth-oriented sustainability initiatives.

#1 is a little more obvious than #2. When the emphasis for ESG is placed so heavily on climate, and in particular emissions, the company can under-recognize efforts that have gone into other initiatives. Things like DEI, responsible labor practices, and business ethics that can get “underfunded” internally with a warped definition of ESG, which can potentially minimize the influence of the company on human relationships and social systems at times where it can be immediately impactful. ESG has to be recognized as a broad umbrella.

(SASB does this well. They’ve identified 26 areas that fall under ESG, of which 15 have no direct relation to the “E” in ESG.)

#2 is what I’ve come to realize over time – and it’s something that I don’t think is immediately obvious.

ESG’s intended purpose is to identify and address the environmental, social, governance issues that matter to a company. The keyword here is matter. In practice today, matter means what gets investors to put more money forward. Matter is what’s relevant to financial performance. Matter is “what does the company do that is different from other companies and raises its equity valuation.”

In other words, ESG is fundamentally a benchmarking framework. It’s used in practice to identify companies that stand out relative to other companies. And it’s used in this way by investors in particular. Which is why the questions that get asked over and over again in ESG circles are “why does ESG matter to financial performance?” “How is this going to make me more money?”

(To put SASB in the spotlight again, this is exactly why they have materiality calculators to determine which of the 26 areas of ESG actually matter for enterprise value across different industries.)

This can undermine true sustainability in leading a company to always look at their neighbor for guidance on what to do and to only focus on things that their investors consider linked to financial return, a mindset that tends to lead companies to take the most conservative path towards sustainability.

A good analogy is in school. The goal of school is to learn (or learn how to learn), but when a student focuses too much on getting good grades (“ESG score”) to get a good job or go to a good college (“financial return”) vs. actually learning (“being sustainable”), the incentive might be for the student to take easier classes or to just do enough to outcompete her fellow students. A parent (the “investor”) might say “why in the world are you taking that class? How is that going to get you a job?” Which is exactly the kind of advice that, while practical, gets in the way of true scholarship. And leads to kids not taking enough academic risks for learning’s sake. (And leads those same kids to take investment banking jobs down the line 😊)

Another way of putting it is that thinking that ESG is the same as sustainability disincentivizes companies to be creative, aggressive, and risk-taking in putting forward new sustainability growth initiatives. If all you care about is the measurement, you’re more likely to stick to what’s being measured.

Don’t get me wrong…ESG is still very important. It (in theory) establishes a fair and objective baseline across companies and industries. It allows the laggards to recognize that they are laggards and take the first step to catching up. It’s a requirement for being a good company. And establishing ESG standards and practices is critically important for catalyzing industry-wide movements forward in sustainability and governance.

But I think it’s wrong to mistake a company’s ESG strategy for sustainability strategy. Every company needs both. ESG can measure a company’s position vs. peers and allow a company to calibrate itself to accept industry best practices. Sustainability strategy will probably overlap in many ways but should always take things a step forward in ways that ESG cannot as a benchmarking tool. Every company has the opportunity to create differentiated, creative sustainability strategy in areas that are not captured by ESG.

In short, get good grades, but don’t forget to learn as well.

An example of what I mean using a fictional lemonade company:

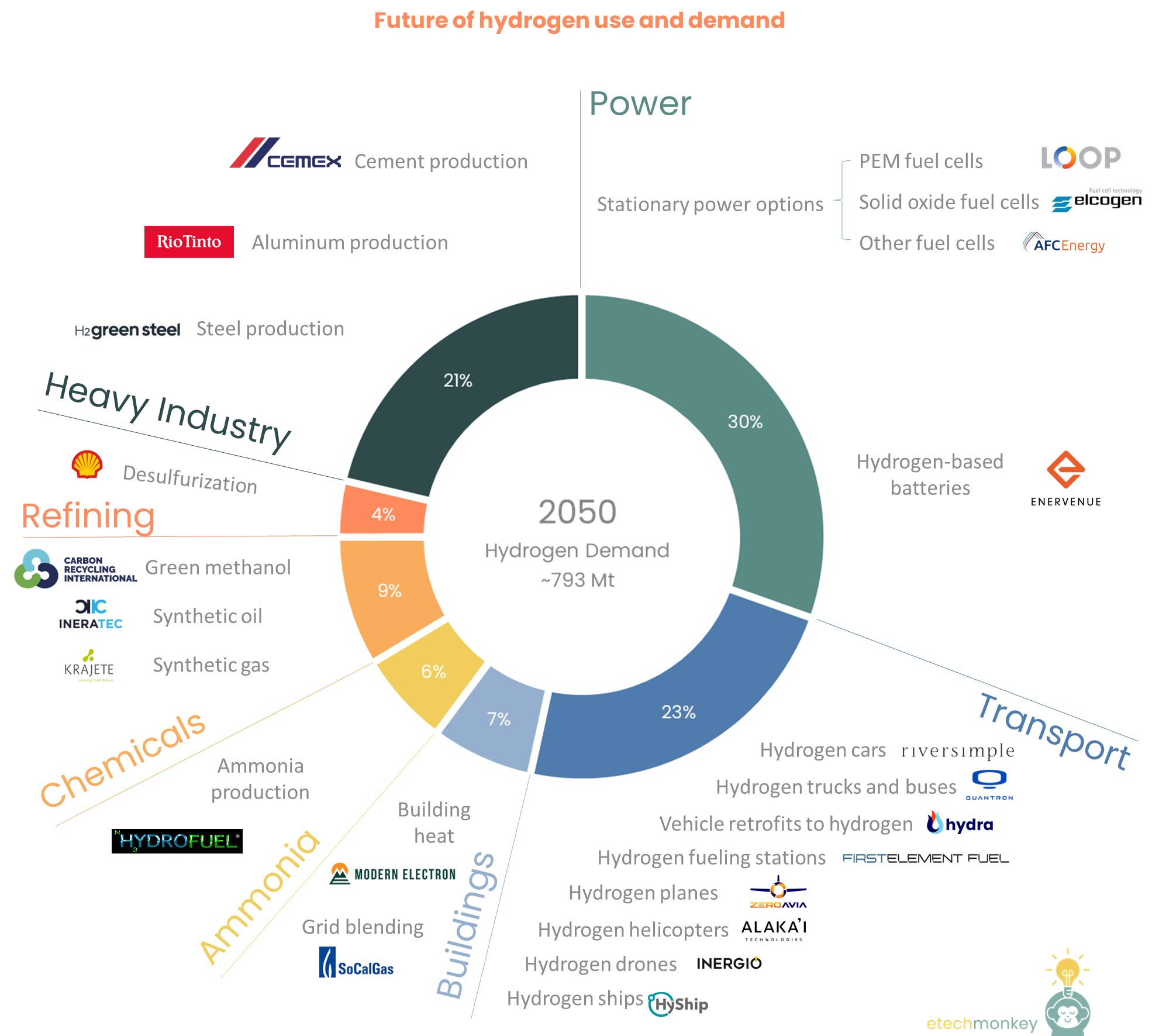

Now having discussed hydrogen production and logistics, the last piece of the puzzle is….hydrogen uses and demand!

