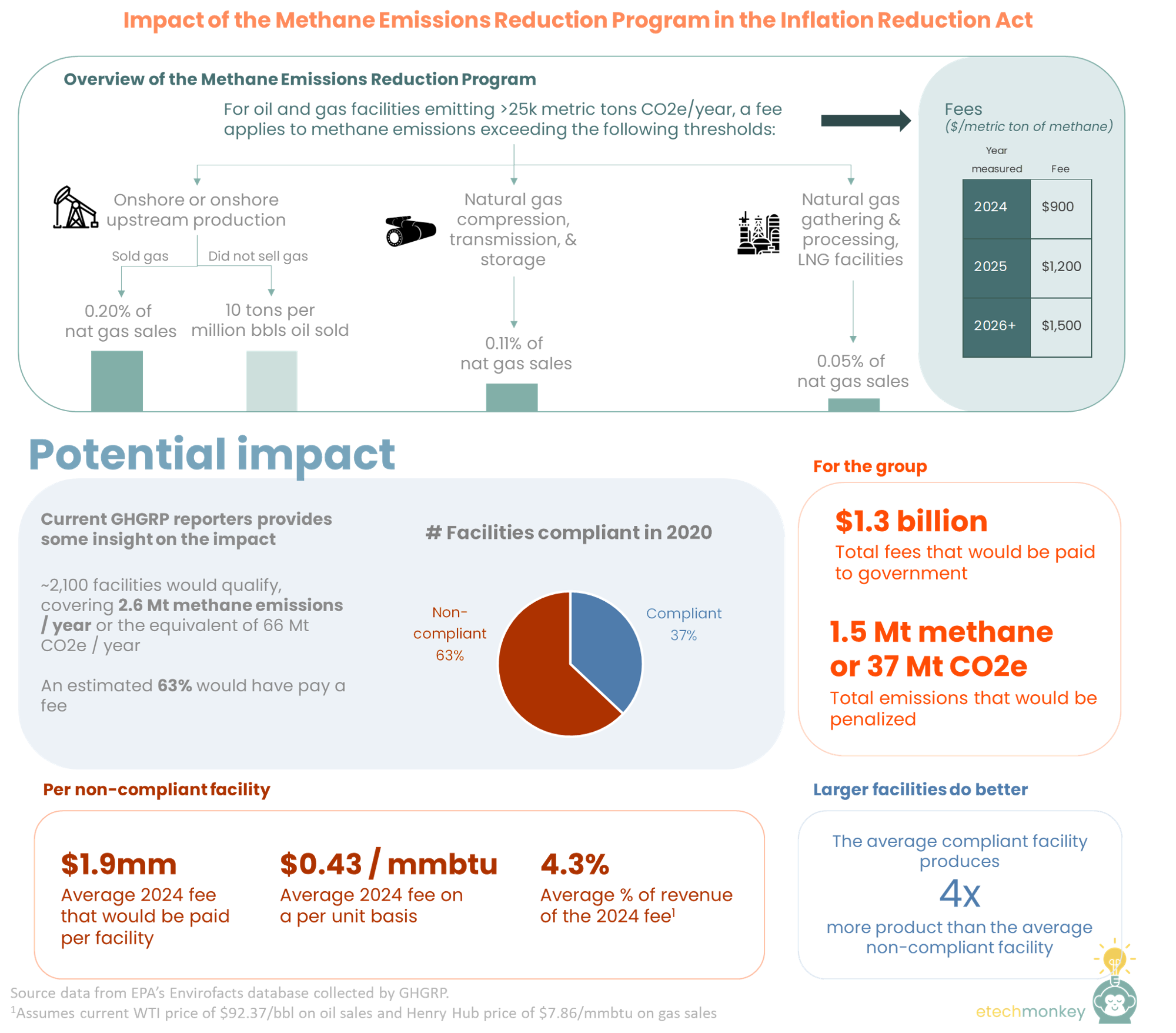

The oil and gas industry has a problem. Capital is leaving in droves. The industry is on the receiving end of increasingly negative social commentary and facing calls to pivot to greener energy sources. The workforce is losing talent left and right. And at the same time, there is immense pressure for companies to become […]

New membrane technology may seem like an obscure part of the energy tech ecosystem, but there are surprisingly many processes across energy that depend on membranes. Anything that involves separation of product, like natural gas processing and oil refining, usually has a membrane involved to separate a fluid or gas New membrane technology may seem […]

