As many of you know, this year is the year of learning for me…and I had to think: what better way to start off this journey than posing some questions I’d like answered?

Deciding Scope

I struggled a bit before writing this post to decide what part of this broader climatetech ecosystem I’d like to cover. I have an energy tech background – which means I looked at technologies that influence what we now consider the energy industry. However, that set of technologies is rapidly changing. Technologies like soil-based sequestration, chemicals manufacturing, waste recycling and WTE, hydrogen jets, HVAC, insulation, etc. have moved into the “don’t care” to “care” bucket very rapidly for traditional energy players (meaning utilities + oil and gas companies). And that’s because carbon is carbon is carbon. What happens downchain or upchain matters…and is increasingly the responsibility of the parties across the whole chain. Selling product into market or buying product from a vendor is no longer a transaction void of responsibility. The energy industry should care where its molecules and electrons are going and how it can help get those molecules and electrons into better places, in addition to producing better molecules and electrons in the first place.

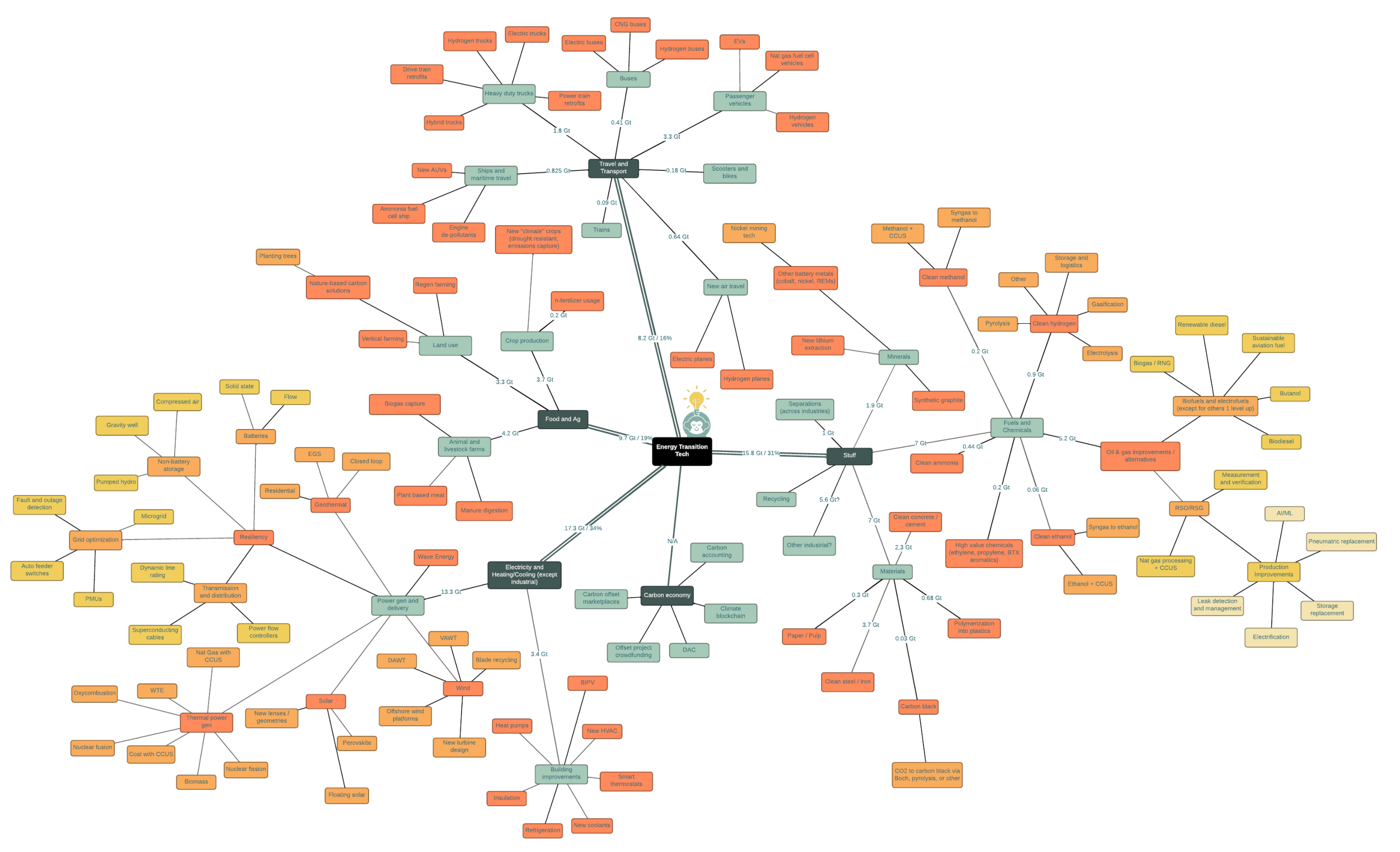

Visualizing FEST

I think Bill Gates does a great job in How to Avoid a Climate Disaster breaking down what we do from an energy usage / emissions perspective. He separates it into making things, plugging in, growing things, getting around, and keeping warm and cool, or in other words:

I call this the FEST framework. Like a FESTival but for seven billion people. One that needs food, beds, ways to get around, sanitation, a clean up crew, and for everyone to be happy and healthy. But one that also only has a limited amount of time, a rapidly growing number of “attendees,” and a planning committee with zero experience doing this well. Sound familiar?

Which leads to the reason why I like this framework so much. What it does so well is allow us to break down how our everyday activities are affected by what technologies we buy, support, develop, invest in, etc. Other breakdowns separate by energy, industry, agriculture, and other abstract categories that don’t mean much to me immediately…I get especially confused with “Industry.” What the heck does that cover? But I know exactly why I care about access to food, electricity, stuff, and travel. With FEST, the impact of tech on living is clear.

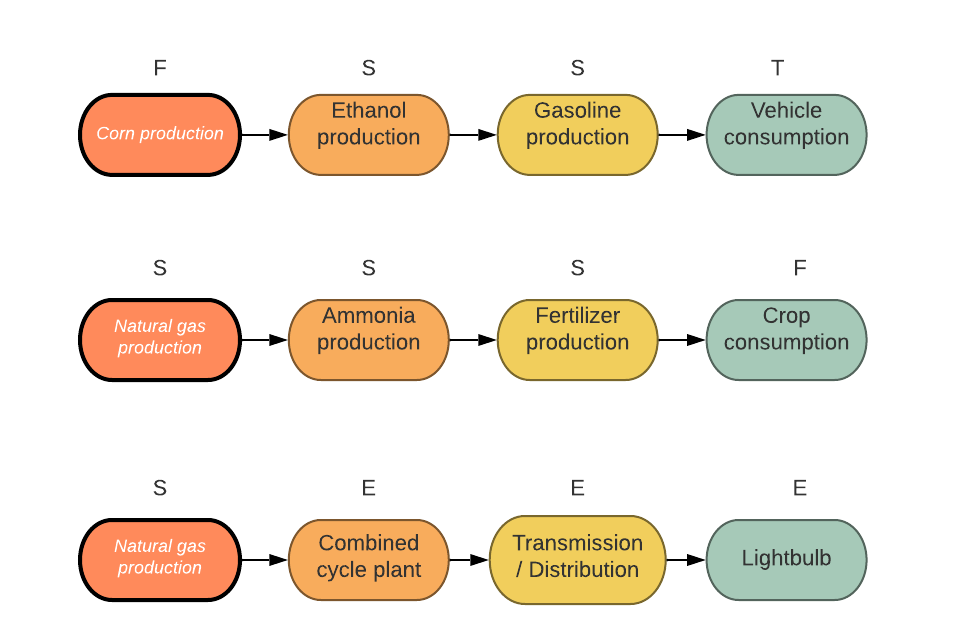

There are of course limitations to breaking things down in this way. The most apparent is that the supply chains are still not clear. For example:

The categories get especially muddling when products with complex supply chains like cars or semiconductors are considered. But overall, FEST is a manageable way to understand and chart emissions impact from various sectors. And sets itself up nicely for a FESTivus-themed conference later this year (if anyone has any desire to fund such a conference, please let me know. I have lots of ideas but no money).

Onto the thoughts and questions...