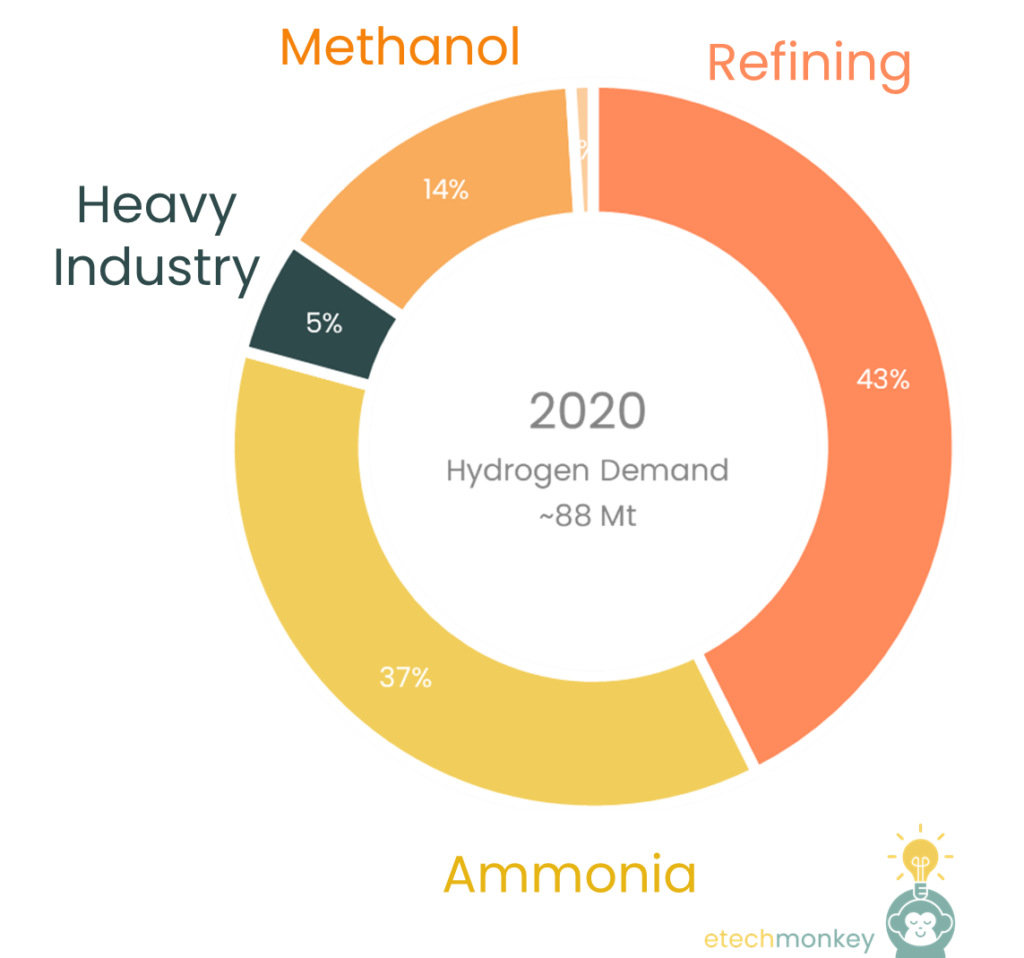

Right now the hydrogen use chart is dominated heavily by industrial offtake – out of the combined ~75 Mt of pure hydrogen in the market in 2020, 37Mt was used for refining, 33 Mt for ammonia production, and the remaining 5 Mt for reducing iron for steel production. Including hydrogen in syngas adds another 15-20 Mt to the total, most of which is used in methanol production.

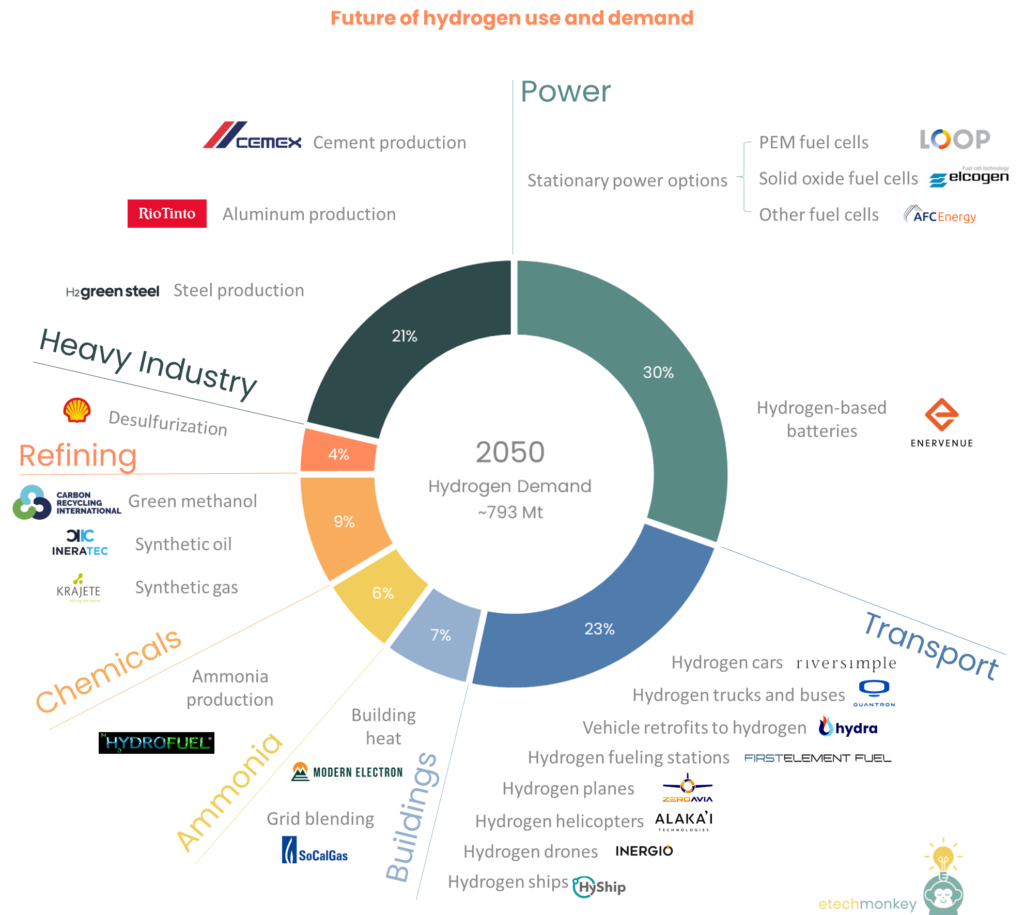

The future of the market is much more diversified…and much harder to predict. 2050 forecasts swing wildly depending on assumptions (e.g. BNEF’s Gray scenario predicts 190 Mt of hydrogen vs. 1,130 Mt in their Green scenario), but most seem to assume more than 500 Mt of hydrogen demand is necessary for a successful transition.