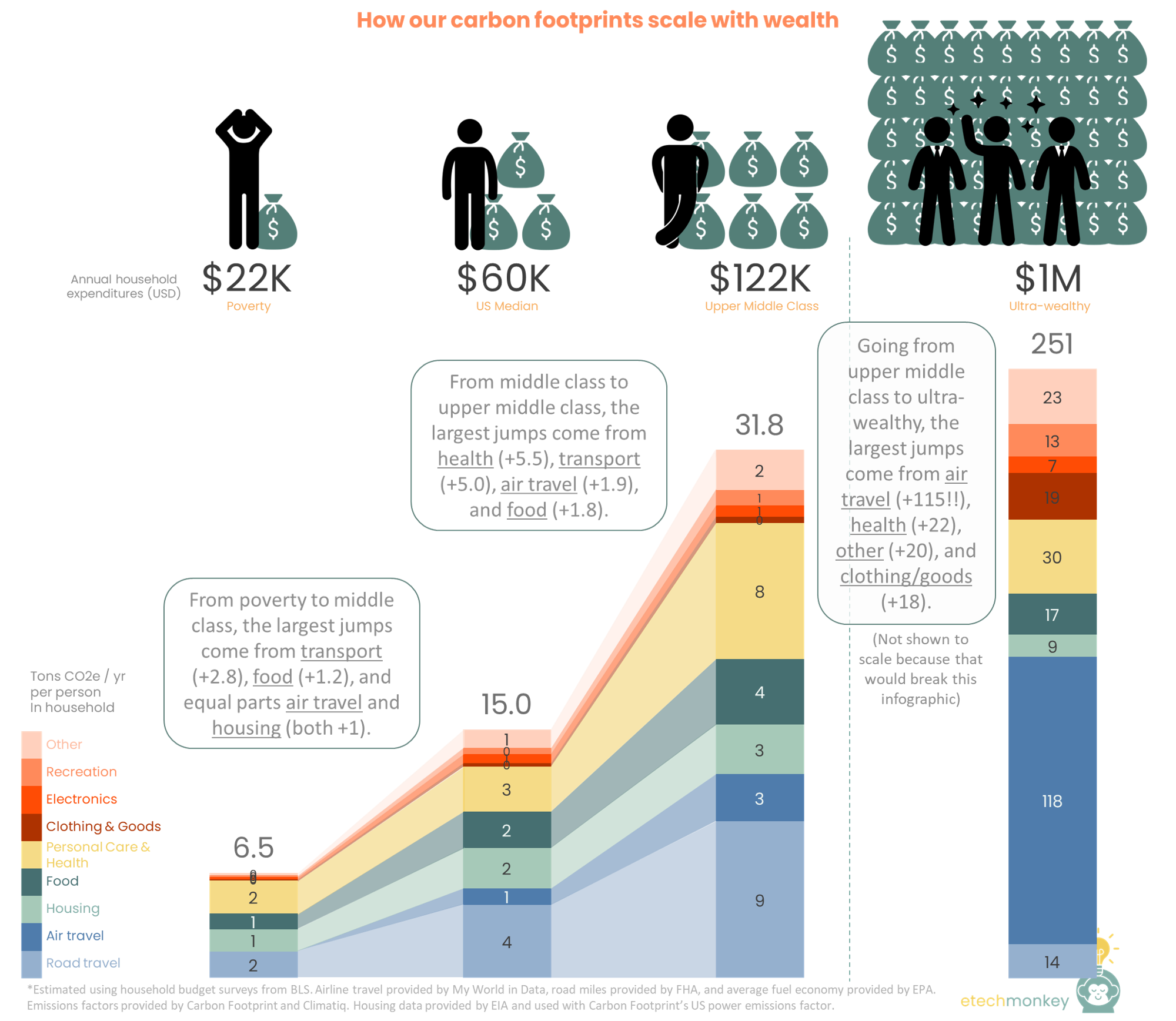

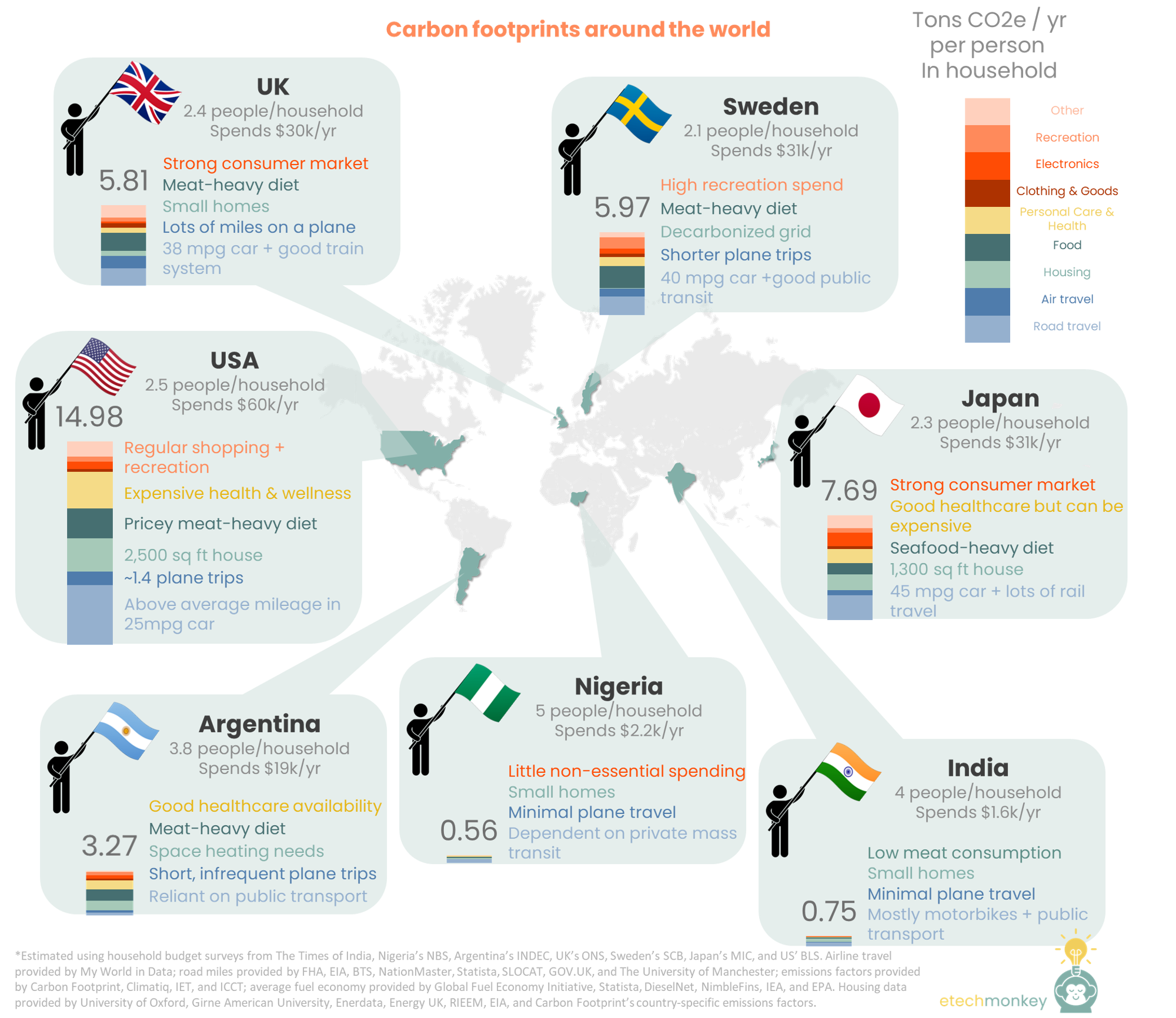

There is a generous amount of discussion around the role of carbon dioxide and other GHG emissions in producing climate change. The majority of headlines surrounding climate change attribute it almost solely to GHG. Goals set by various climate authorities focus almost entirely on reducing the global carbon footprint and our CO2 equivalents. And when […]