Would love any thoughts / comments / answers / more questions to add to the list 😊

To see a larger version of the FEST map, please click here.

Last time we wrote about the different components that make up project motivation for energy transition infra, BEPTC. How well a project can address each of these components and establish project motivation is often times the driving force behind an equity investor’s initial interest in the project.

But after interest is established, the real diligence begins to determine level and type of development risk, which informs an investor’s view of fit with their investment mandate and the ultimate investment structure (% equity or debt, assetco vs opco vs holdco, etc). Once again, we cite NREL’s framework for the second phase, SROPTCC, or Site, Resources, Offtake, Permits, Technology, Team, Capital:

These first three are crucial to securing the base project economics. Often times, projects come to us when these three are still in flux, which makes modeling the project more challenging and why some more conservative investors prefer agreements to be more or less in place before they engage. At the same time, project developers often find that initiating conversations with investors when agreements are not finalized can provide larger corridor for investors with different risk profiles to come in and help negotiate those agreements to their liking. Balancing the timing of these conversations is an art much more than a science. Sometimes we advise clients to execute LOIs with the appropriate parties, which can formalize a series of conversations into a document that can be shown to an investor but also leave room for further negotiation. This formalization and documentation is important for projects that are “first of a kind” or championing a new set of relationships.

The last four components are ones that every project should also have clear visibility around before talking to investors (and probably do based on work done during the project motivation stage) BUT are not crucial to the economics of the project. Instead, they more so dictate timing and execution risk around a project. Thus, these components can change a little throughout the financing process without major effect. At the same time, much of this work will inform the first three, so it’s unlikely that these components will change drastically anyway.

Hopefully that provides a clear framework around how projects in the energy transition space are evaluated by investors. For project developers, the broad takeaway is that there are many questions that will get asked around the development / financing process, many of which there won’t be clear answers to from the get-go. The important thing is to have answers at ready and be ready to document and validate those answers at each step.

An interesting dilemma for capital providers in energy transition these days is being able to underwrite the unique risk profile for infra development in the space. Traditional project development relies on visibility, predictability, and repeatability, all aspects that get blurred by the uncertainty, dynamism and constant “newness” that runs across energy transition. That’s why infra has traditionally focused on projects that have low to no technology risk, rich precedence, and contracted cash flows – things like roads, buildings, pipelines, etc.

Renewables has come a long way in its road to being the perfect project finance candidate. Technology development has progressed to the point where solar panels and wind turbines are proven at scale and, on the lower end, virtually commoditized. Backstopped by typically 15-20 year PPAs, renewable assets have become prime targets for energy transition infra deployment.

But there’s a whole host of other new energy infrastructure that relies and will rely predominantly on emerging energy technologies. That includes storage, CCUS, hydrogen, biofuels, water recycling and filtration, waste-to-energy, etc. For so many of the companies in these areas, the capital ramp is quick – going from Series A/B to the next phase of capital can mean a jump from $5-15mm to $50-500mm+. The step-change nature of the development cycle for hard tech means that the incremental de-risking that is achieved is often disproportionate to the incremental capital ask. Most of the time, the change in capital is much larger than the perceived change in risk.

NREL breaks down the different components of project motivation, which is what they define as what drives the project forward and gathers the necessary stakeholders. They break it down into BEPTC – Baseline, Economics, Policy, Technology, and Consensus. How this framework plays out in energy transition infra:

How this relates to raising capital is that it’s these very core elements that come to form the “gut feel” of whether a project is worth pursuing. When presented with an opportunity, investors have to make quick decisions on whether to spend time on that opportunity – and what we’ve observed is that it’s this general framework that investors use to make those quick decisions.

Once a project gets the green light for deeper due diligence, the next steps are understanding the timing / stage of a project and refining an investor’s understanding around risk to see whether that matches up with an investor’s investment mandate. A good way to look at this phase is both quality of decision around and progress on decision around: site, resource, offtake, permits, technology, and team.

The concept of economies of scale has been long ingrained into our paradigm of an efficient economy. Reducing costs by increasing efficiencies in larger scale, more centralized production units makes sense to us intuitively. We’re taught to buy supplies in bulk and get a discount, spread fixed overhead over larger production volumes, use size to gain market leverage over customers and suppliers, and access larger and cheaper tranches of capital via larger capital projects.