For simplicity purposes, I’ve averaged three sources (BNEF Green, IEA Net Zero by 2050, and Hydrogen Council’s 2050 forecast), which results in ~793 Mt of hydrogen demand. 75% of this demand comes from new uses: Power (30%), Transport (23%), and Heavy Industry (21%). The remaining quarter is made up of hydrogen offtake that largely exist in some form today (ammonia: 6%, chemicals: 9%, refining: 4%) in addition to building heat demand (7%).

(Note that these are not vetted or sorted. This is just a list I compiled of advertised hydrogen use methods from various companies):

To summarize, the future of hydrogen is massively EXCITING! It’s hard not to believe in a robust hydrogen market when faced with the different products under development today that will depend on cleaner sources of hydrogen in the future.

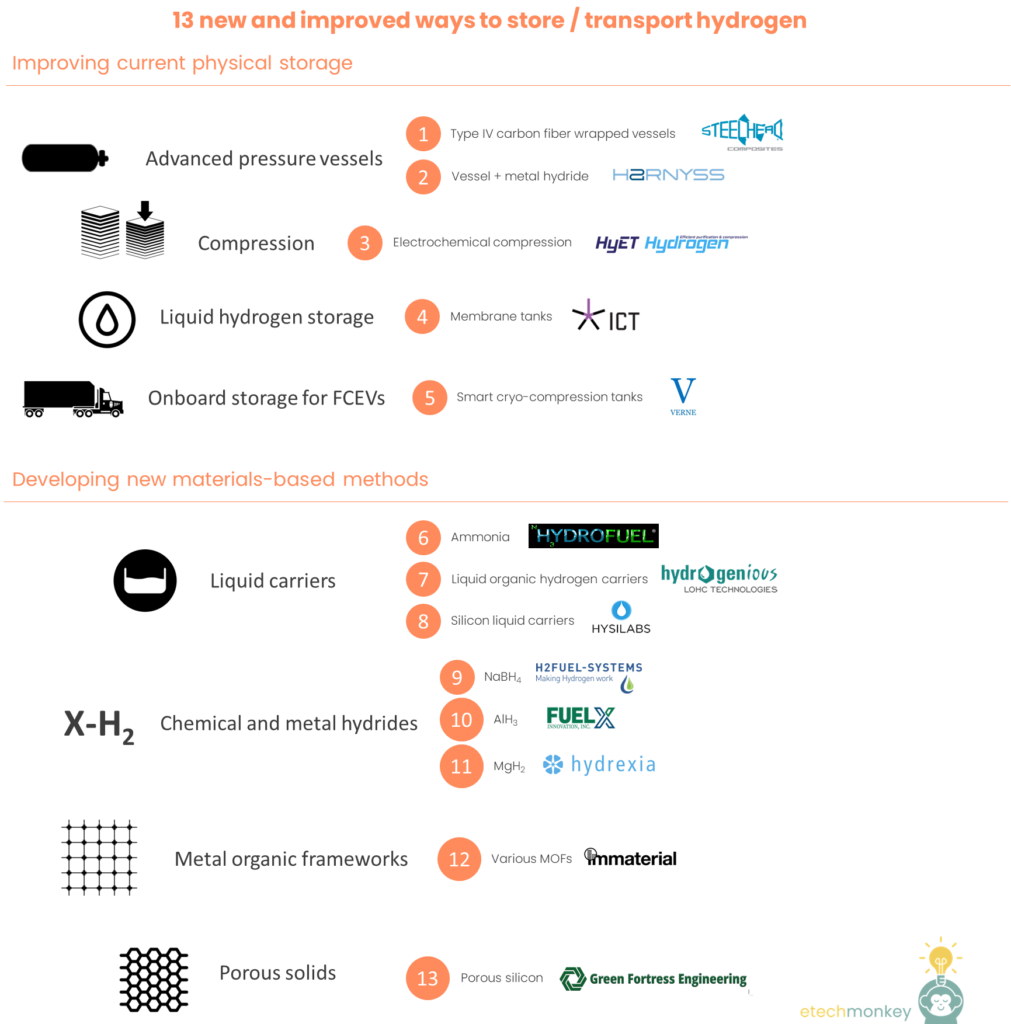

Last week I explored the current costs and methods used for hydrogen logistics today. This week will be about the future of this part of the value chain: what new methods are in the process of being developed and commercialized?