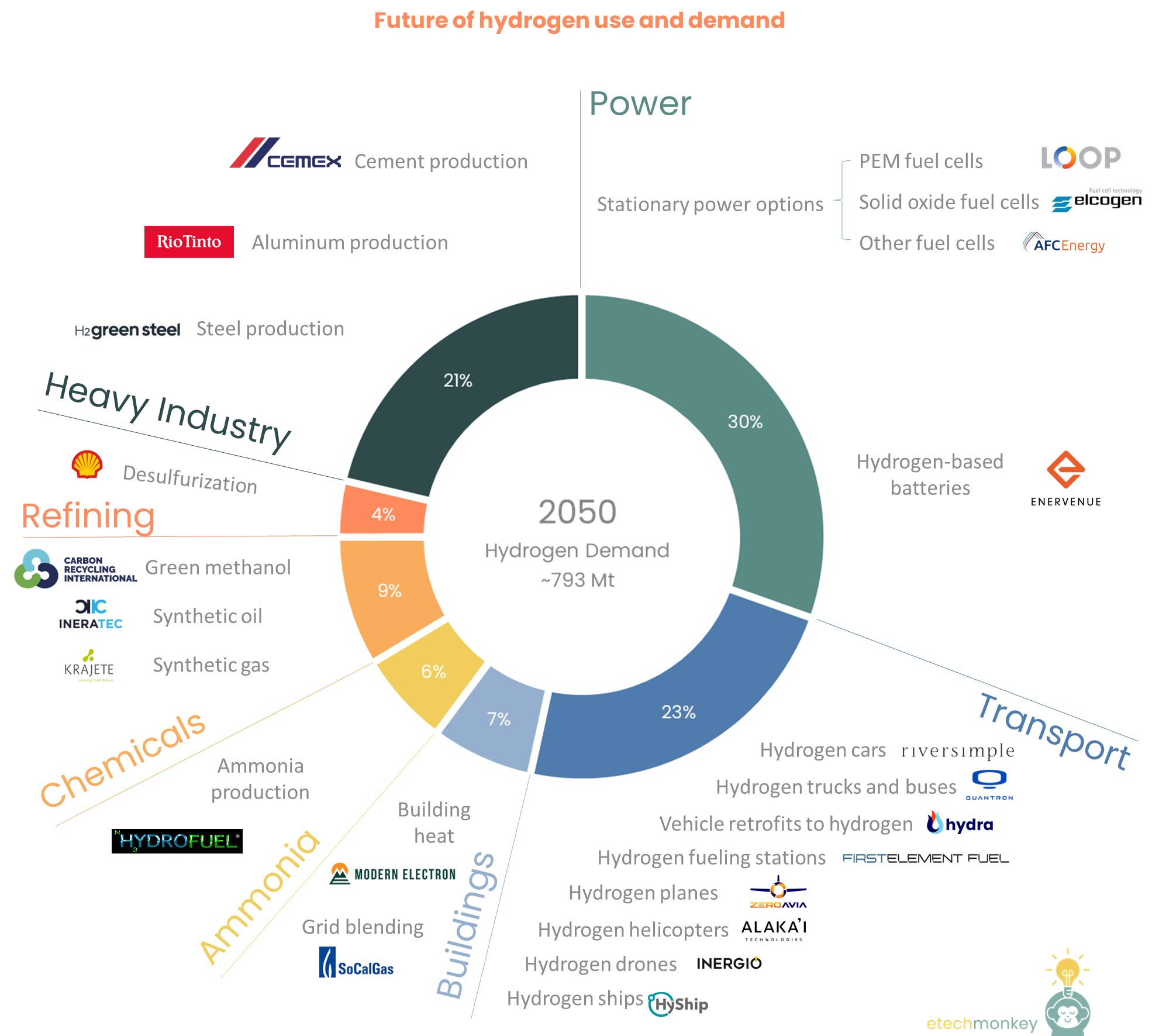

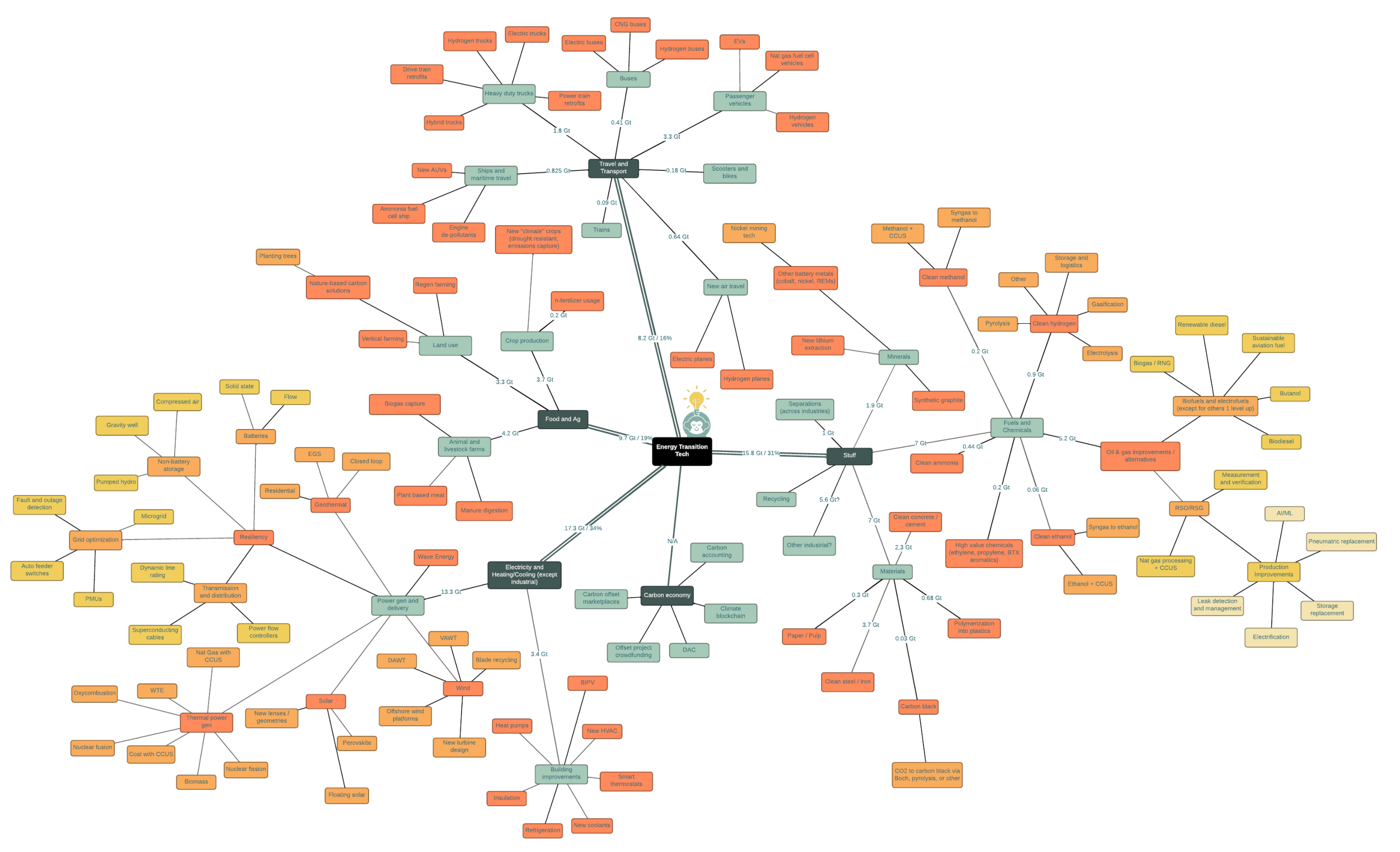

At TPH, energy technology is a broad umbrella. We typically include any technology with an impact on any type of energy at any point in the value chain. But when the rest of the world speaks about energy technology, there are often varying degrees of alignment with this definition. The “older” definition of energy technology […]

It’s been hard not to notice that SPACs have emerged as the new “It” vehicle for the capital markets. The last few Bloomberg headlines this past month speak enough in of themselves: “Why Blank Check Companies (SPACs) Are Filling Up Fast “What Are SPACs, the Hottest Stocks of 2020?” “TPG is Said to Plan ESG, […]