The twist with economies of scale in the context of climate change is that the classic industrial optimization problem becomes bifurcated. Efficiency as a goal has to compete with climate friendliness. That changes the economies of scale equation a bit.

In a traditional economies of scale model, industrial centers produce vast, cheap quantities of product and that product is delivered to other industrial centers for further processing or large distribution warehouses for delivery to the end user. The result is the ecosystem as we have it today: industrial clusters where similar products are developed in tandem, networks of pipe/rail/trucking routes where product can be delivered to another industrial cluster where synergies can gain be realized.

But in an economy where climate impact is prioritized, these centers of industry are focused on delivering the smallest footprint, and that may not line up exactly with our traditional model of economies of scale.

A prime example is the distribution of solar resources. Residential solar comes in at ~$0.15 - $0.22 / kWh vs. community solar at ~$0.07 - $0.17 / kWh vs. utility scale solar at ~$0.03 - $0.04 / kWh, costs that indicate a fair bias towards “bigger is better.” But when taking into account factors that affect the environmental impact of each project like land usage, transmission losses and time to deployment, residential solar starts to level the playing field.

This effect is even more prominent when considering energy resources that don’t have as efficient of a network to deliver to the customer. Within the industrial ecosystem, goods get hauled between industrial sites everyday. For processes that are aimed at lowering the carbon intensity, the effect of this haulage, which includes road fuel and any preparation work to get the product ready for transport, on the carbon footprint makes a sizeable dent on the overall score. Decarbonizing a heavy industry facility will require making sure the incremental footprint made by logistics at that site is netted out against the footprint reduction of the process itself.

A salient example of this is in CCUS, where the financial and environmental cost of transporting CO2 means that sources have to stay close to capture sites which have to stay close to end uses / points of consumption. The end result is a much more distributed network vs. incumbent industrial networks like this in oil and gas or steel production.

Several other areas of climate tech will follow suit in becoming more distributed over time, including hydrogen, green chemicals, and agriculture. The closer one’s customer base is to the individual consumer, the closer the industrial site might have to be a population center, spreading these networks much more similarly to population. The environmental benefits are not just limited to logistics either – finding more sustainable ways to produce something will fragment our industrial products such that regionalism / customization to the local consumer will have an increasingly dominant effect (e.g. consuming produce that’s local or using energy produced by a local landfill). This will often run counter to the traditional inclination to build towards economies of scale and centralization.

A final thought: perhaps the end result of all of this is that population growth and migration will evolve to take advantage of areas where economies of scale won’t have to be sacrificed for the sake of decarbonization. Urbanization is often pointed to as a key risk factor for climate change, mostly due to the current limitations of urban infrastructure. However, urbanization does have the nice benefit of creating economies of scale in having points of consumption all gathered into one place. Cities were once built around proximity to coasts and rivers to take advantage of trade and water available for agriculture/drinking. Now that we’ve identified novel, cleaner ways to utilize the resources around us, perhaps cities will evolve to be gathered around those industrial resources instead.

Energy transition and circular economy go hand-in-hand, both optimizing for an ultimate vision of sustainability. Where they overlap is around the industrial processes that generate energy, adjacent to energy production, or use energy in a significant way. Creating a circular economy means that products are able to be used for longer or for more purposes, waste products are turned into feedstock for creation of new products, and that there are industrial pathways in place for recycling, repurposing, and recovering within the product’s lifecycle. We see the circular economy divided into two main areas:

Waste to energy, or creating electricity, heat, or fuels out of trash or organic waste. Landfill to biogas, dairy manure to RNG, municipal solid waste to syngas are all thriving examples of these pathways. Most of these technologies have existed for decades in order to reduce the operating costs and amount of land occupied by waste management facilities, but we’ve seen a recent “renaissance” of activity and development. The unusual tenure of the technology (derisking it in many people’s eyes) combined a macro focus on decarbonization and expanding regulatory programs like LCFS have led to WTE projects skyrocketing in number.