Innovation in storage seems to be bifurcated between 1) improvements to current physical methods and 2) developing new materials or molecules to capture and/or transform the hydrogen. Most startups and research labs seem to be working on #2, which is perhaps a symptom of the fact that there are an incredible number of materials to explore for this application. In fact, the DOE hosts a great database that lists out 250+ hydrogen-storing materials that researchers have discovered.

I won’t come even close to going into all of those methods, but hopefully the below gives a high level overview of what methods are actually being worked on by startups in the ecosystem.

(Note that these are not vetted or sorted. This is just a list I compiled of advertised hydrogen storage methods from various startups):

Distributed hydrogen production does somewhat belong in this section too. Having onsite production at demand points like fueling stations eliminates the need for any hydrogen transport. Companies like IVYS Energy are working on building these all-in-one fueling stations.

It’s also worth mentioning the prospect of shipping hydrogen. Maritime transport of hydrogen is still in its infancy. It will be interesting to see whether or not international shipping of hydrogen will be necessary given the widespread availability of hydrogen-bearing sources. There are also some efforts in recent years to test out actually producing (then shipping) hydrogen on ships.

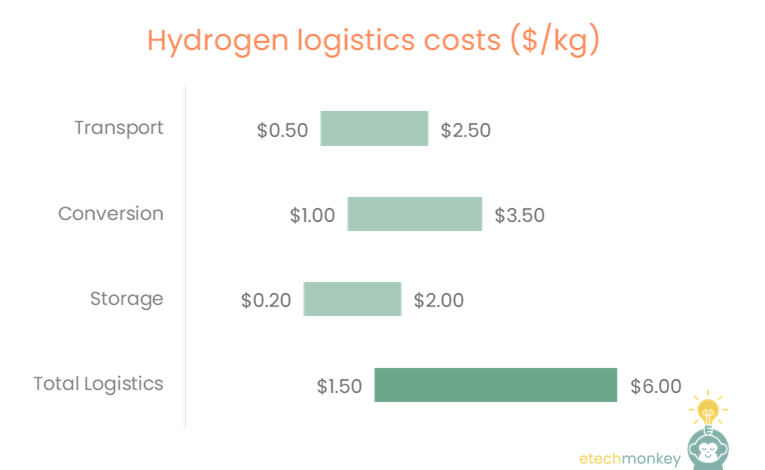

In terms of costs, there aren’t great sources for the potential costs of transport in the future based on all of the methods described above. According to one study examining Germany by 2050, transport + logistics could get down to $0.30 - $1.60 / kg vs. the ~$1.50 - $6.00 / kg range we determined last time for current methods. This study only looked at gas, liquid, and LOHC methods though.

Finally, I’ll just end on the size of the future market. Luckily, this was actually a bit easier to find than the size of the current market, thanks to the smart people at IEA. According to their Net Zero scenario, they believe storage needs could amount to ~50 Mt by 2050, which is just under 10% of the 500+ Mt of hydrogen that they believe will be needed for Net Zero. That is a lot of hydrogen to store, considering the current total hydrogen produced right now is ~70 Mt. But considering the number of new methods that are under development, I'm optimistic that we'll have plenty of economic storage by that point.

Last time we talked about hydrogen production. I thought it might make sense this week to do a dive into hydrogen transport, storage, and other logistics.

Since there’s a lot that’s not well covered on this subject, I'm dividing this into two parts. In part 1 today, I’m going to explore the current status of this market. Part 2 will lay out new technologies and developments.

The nice thing about the hydrogen logistics industry is that it very much exists today. There is already a functioning model of moving product around safely and at a certain scale.

Most hydrogen today is stored and transported via physical methods, either a) in gaseous form via pipeline and high-pressure vessels or b) in liquid form via cryogenic tanks. Materials-based methods like hydrides or liquid organic carriers also exist, but these are still being commercialized.

I had a hard time finding a breakdown of each storage/transport method (so if anyone has one, would love to see it), but from what I can gather, hydrogen is currently most frequently transported in gas form on tube trailers. Liquid hydrogen transport is limited to large volume, long haul applications where the expense of liquefaction and insulation + the boil off loss of the hydrogen can be covered by the scale and immediacy of the demand (markets usually 150+ km away where a few tons per haul can be used in a short time…space programs are often cited as an example). Pipelines exist but only cover a few hubs (e.g. US Gulf Coast and Northern Europe) and require consistently large amounts of product transported through the same route in order to justify the upfront capex.