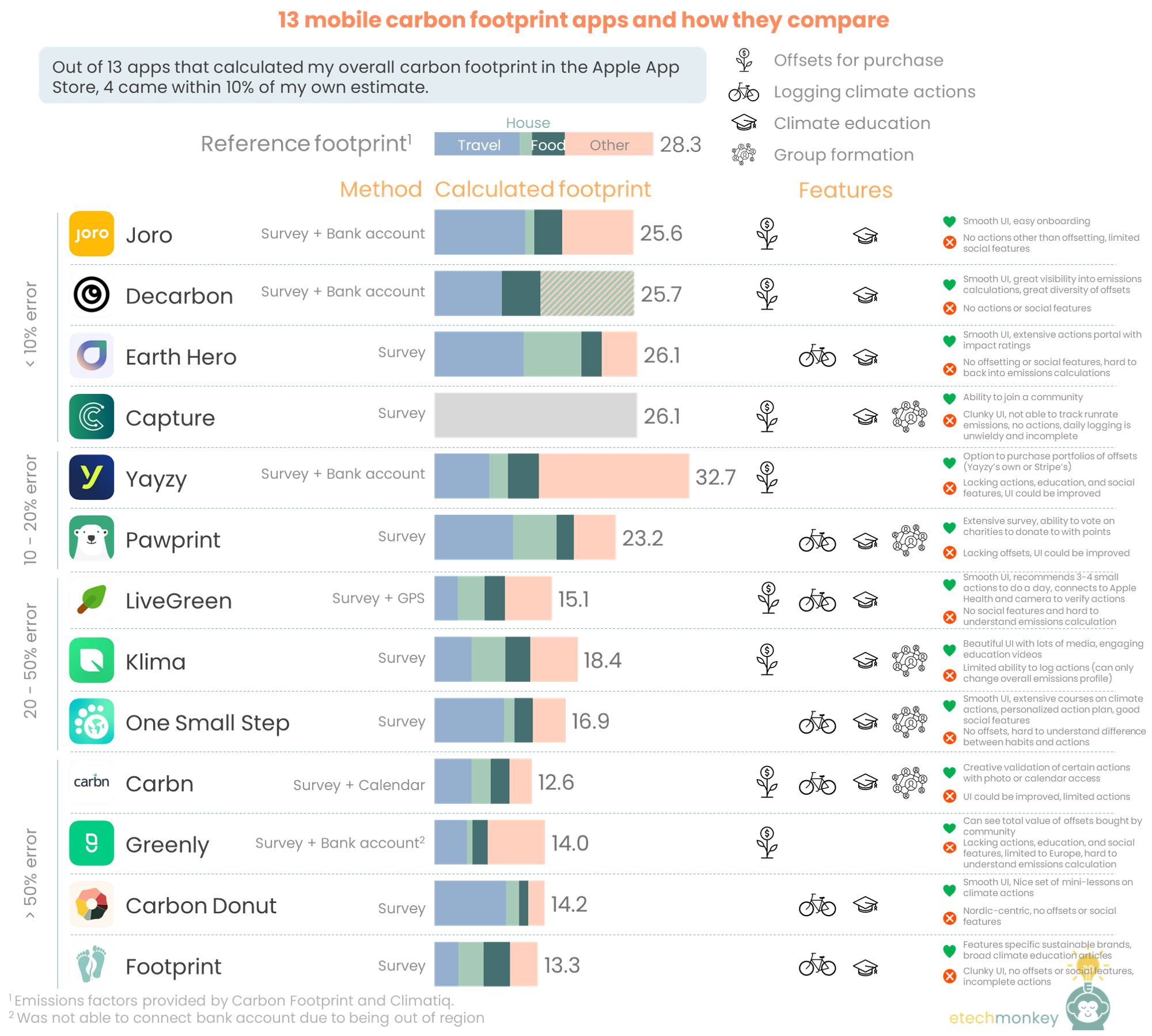

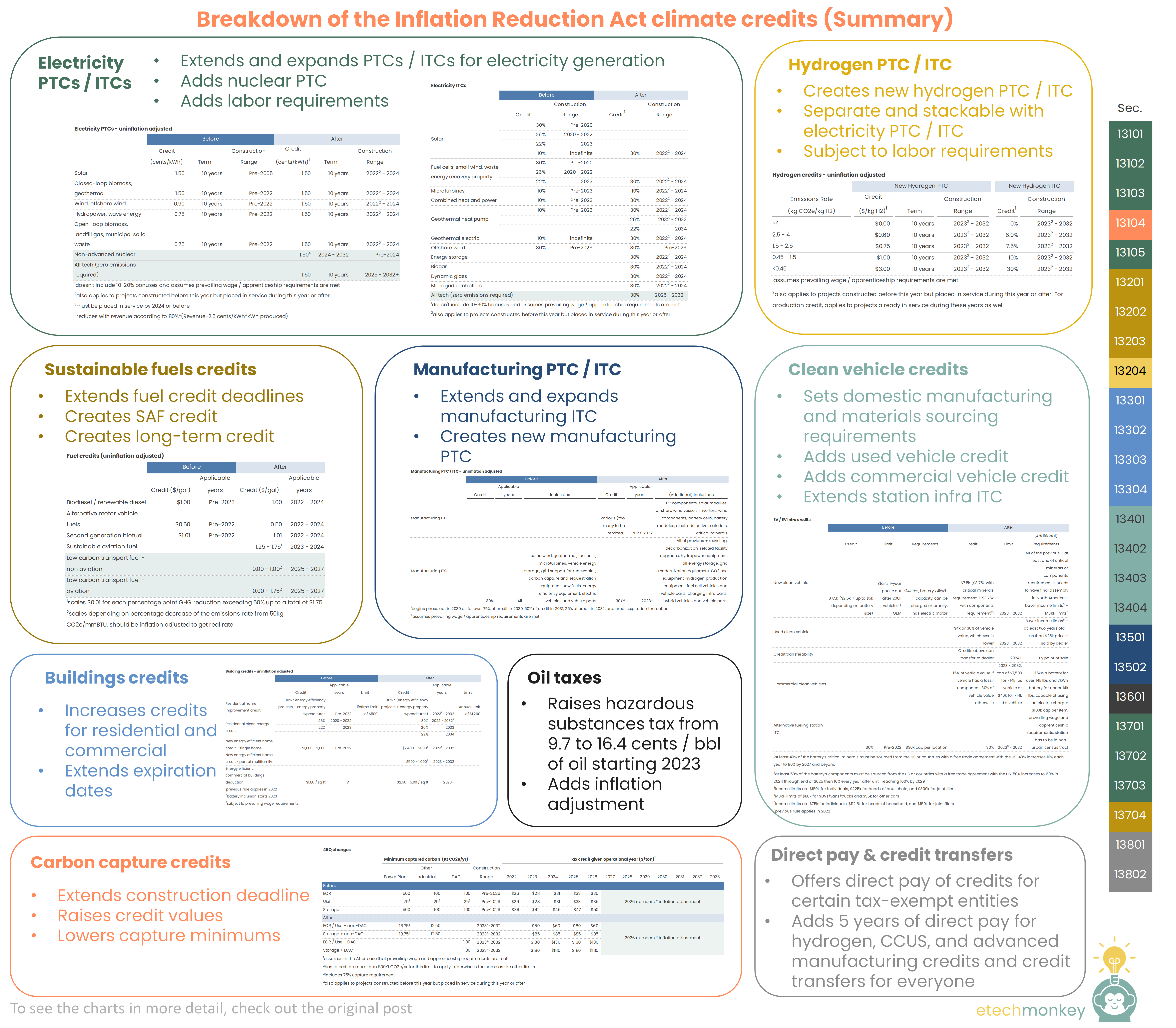

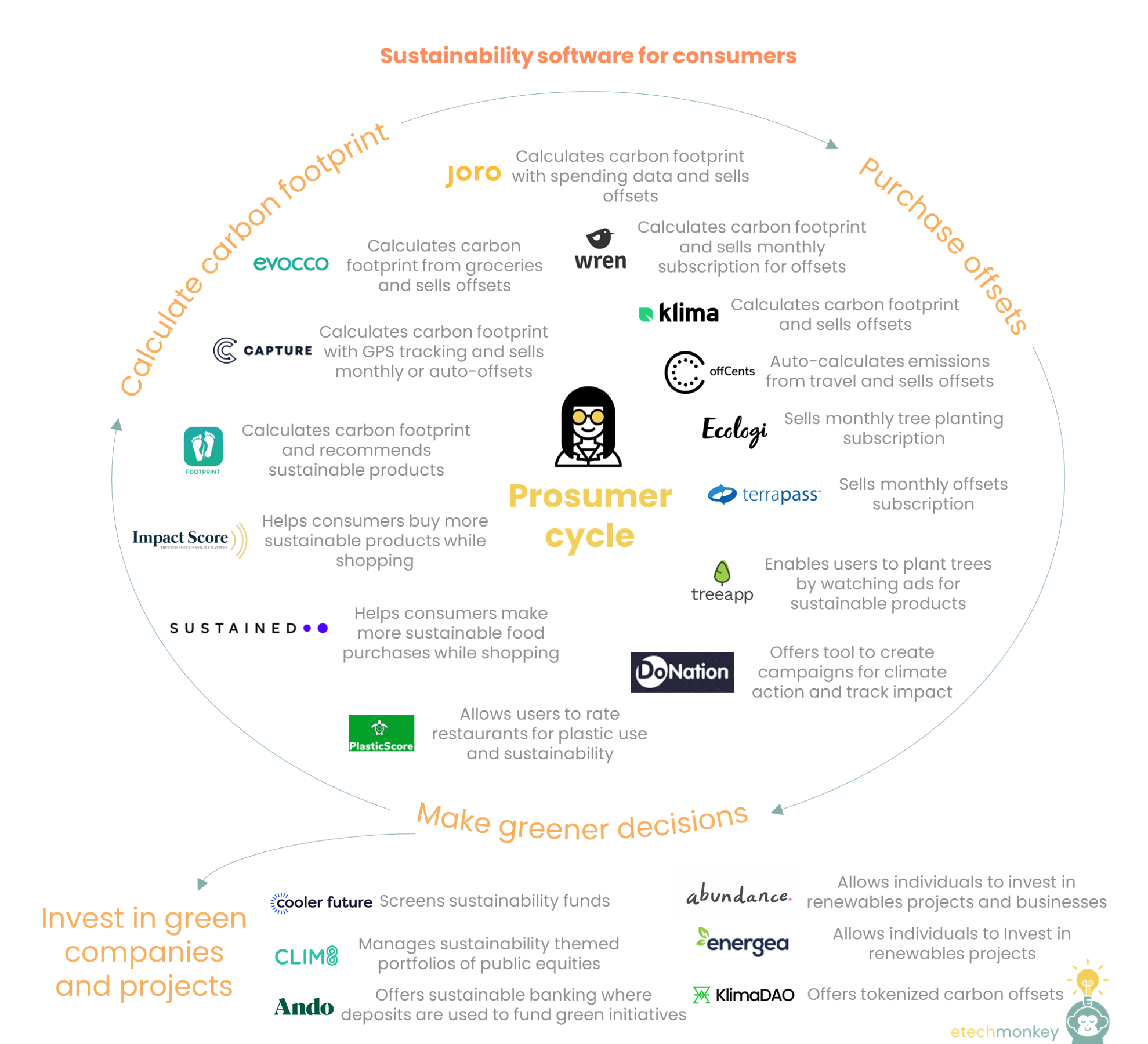

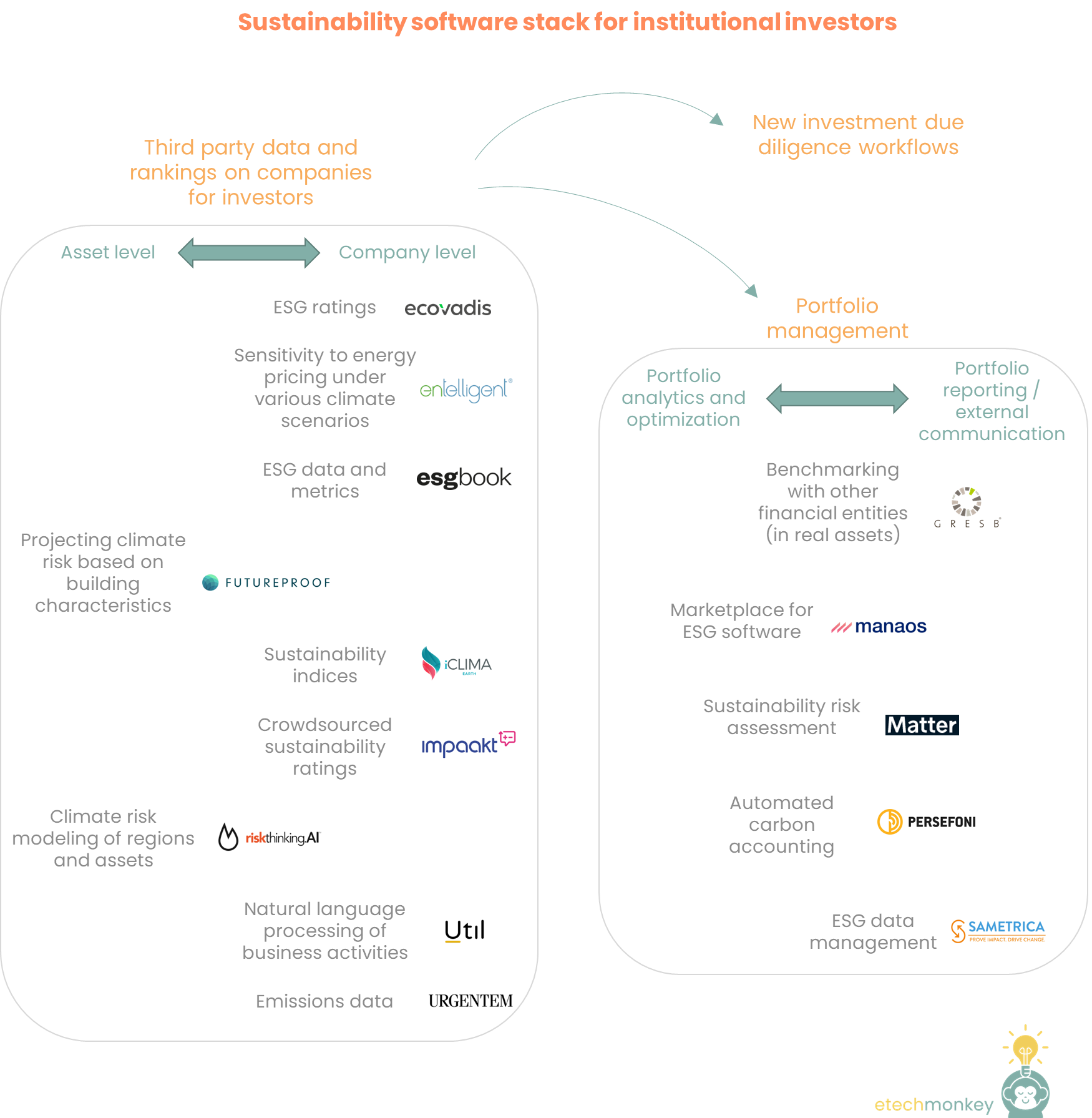

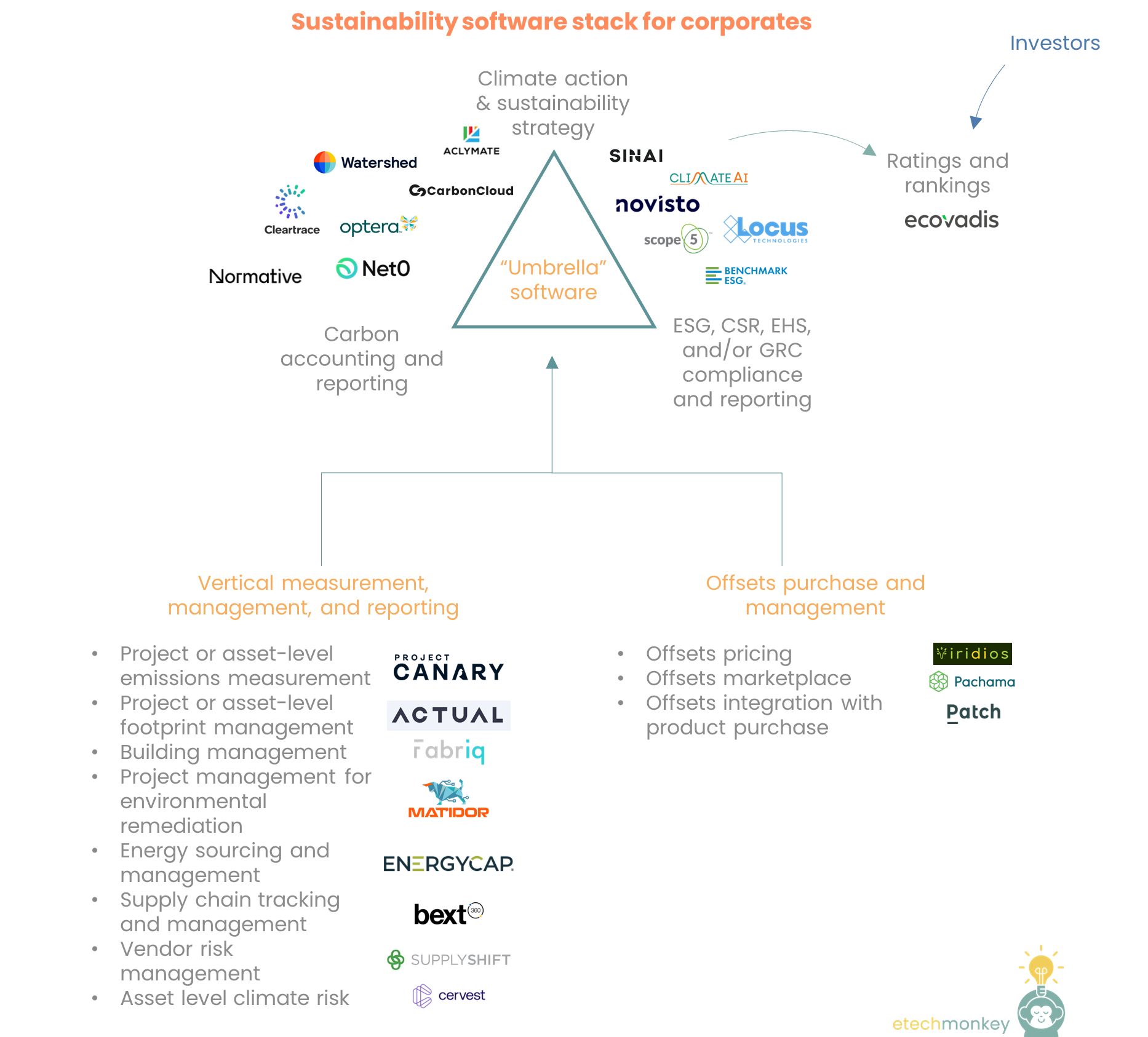

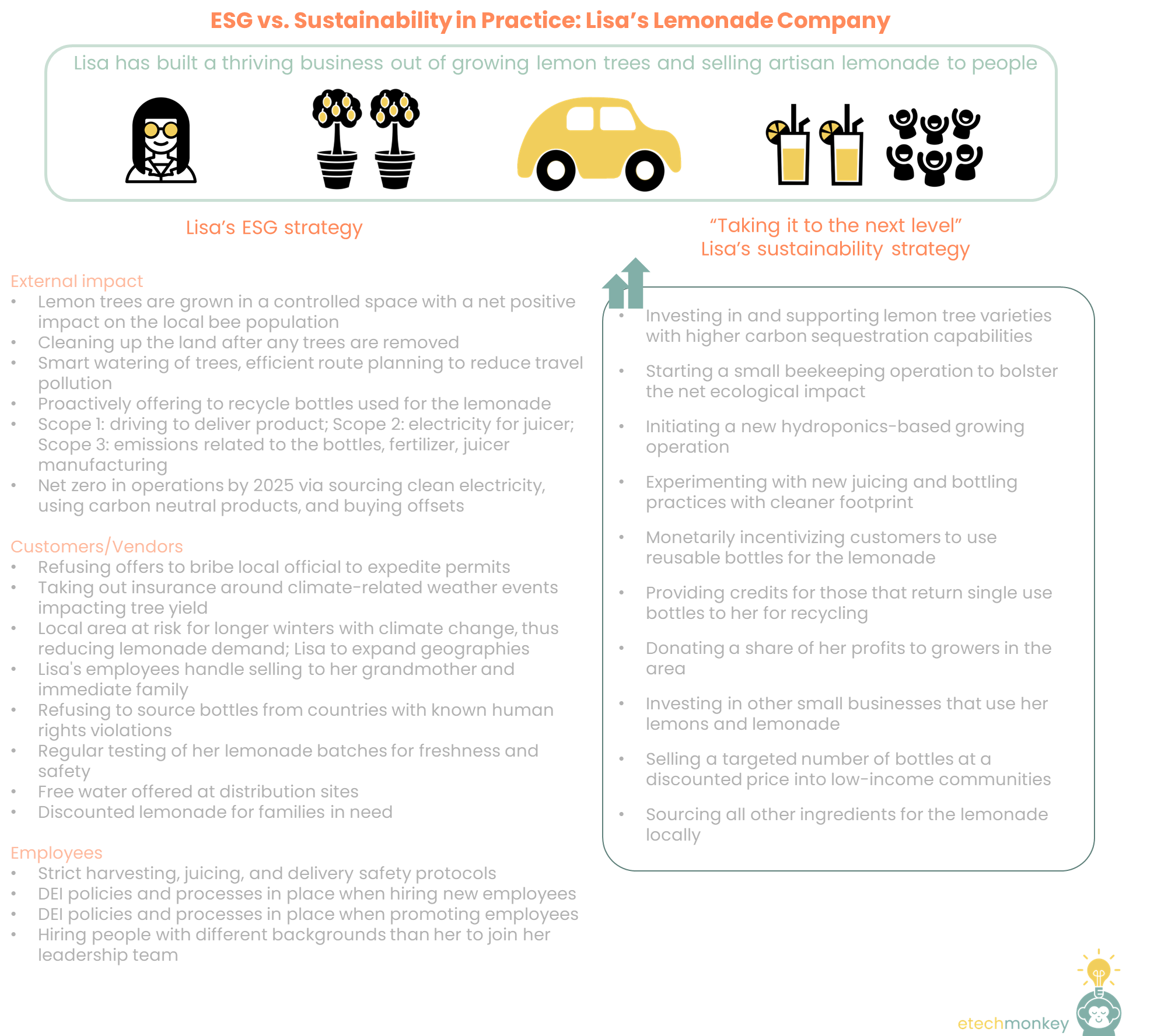

Carbon accounting is complicatedIt’s hard to not run into debates over carbon accounting. Almost all of the 6 ‘W’s have a certain degree of contention around them. What environmental metrics do we report? Where and how do we report them? When do we report them – every year, every quarter, in real time? Who reports […]

While the COVID crisis has no doubt resulted in tragedy, both in human life and economy, the silver lining of it all is that the environment has benefitted, as evidenced by improvements in air quality, water quality, and possibly wildlife conservation. 3 months into our lockdown, the implications of these improvements on our environmental goals are apparent. Our Paris […]

It’s actually fairly hard to track down public company GHG emissions data. The GHGRP (Greenhouse Gas Reporting Program) only releases data reported at the facility or regional level, not at the company level. Data at the company level is buried in individual, non-standardized 100-page long climate reports, often in varying flavors of charts, tables, and […]