The production of goods from waste resources or industrial by-products. The utilization of CO2, normally a by-product or waste product, in producing chemicals, carbonates, or synthetic graphite has been a big topic. Plastics recycling has been and continues to be a dominant focus in this space. Creating chemical precursors like methanol or ethanol or hydrogen from excess syngas streams or waste biomass can be the industrial bridge to creating more sustainably produced plastics.

Creating these pathways is no easy task – and being able to sustain them over a long period of time will be even harder. A big challenge with circular economy pathways is maintaining the balance between supply and demand. An instable waste stream can cause a feedstock shortage, disrupting commercial agreements and leading to price volatility. Because the components of a circular economy are so interdependent on other processes, a circular economy is vulnerable to the domino effect. One sequence of disruptions can completely eliminate the viability or need of a pathway.

This brings us to the ultimate challenge: commercializing circular economy pathways for the long term. Like other industrial-scale projects that we have seen in the energy transition space, circular economy projects will require a combination of technology development and project development, two different sets of expertise and ecosystems. Moreover, the traditional infrastructure development mindset relies on having high visibility of offtake and feedstock. Both of those are hard to secure long term in a circular economy, where inputs and outputs are always shifting according to market dynamics.

The name of the game for circular economy is flexibility. Having optionality around feedstocks and offtakes will generate an advantage for projects, especially those that deal with intermediary products. Most of the projects we look at don’t future test their pathways, only basing their narrative on one particular macro outcome. Circular economies are not static, especially as we deal with the behavioral science surrounding waste vendors. A big question is what happens when a waste turns into a valuable product, one that merits a premium vs a discount? We saw that happen with flared gas to bitcoin mining. It’s for that reason that for companies looking to commercialize circular economy projects, we recommend extensive scenario planning.

In any case, the circular economy is an exciting vision that is flourishing now. WTE, which was once the dirty cousin of wind and solar in the renewable energy industry has turned into a fast-growing behemoth. Recycling is not so consumer driven anymore and scaling up to replace industrial processes. We’re excited to see this space grow and what comes out of it.

Carbon offsets and carbon credits are interesting financial instruments intended to provide a way to quantify and monetize environmentally beneficial actions. They are similar to Renewable Energy Certificates (RECs), which are credits assigned to MWh produced of renewable electricity. Like RECs, a certain number of carbon offset credits are assigned to a project and can be bought / sold separately from the project. But while RECs are solely for promotion and facilitation of renewables development, carbon offsets can theoretically be sourced from just about anything that is emissions reducing.

This broad, broad scope has encouraged a variety of projects to be counted towards a carbon offset. Everything from installing cleaner stoves in Mozambique to reforestation to installation of biogas digesters can generate carbon offsets – and there are many more that are being qualified by the day. This diversity is both a blessing and curse. On the one hand, many projects that are too niche to receive regulatory and / or traditional financial support have a mechanism by which to access for-profit capital. On the other hand, the variation in carbon type and quality has proved a challenge for those looking to establish a unified carbon marketplace.

A part of this challenge is the multiple issuers, resellers, certifiers, registries, verifiers and auditors that each play a part in filling a part of the value chain for at least one carbon offset pathway. The market is extremely fragmented and operates across too many spheres of influence, leaving no one authority with the ability to demonstrably consolidate and reconcile every approach.

As a result, the current carbon offset market looks a bit like a dysfunctional circus – lots of interesting acts going on at the same time in different places, with little continuity or direction. The chaos is bolstered by additional issues like:

Accountability is lacking – carbon offsets require near permanence in the sequestration or use of the carbon involved, but that permanence is difficult to monitor and ensure effectively

Additionality is currently incredibly subjective – a carbon offset project needs to show “additionality” to what the status quo plan was for that piece of land or operation – or in other words, demonstrate that had that carbon offset project not been in place, an emitting action or project would have happened instead. But proving that is difficult and a bit like trying to prevent a crime that hasn’t been committed yet…something that John Anderton taught us is a highly vulnerable model

Fourth dimension issues – carbon offset projects can generally quantify what the carbon impact would be over a lifetime but struggle in predicting what the shape of those offsets would be, especially in those outer years. Therefore a project could be issued a slew of credits for avoidance or protection actions taken in the future, but the actual real impact from that project may diverge from what was assumed at the time and generate controversy. Thus if the intention of a company is to buy credits to offset emitting actions taken at a certain point in time, a significant lag between the time of emissions and the time of actual offset might reduce the “net present value” of that offset (is there such thing as time value of impact?)

