Last week I did a review of the new IRS climate credits in the Inflation Reduction Act (Sections 13101 through 13802). The other climate-related portions of the act (Sections 21001 - 23003, 30001 - 30002, 40001 - 40007, 50121 - 50303, 60101 - 60506, 70001 - 70002, 80004) cover appropriations to states and government agencies for various programs (home rebates, EV manufacturing, electric transmission, air pollution, etc.) with loose guidelines as to use of funds. For a more detailed list of what funds are assigned to what programs, check out the CTVC database.

I didn’t focus too much on these sections since how those funds will be deployed out of those agencies is still currently unclear. It’ll take time for these government agencies to figure out their rules for what projects / entities qualify for those funds. And then it’ll be an additional step to figure out how to enforce those rules in a practical way. Until then, the impact of these parts of the legislation are hard to judge.

That being said, Section 60113 is worth discussing.

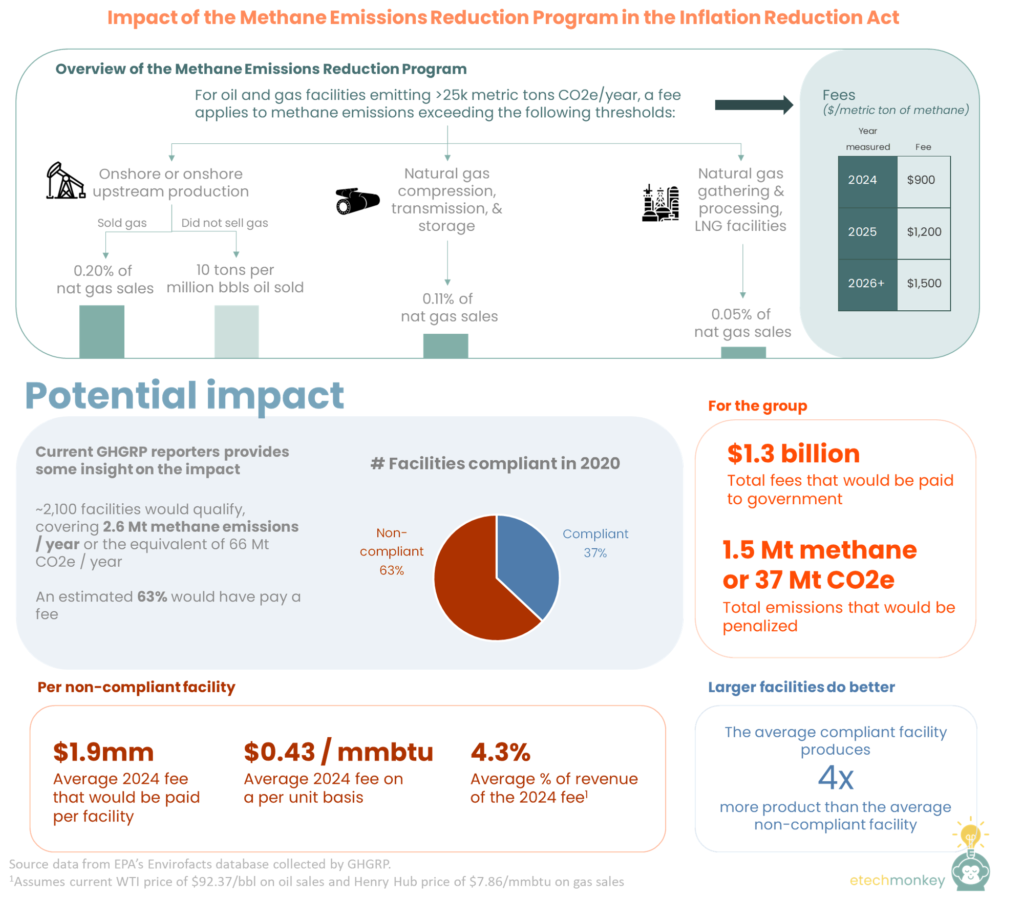

Section 60113 is a methane tax on the oil and gas industry. It places a methane fee on oil and gas facilities that report >25,000 metric tons of CO2e / year. For whatever emissions exceeds the emissions threshold for that facility, the charge would be:

The emissions thresholds are as follows:

There’s also an exception built in to exclude facilities that that are already regulated by state-level methane emissions requirements, provided that those requirements would result in emissions reduction equal or greater to those that would be imposed by EPA’s proposed rule from last year.

Using current GHG reporting, the potential impact from this fee is 37 Mt CO2e, maybe less

The >25,000 metric tons of CO2e / year is the same threshold used by the EPA to determine eligibility for facility-level GHG reporting, so we actually have an idea of what emissions would be subject to this new tax.