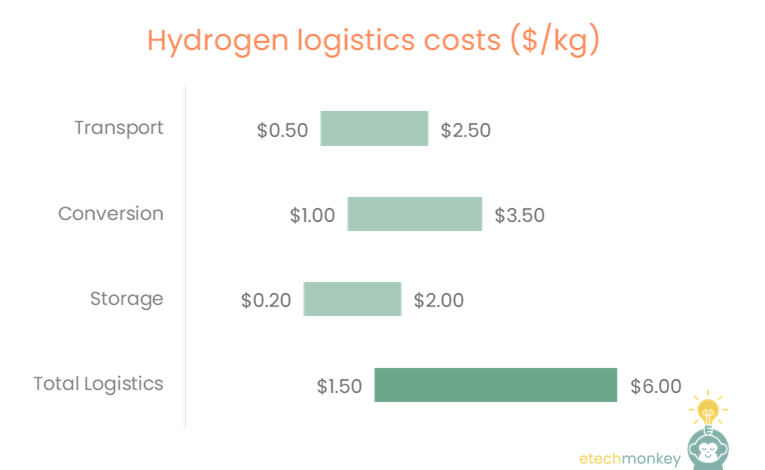

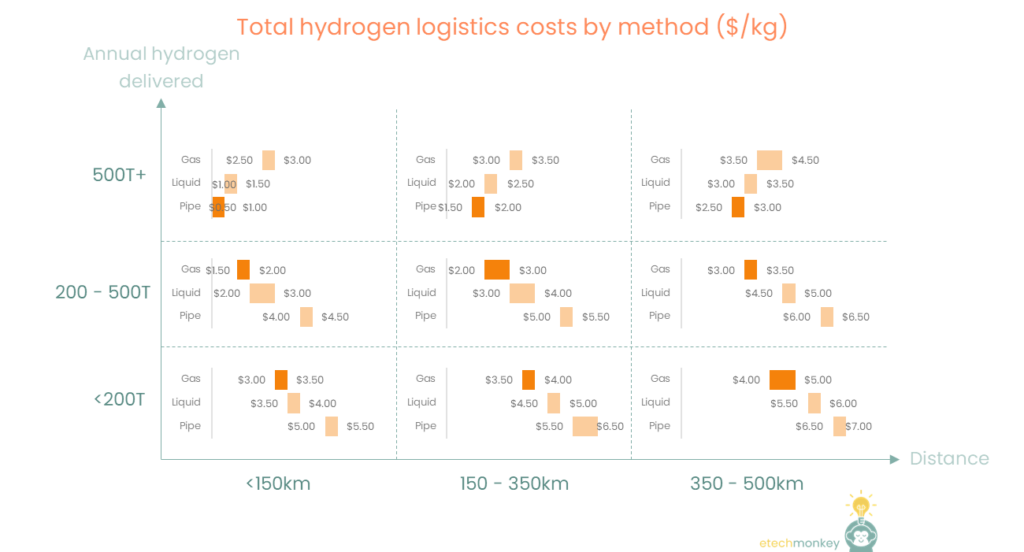

Costs vary by technology, distance and amount of hydrogen carried, but typically for distances 500km or less:

Note that the above still doesn’t include the cost of refueling stations if you are looking at the logistics cost for a distributed fueling network. Adding in that cost, which is ~$7/kg, is not exactly straight forward since hydrogen can also be produced on-site at these stations, which eliminates many of the previous logistical costs.

It might also be helpful to think about how these costs break down by method. The below shows what I estimated for total transport, conversion, and storage costs in $/kg for each of gas trucking, liquid trucking, and gas pipeline:

Generally, for deliveries <500T annually, tube trailers are the most economic option. For bigger deliveries, pipe wins out. However, since there aren't enough pipelines to be able to service all of the areas in which large scale hydrogen is needed, liquid hydrogen trucking is often the next most economic option.

These numbers are imprecise and don't take into account situational differences like the availability and accessibility of equipment, lower contract pricing, regional variations in power costs, consumer preference, etc. My understanding is that right now, gas, liquid, and pipe are all used across the matrix despite the price differences shown here.

I also tried to figure out exactly how much hydrogen is stored and transported today.

This is very difficult to find, unlike the widely reported 70 MT number that represents hydrogen produced. I guess the reason why this estimate is so obscure (other than the fact that maybe people don’t care enough about the logistics of hydrogen as much as the production of it) is that most of the hydrogen today is transported and stored by largely same the few giants that are producing the hydrogen. Since the hydrogen is moving around a few internal company ecosystems, perhaps there hasn’t been good data (that’s not proprietary) gathered around this. I’m hoping once there are more third parties in the logistics ecosystem, that will change.