Misalignment of funding objectives – carbon offset pricing is driven by a number of factors: location, human welfare impact, employment impact, vintage, capital costs, etc. What’s been interesting to observe is how cheap an offset project can be, ranging sometimes from a fraction of a dollar / ton of CO2 to several hundred dollars. When a company has to make a decision around whether to develop an emissions reducing project or just buy certain carbon offsets, the most economic option may be just to buy some cheap carbon offsets that may be equivalent on a ton-to-ton basis but may end up discouraging the company from directly reducing its own emissions footprint

This exceptionally blurry universe of carbon offsets has created multiple opportunities for innovation: the monitoring of permanence, data collection to prove additionality, value chain tracking via blockchain, exchanges and entities that can help standardize carbon pricing, etc. Kimmeridge recently put out a paper that argued for an oil and gas-specific carbon offset exchange, one run by the industry and for the industry. Perhaps there’s an argument for multiple “vertical” exchanges that focus on industry “insets” (instead of offsets), where certain industry-specific carbon projects can only be used to counterbalance certain industry-specific actions. Perhaps we will figure out a way to create the “one true exchange.” In any case, it’s clear that the conversation around carbon credits is fast evolving – and despite all of the crime tape around the system today, there are plenty of sharp innovators on the scene to help.

The capital requirements of the energy transition are well-publicized. The amount of money that needs to be invested in order to install new renewables capacity, upgrade the grid, deploy new vehicle fleets, integrate new heating and cooling systems, scale up carbon capture, build up bioenergy pipelines, etc. is in the tens of trillions of dollars. Those aggregate numbers are staggering, but it’s hard for an average consumer to visualize exactly what that impact will be on our day to day. Perhaps we all have to plan on buying an EV in the next decade? Upgrade our heating systems? Choose a more efficient oven or washer/dryer? Foot a higher utility bill? Perhaps we all should expect to pay a bit more in taxes over the next few decades?

For workers in energy, that impact is a lot more apparent. Putting that much capital to work and retiring the corresponding amount of heavy infrastructure will have enormous labor implications. Most of those who touches oil and gas – from investor to CEO to engineer to field tech - are thinking about the transferability of their skills to new energy areas. Geologists and reservoir engineers are evaluating applying their ability to characterize the subsurface to areas like geothermal or carbon capture. Construction workers used to being on the oilfield are evaluating similar work constructing solar panels. Project managers are thinking about how to step into the new wave of new energy-oriented projects. The industry is now facing an unprecedented time of despecialization, that in which nearly everyone in the oil and gas ecosystem, from operator to service company to startup to investor, is being pressured to orient their roles to be less niche and more market agnostic.

And this despecialization doesn’t come without consequences. Pay is one big one. It’s well reported that the average pay for a job in renewables is more likely to be lower paying than a similar job in oil and gas, with the discrepancy ranging anywhere from 20% (construction worker to construction worker) to 40% (engineer to engineer). The gap is even wider when considering the probable scenario of a tenured worker in oil and gas taking a step-down in position in order to learn the ropes of a new trade. And that still doesn’t include the costs of training or job search. Although companies like Workrise are moving to ease this burden, the energy transition will still overall be a painful process for the average worker. With pressure continuing for renewables/new energy to lower costs, coupled with the pressure for oil and gas companies to keep offering attractive compensation packages to attract talent, this pay gap will likely continue for a long while.

What also comes with despecialization is dealing with increased competition. We see this happen with energy tech companies looking to expand outside of oil and gas as well. Although the oil and gas industry is large, the world outside of it is even larger. As more and more people look to transition with a less specialized and more commoditized skillset, they will have to contend with competing against both other workers transitioning and new workers from other industries. The mental and financial stress of dealing with this increased competition can be incredibly taxing.