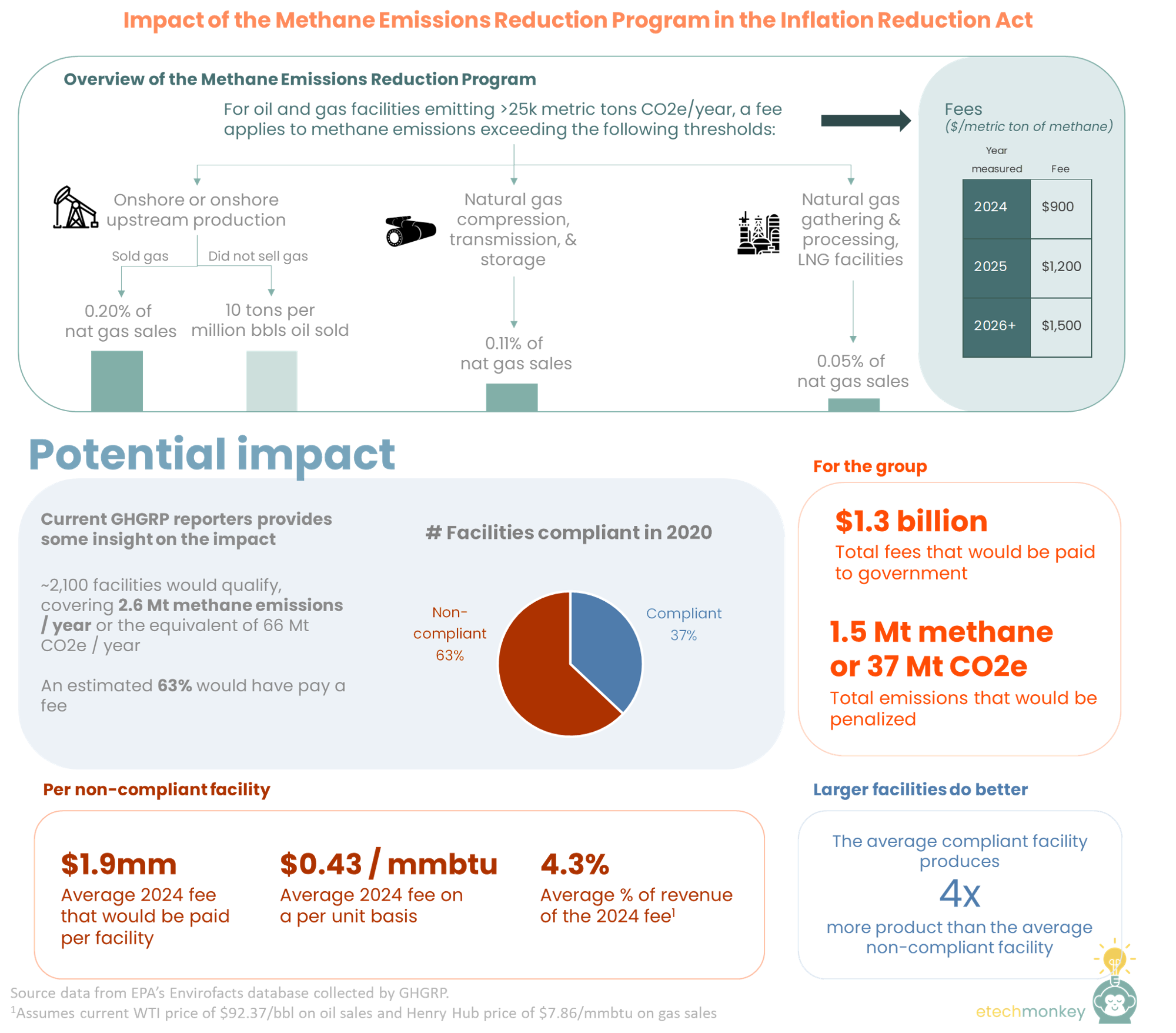

In 2020, the 2,103 qualified oil and gas facilities that reported to GHGRP emitted a total of 0.3 Gt CO2e / year. Of that amount, 77% or 0.2 Gt CO2 are from CO2, and 23% or 0.07 Gt CO2e (which is equivalent to 2.6 Mt methane) are from methane. To put this in context, the total emissions in the US right now is 5.8 Gt CO2e, so the covered facilities represent ~5% of the total.

If we impose the methane fee on the facilities that exceeded their thresholds we can see that an estimated 63% of current facilities are currently not compliant. Those facilities represent ~1.5 Mt methane in excess, or the equivalent of 37 Mt CO2e. With the 2024 fee amount, that’s ~$1.3 billion in fees paid to the government.

The numbers are possibly smaller considering the regulatory exception that may allow some facilities to bypass this fee. Facilities in states like Colorado can follow state regulations instead if the emissions reduction would be greater or equal to those imposed by the currently proposed but not active EPA rule. It’s unclear how that emissions impact would compare to this fee.

The economic impact won’t cripple operators by any means but can be significant

A non-compliant facility on average would pay $1.9mm for 2024’s emissions measurement. That translates to $0.43 / mmbtu or 4.3% of estimated revenue using today’s prices. Though 4% of revenue is no small change, commodity swings can be much larger for oil and gas facilities. Cost structures often take this potential volatility into account and are sized appropriately to be able to handle them. So at today’s prices, the economic impact should be easy for most operators to handle (9 facilities actually would have the fee take up more than 50% of revenue, but those are large outliers).

That being said, commodities do shift quickly and if pricing drops down close to the breakeven, the extra punch from the methane fee could hurt a lot more (average of 12% at $40 oil and $2.50 gas). So hopefully that itself gives operators enough incentive to take emissions reduction seriously.

These thresholds are generally in line with what industry has already set for itself but will incentivize laggards to comply

OGCI, composed of many of the large oil and gas majors, already met its 0.20% methane intensity target in 2020 and is now setting up to have a target of well below 0.20% by 2025.

ONE Future, a natural gas consortium, has publicly stated its goals to be 0.28% / 0.08% / 0.111% / 0.225% for upstream / gathering / processing / transmission & storage. These are much higher than the methane fee thresholds, BUT in practice (or at least in what's reported), the consortia has already reduced its emissions to be well under their goal and the methane fee thresholds. In 2020, they reported 0.11% / 0.04% / 0.02% / 0.14% for upstream / gathering / processing / transmission & storage, which, save for a 0.03% difference in transmission, are in compliance with these new methane fee thresholds.

So for the operators that have already set goals and are working on their methane intensity numbers, this fee should have low to minimal impact on their efforts.

But looking at the wide distribution of methane intensities across operators, there are many that are egregiously off base. This fee would hopefully help push those laggards to keep up with the rest.

The fee doesn’t apply equally, hitting the smaller facilities harder than larger ones

A couple of interesting trends to observe: the non-compliant facilities tend to be smaller facilities, having an average of 48 Tbtu production, more than 4x lower than the compliant facilities (perhaps a factor of the methane intensity goals mentioned above). Offshore facilities also tend to be more non-compliant than onshore facilities. LNG, though with very few facilities in general, is much more compliant than its traditional gas counterparts.

GHGRP under-reporting is a real issue and could handicap the emissions impact

What was confusing to me was the discrepancy in methane emissions accounted for under GHGRP and the methane emissions estimated by EPA’s GHG Inventory (GHGI). According to GHGI, methane from natural gas and petroleum systems account for 0.2 Gt CO2e in 2020, almost three times higher than the 0.07 Gt CO2e that is reported in GHGRP. That’s out of a similar 0.3 Gt CO2e number of total emissions. In fact, for some reason, the proportion of methane emissions reported in GHGRP is switched from the proportion of methane emissions reported in GHGI. I double and triple checked these numbers but couldn’t figure out why these don’t reconcile.

But beyond what could just be a government database problem is the overarching issue with GHGRP emissions accounting. There are more and more studies that point to GHGRP under-reporting for all sorts of reasons - industry non-compliance, bad methodologies, and reporting thresholds that exclude the majority of emissions. That's an issue not only for determining the fees in a rule like this but also for eligibility for GHGRP in the first place. Though GHGRP does put in place some verification procedures and requires operators to document all emissions reporting, there are still plenty of ways an operator can bypass the system, deliberate or not. Once there’s a real monetary incentive to do so, I suspect that under-reporting may be even more prevalent.

The way to counter this is with technology. With better methane monitoring technology will come higher standards for reporting. That will in turn allow EPA to not only verify the emissions numbers more easily but also allow operators better manage their own footprints in real time.

Some companies working on this problem: Project Canary, Kayrros, LongPath, Earthview, Seekops, Qube, GHGSat

TLDR; the methane fee is more of a gentle push vs. a kick in the butt. It likely won't have a big emissions impact, but it will play an important role of pushing industry laggards to catch up with industry leaders that are already setting similar methane intensity targets. Plus it generates an extra $1B for the government.