Anyway, the best estimate I could come up with is 4 - 5 Mt. That’s dubiously anchored on several reports that seem to estimate that the hydrogen storage market at ~$14B right now and an assumed cost (loosely based on the above averages) of $3 - 3.75 / kg. That implies that less than 7% of current hydrogen production is stored.

Next time I’ll look into the future of this market. Thanks to the below for offering data points on cost:

Hi everyone – I’m sorry for falling off the map after that last post. I have been a bit busy taking care of some things, including physically moving to Denver. The move was a little unplanned but thoroughly welcomed. One of my goals this year was to explore new networks and Denver will be a great hub to do that from. I’ve been incredibly impressed with the Denver tech community + the many exciting things happening around energy transition and climatetech in this city. The easy flights to Houston are also a big plus!

You might have also seen that I was made an advisor to Boundless Capital Partners, a Denver-based investment bank focused on energy infrastructure and technology. I’ll continue to “do my own thing” but this gives me chance to support a stellar team taking a differentiated approach to investment banking while also staying adjacent to some relevant dealflow. Give me a shout if you’d like to learn more or to generally catch up.

Today let’s talk hydrogen production.

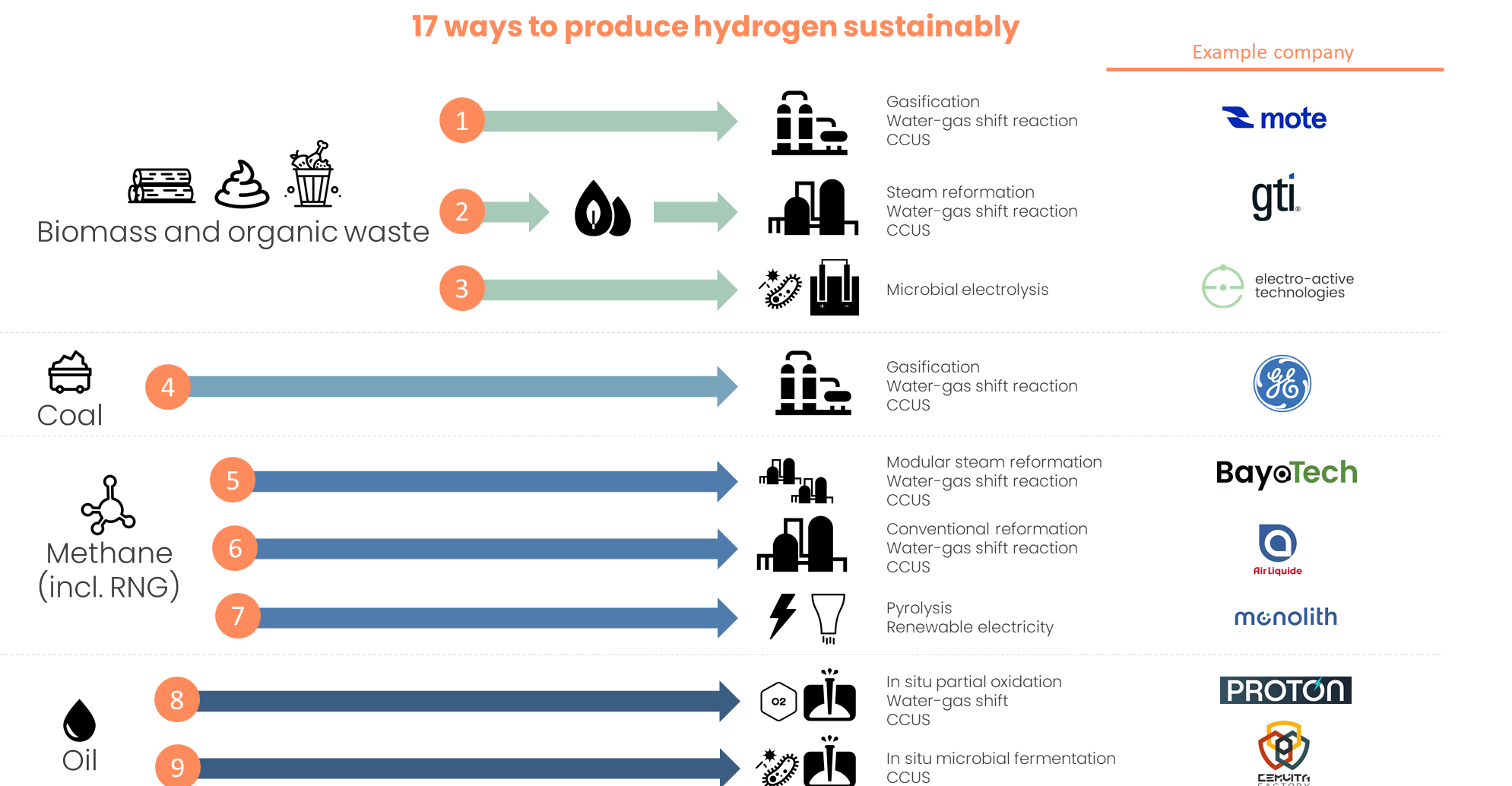

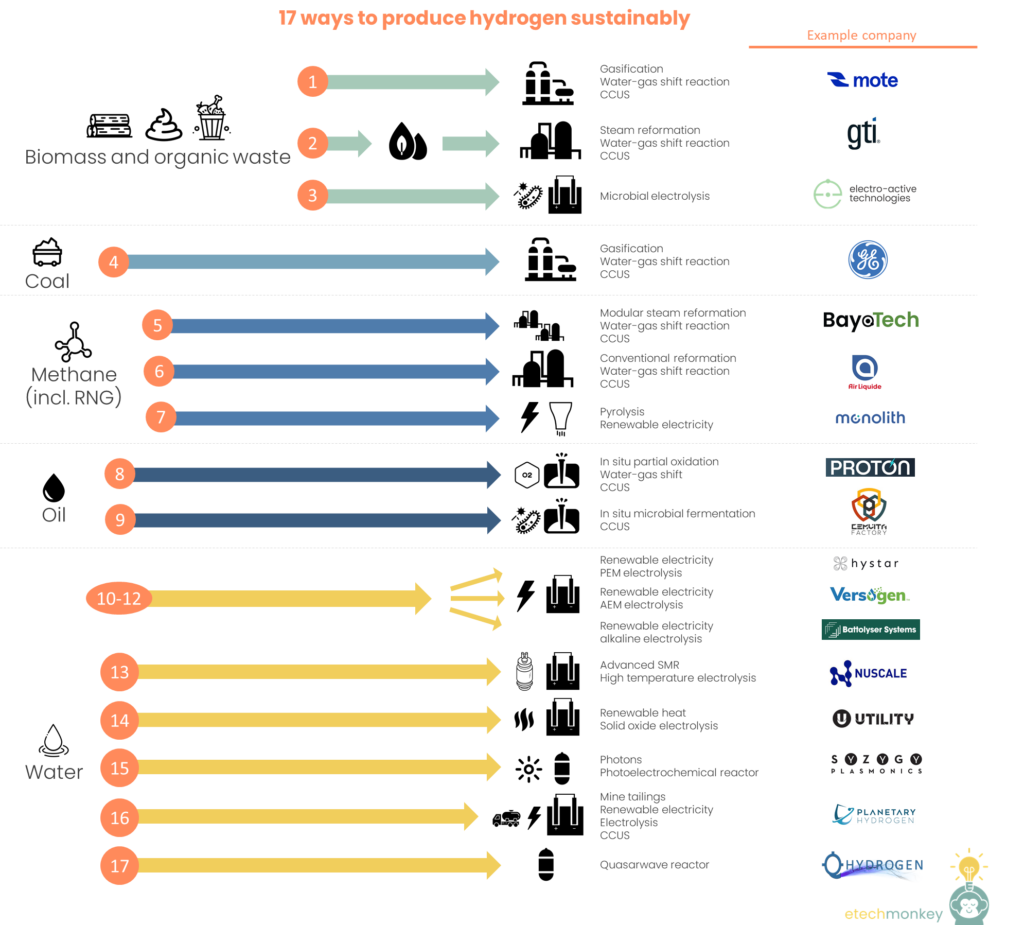

A lot of you might know that the reason why I am long hydrogen, despite the logistical shortcomings of the current network, is the many ways that hydrogen is able to be produced from a variety of sources. Hydrogen is the simplest molecule in the universe, which lends itself to be a product or by-product of a variety of different pathways.

See below for some of the different ways I know of to produce low-emissions hydrogen (Note that these are not vetted or sorted. This is just a list I compiled of advertised hydrogen production methods from various companies, mostly startups.):

*Note: The list could be made even more precise through differentiating between SMR, electrolysis, and pyrolysis by type of catalyst used. For example, there is a sub-category of plasma-based catalysts that are used in pyrolysis.

For a more in-depth explanation of some of these, the DOE is a great resource.

A few observations on the list:

Hope you enjoyed today’s roundup. Would love any feedback or comments!