All of this will change the average worker in energy. The workers that stay in energy will increasingly be the ones that can appreciate the non-pay related benefits of working in energy transition. That includes job stability, impact, and social responsibility. This is not new to the average Gen Z or millennial worker. Studies have shown that Gen Z workers prioritize purpose over pay. So as the generational turnover occurs, becoming a company that emphasizes social mission and responsibility will be key to attracting and retaining talent – and perhaps naturally resolving the pay gap.

In the meantime, for those that have not adjusted or can’t afford to adjust to this mindset, the road ahead will be a little rocky. BLS reports that 400-500k workers work in oil and gas extraction or support activities for oil and gas – and using more inclusive taxonomy, that number expands to somewhere between 1-3mm according to USEER and more than 10mm according to API. As this workforce moves to despecialize and enter into a job market driven by transition, many will be tested on their flexibility, ability to learn, drive, and passion for what they do. Many will flourish under these settings. And many will be pressured to move on from this industry. How this will settle out is still a mystery. If there’s any surety around the future though, it’s that the transition won’t be easy for our workers.

It’s no secret that with the evolving energy landscape, there will be more business models in our industry oriented towards the individual consumer. The advent of new price comparison websites such as Power2Switch or PowertoChoose have made comparing retail energy plans much easier, showing in simplified terms what the average cost per kWh is for certain thresholds, highlighting whether the rate structures are fixed or variable, % renewable energy, etc. Digitalization has made the consumer more powerful in energy choice, leading to an increased focus in studying and responding to the different components of consumer preference.

This has changed the retail energy product offerings over the years, with more robust online / bill pay platforms, higher % of renewable energy, clearer billing structures, and partnerships with sophisticated energy management tools like Nest playing key roles in swaying the more capricious consumer. We increasingly see more energy companies having to take learnings from more traditionally consumer-facing businesses like retail or tech in order to stay competitive. Standard practices in retail and tech like A/B testing, consumer data gathering, and consumer-oriented marketing have been and will increasingly be transplanted into the energy sector.

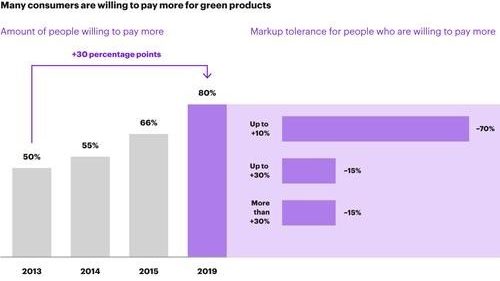

But this trend is not isolated to residential electricity consumption. Current energy-centric products like EVs and some types of batteries will also find momentum in direct-to-consumer models (such as Tesla). Traditionally oil-weighted products like plastics and polyester fibers are selling into markets where consumers are increasingly having a preference for low carbon / circular economy types of materials (think recycled PET yoga pants or bottles). A Kearney study found that the percentage of consumers that would be willing to pay more for “green” products has jumped 30 points from 2013-2019.

Fuel distribution and consumption has also been impacted by this trend. There is a strong case to be made for why oil and gas and other fuel production companies should expand their retail energy presence – and indeed, we’ve seen some oil and gas companies already pursuing this strategy. Shell, in 2018, committed to investing $7-9 billion in developing a new downstream strategy, expanding its convenience store locations and revamping the product offerings and services at each location. BP formed a joint venture with ArcLight to buy convenience store chain Thorntons. Some companies have taken an even more creative approach, partnering with consumer-facing businesses like food delivery services. The benefits are multi-fold: production companies can find better outlets for their fuel products in a market of diminishing demand growth, increase margins by offering high-value products and services outside of the commodity, and drive better brand perception by direct-to-consumer marketing.

Retail energy also creates better opportunities for energy transition. As renewable fuels gain market share, product portfolios will become more differentiated and complex, which means being able to build a consumer understanding of the different fuel blends will become more important. That understanding is difficult to ramp up without a direct line of communication to consumers. Having a retail presence also creates optionality for energy companies to put in place EV charging or hydrogen depots once the demand is in place.

The point is that energy in a lot of ways has become a consumer matter. All types of energy usage - electricity production and consumption, energy and carbon usage in product manufacturing, fuel distribution and usage, etc. – now involve more consumer input. And the flexibility that a world of energy choice affords means consumer input will increase in importance going forward. Transitioning to a B2C sales model with greater understanding of consumer purchasing decisions will build more nimble and defensive businesses.