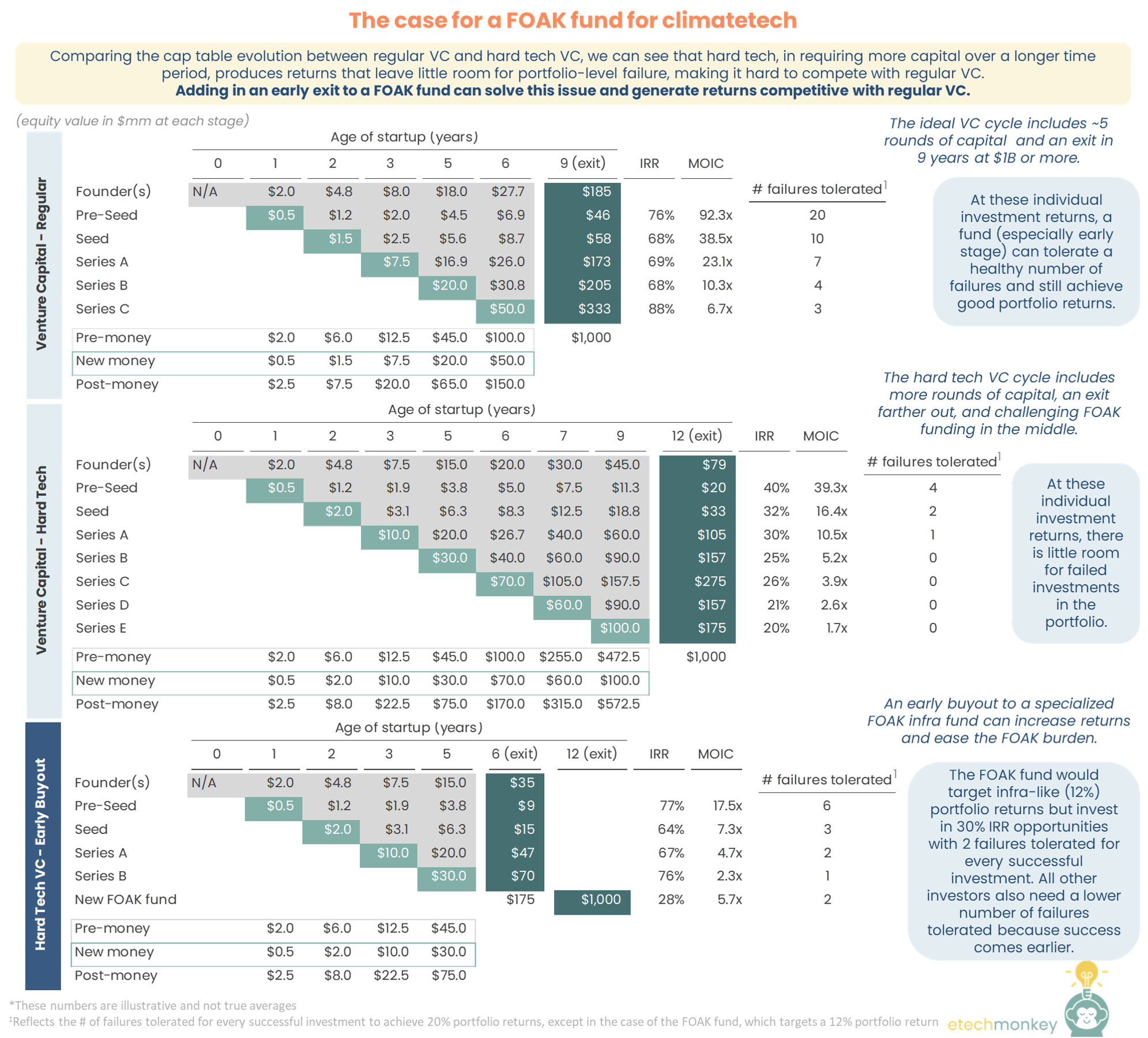

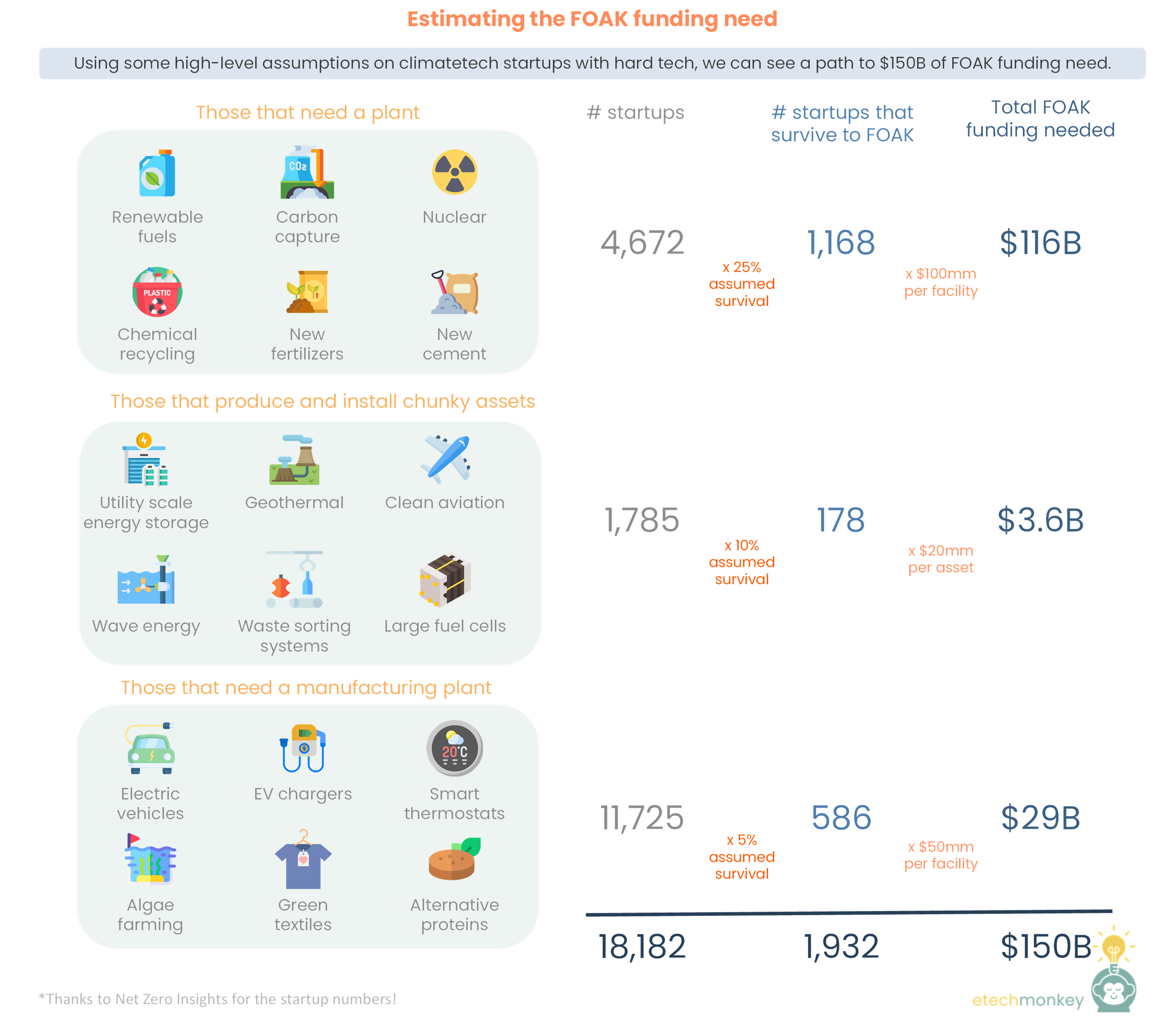

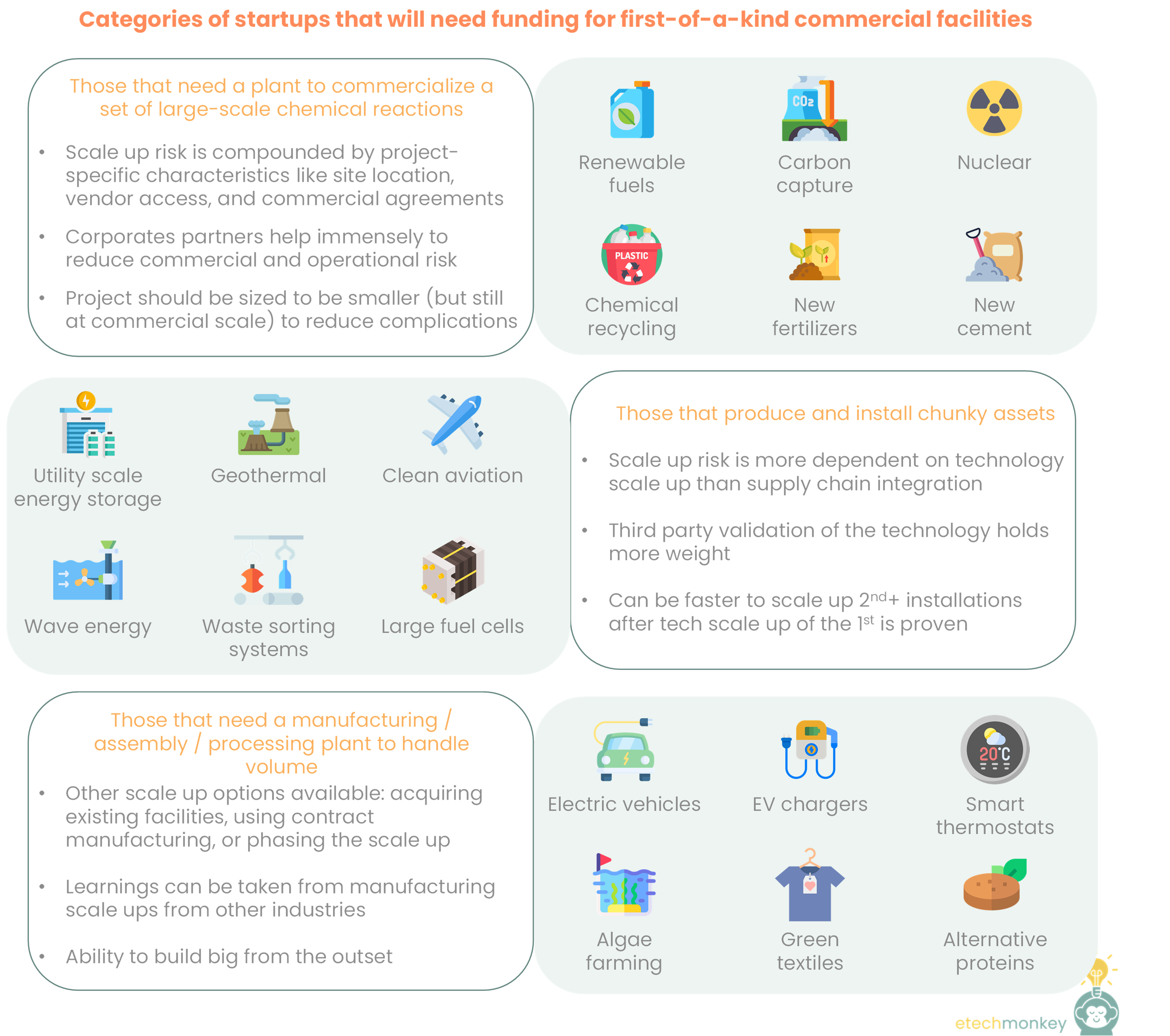

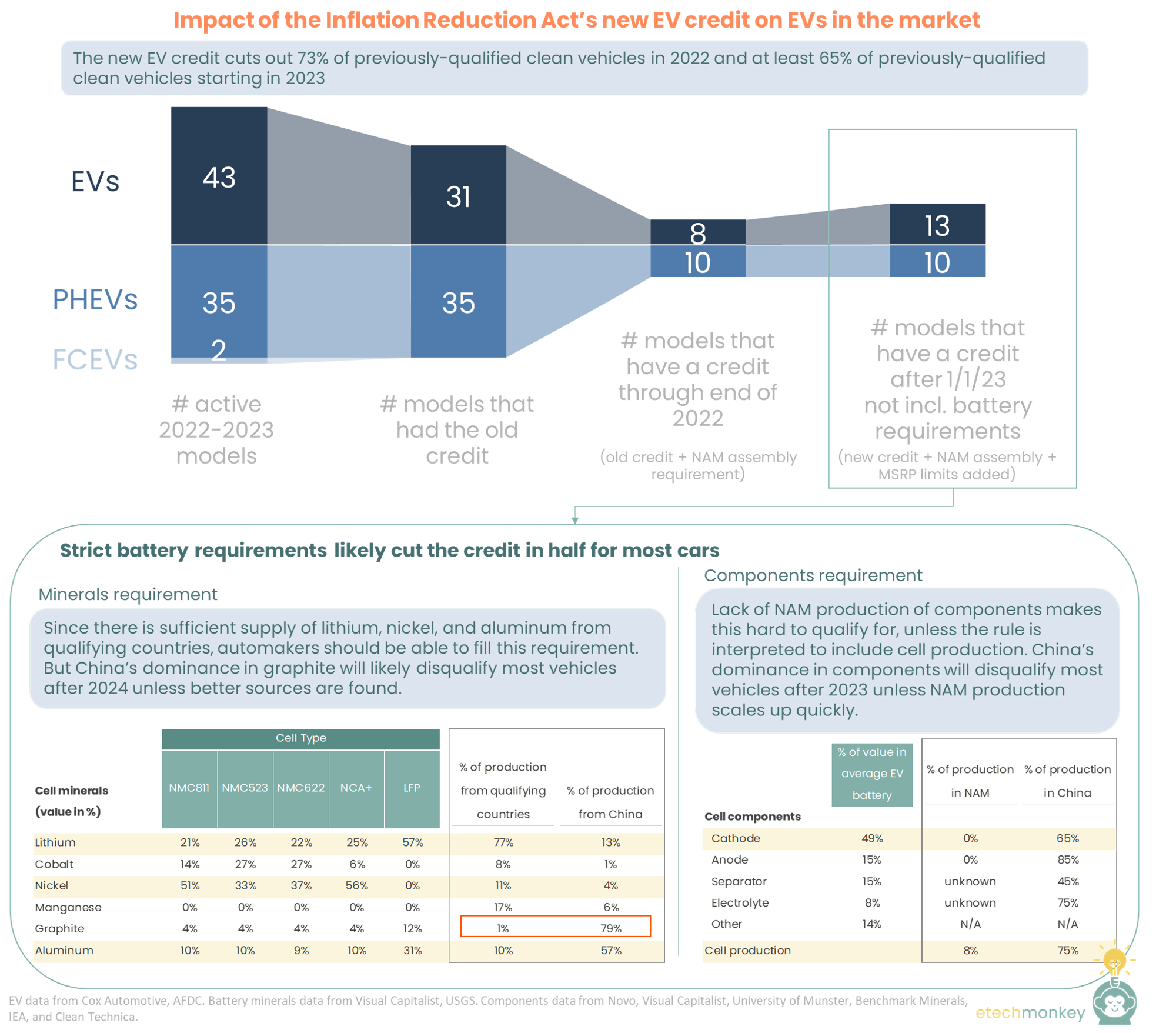

Last time, we explored how the venture capital world came to dislike hardware and prefer software. Modern technology companies with hard assets continuously face difficulty finding funding and often receive heavily discounted valuations because of increased competition for VC capital with similar-stage asset-light businesses. Multiple aspects of an asset-light business align it better with the VC […]

I often hear the words “Sorry, I can’t invest in hardware” Or “we’re only interested in capital light businesses” nearly everyday while speaking to others on our energy technology effort. It’s a very common wall to run up against. Out of the collective $167B raised in the US in 2019 for venture capital deals, $94B […]