Consumers are paying attention to energy and it won’t be long before energy will have to pay attention to consumers as well. Consumers matter in consumer matters.

A question we always run into in energy tech is when a technology is worth investing in. How does one know whether a certain technology will persist or desist? What signals form the “green light” to say that a certain technology is for sure sticking around long enough for a good investment to be made? It’s a million, billion, and even in some cases, trillion dollar question (depending on how large of a capital investment is at stake). And it’s especially hard to answer in the world of energy tech.

The challenge with this space is answering the larger questions around adoption rate and predicting the “tipping point.” Malcolm Gladwell famously wrote a book about this entire phenomenon, illustrating the many parallels that dissemination of ideas and beliefs and behaviors have to each other. The moment a trend turns into an epidemic is a tipping point, and just like in literally viral epidemic, the adoption is driven by “superspreaders,” which are a minority of the population. Gladwell lays out the 80/20 rule, which is that 20% of the participants do 80% of the “work.” He defines the 20% to be separated into three different categories:

The Connectors – those that have wide social networks and link up disparate parts of population

The Mavens – those that are collectors and spreaders of knowledge

The Salesmen – those that are good at persuading others to change their behavior or adopt a new idea/belief

Gladwell isn’t the only one that has identified the role of “movers” in tech adoption. Scientists at the Rensselaer Polytechnic Institute found in 2011 that the tipping point threshold for when a sticky belief turns into majority opinion hovers at around 10%. In other words, the burden of accelerating adoption falls disproportionately onto the first 10% committed opinion holders of a population. It may take some time – possibly even forever – for that first 10% to accumulate. After that 10%, researchers found that the exponential switch flips and there is clear line of sight to majority adoption.

We have seen this happen in energy technology. Its tough to quantify the number of “committed opinion holders” around electrification of vehicles and how that’s progressed over time – perhaps that’s somewhat proxied in the multitude of consumer surveys that have shown a dramatic increase in the proportion of consumers intending to buy an EV in the future, a number that has shot up from ~17% to ~45% in 5 years for the US. But some minority threshold did get crossed and the power of population consensus amongst investors around the future being electrification has enabled a dramatic increase in investment into the EV ecosystem (28 SPACs…!).

When will that threshold be crossed for ecosystems less developed like hydrogen? Or carbon capture? Figuring out when the tipping point will occur can make a big difference in whether we will see the same acceleration happen in these spaces. Most reports look to 2030 for green hydrogen to make a significant dent in global hydrogen production. But a lot of that acceleration depends on costs falling at rates in-line with the drops we’ve seen in solar and wind. If there is a tipping point earlier – as we have seen can very well happen with the increasingly steep s-curves observed in the general technology space – it’s possible that something like hydrogen that is still considered speculative by many investors may be here faster than we think.

One of the most interesting aspects of the energy and industrial tech ecosystems is that they’re dominated by large, established companies –companies like the integrateds, large utilities, service companies, independent E&Ps, industrial gas players, etc This is both a blessing and a curse. It’s a curse because technology that is not validated at one of these constituencies often faces a much higher hurdle to be adopted by general industry…and we’ve talked at length about how lack of change culture and siloed roles often prematurely stilt tech uptake in some of these organizations. But at the same time, it’s a blessing because just a few “committed” corporates that can create a culture where the whole company is buying into the strategy can move a technology much closer to tipping point than if the same were to occur in other industries. For better or for worse, we are an in an industry where the large energy companies have the power to be “movers” in the new energy space.

With something like hydrogen technology, which already has a good growing set of committed stakeholders on the demand side and, to a certain extent, on the supply side too, perhaps all it takes is just a couple more of these large players to move themselves into the “committed opinion holders” camp before a tipping point occurs. For the rest of us, making sure that the decision makers at these companies realize how much is at stake in their hands is crucial.

As we close the books on one of the most unusual years in our history and look to a better, brighter, and less catastrophic 2021, we can at least assure ourselves that 2020, at minimum, offered us some interesting lessons for the energy tech space. Here are some of ours: