The oil and gas industry has a problem. Capital is leaving in droves. The industry is on the receiving end of increasingly negative social commentary and facing calls to pivot to greener energy sources. The workforce is losing talent left and right. And at the same time, there is immense pressure for companies to become profitable and start generating cash flow.

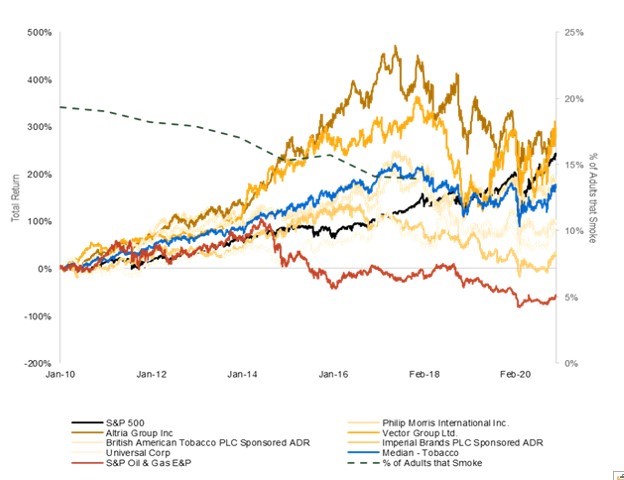

One of the best examples of an industry that’s gone through a similar struggle is the tobacco industry. The 1980s and 90s were a time of reckoning for tobacco, as the medical industry vilified cigarettes, investors faced multiple divestment campaigns, and regulatory bodies sought reparations in the form of litigation, an effort that culminated in ~$365B paid out via the Master Settlement Agreement in 1998. In response, the tobacco industry diverted its efforts to international markets, where social campaigns were considerably weaker, hiked up prices to become more profitable, cut costs, and heavily consolidated. They also made efforts to branch into growthier adjacent products like e-cigarettes and marijuana, albeit with varying success. Three decades later, the tobacco industry has transformed itself from an industry doomed to wither into oblivion into a relatively stable cash flowing machine, throwing off an average ~7% dividend to investors like Allianz desperate for yield. Total return has been stellar compared to the S&P up until 2018 (see Figure 1), when tighter FDA regulations around nicotine content and menthol cigarettes tumbled prices. Nevertheless, the tobacco industry continues to attract contingents of yield investors despite the continuing decline in smoking. It’s not quite a success story, but in the long game, it’s certainly beating expectations.

The analogy one can draw with the oil and gas industry is pretty clear, though not a perfect one. One lesson is that the playbook of demonstrating consistent yield is enough to draw back investor interest against relatively formidable social policy. An offshoot of this lesson is that consolidation and cost cutting are productive measures to achieve that end goal, and ones that should not be ignored as just a phase by those that have seen the industry in better times or believe that a resurgence in the commodity might change any of that. The yield paradigm is here to stay if we are look to tobacco as an example.

Of course, where the seams come loose is in the differences in capital intensity and end consumer between the O&G and tobacco industries. The oil and gas industry is highly capital intensive and produces commodities, which are not as easy to immediately increase profitability on by raising prices. The B2B model of the energy industry solves for the lowest cost product that achieves desired performance levels vs. the B2C model of the tobacco industry that can overcome this with brand favoritism and product differentiation. And while arguably both oil and gas and cigarettes are sold to a more or less captive consumer base (one from a necessity and one from a perceived necessity), the difference here is that the onus for transitioning away from a tobacco addiction is placed on the consumer, while the onus for transitioning away from an oil and gas “addiction” is placed on industry and the oil and gas companies themselves.

This nuance is important in that it demonstrates what a disconnect from consumers can do to create a heavier burden on the producing company. In not providing the necessary tools for a consumer to be able to transition easily, the oil and gas industry is continuing to set itself up for the narrative that the consumer is not to blame. So maybe the lesson here is that there needs to be greater integration between the oil and gas companies and the products that actually use the oil and gas – like vehicles or stoves. Becoming consumer facing could dramatically change the social dynamic and connect the industry with its most vocal opponents to solve the consumption problem together.

It's worth emphasizing that this comparison is NOT saying that oil and gas should be treated like a poison. Oil and gas enable and improve many vital operations around the world, while tobacco is detrimental to human health and welfare on an absolute basis. There are many existing technologies today that can turn oil and gas into a sustainable energy source, while the same can’t be true for tobacco (e-cigarettes tried). That’s exactly why the tobacco industry’s growth today is clearly a hopeful sign. The oil and gas industry has many more options than the tobacco industry to turn around its narrative.

A final lesson from the tobacco saga is that it does pay out to pursue the right growth initiatives. International markets, with a less developed social policy and greater product need, are an obvious target for both industries. And engaging in “smoke free” products with higher growth potential is possible and can be accretive for both the narrative and business itself, though this initiative certainly doesn’t come without risk, most recently demonstrated in the rise and fall of Juul. So the takeaway for oil and gas companies is to continue to seek energy transition opportunities in earnest…but with the expectation that the road will be long and rocky. Some experiments will inevitably fail, but most will certainly be worth doing.

New membrane technology may seem like an obscure part of the energy tech ecosystem, but there are surprisingly many processes across energy that depend on membranes. Anything that involves separation of product, like natural gas processing and oil refining, usually has a membrane involved to separate a fluid or gas New membrane technology may seem like an obscure part of the energy tech ecosystem, but there are surprisingly many processes across energy that depend on membranes. Anything that involves separation of product, like natural gas processing and oil refining, usually has a membrane involved to separate a fluid or gas stream into component parts. Biofuel production relies on membranes to remove by-products and yield a higher purity final product. Carbon capture systems often use membranes to separate CO2 from a gas stream in pre and post-combustion and to separate O2 from air in oxy-combustion. Many batteries use membranes as separators between the anode and cathode and similarly, hydrogen fuel cells depend on membranes to function as electrolytes for proton exchange. We recently pointed out the importance of water technology in energy transition. Membranes play a large part in enabling desalination, industrial and municipal wastewater treatment, water reclamation, and water purification.

So it’s clear that the development of novel membranes is important to both existing energy processes and future energy processes. Compared to alternative systems that use solvents and sorbents, membranes have the advantage of lower capital and operating cost, lower decay rates in performance over time, higher reliability, and great process continuity (vs. bath processing). The right membranes can lead to mass commercialization of many energy technologies.

But it’s no easy task to create new membranes. Membrane development is very closely tied to new materials technology, as what most membranes try to achieve cannot be achieved with natural materials. Depending on the application, membranes can target varying levels of permeation rates, physical and chemical modification properties, selectivity, resilience under physical conditions, and feed pressure. Commercializing membranes in an industrial system often means balancing cost, capacity to handle the permeating species, fouling risk, lifespan of the membrane, ease of installation and cleaning, and, increasingly, sustainability of the membrane manufacturing and disposal. Given how many different membrane materials can be used, how many structural variations there are in constructing the membrane, and how many different post-formation treatments can be applied to the membrane, membrane development is a very heavily iterative and scientific process. It’s not easy.

And that’s why, more than ever, energy transition requires investment and support of science-based technologies. There is a short list of investors (less than 200 across all stages and geographies in the venture space, or <1% of all venture capital investors) interested in advanced materials and materials science. These technologies often times rely on the government, incubators/accelerators, family offices, and other types of non-traditional funding to move them through the development cycle…but these capital pools are much smaller than the need, especially when it comes to scale up from lab or pilot to first commercial facility.

Membranes are just one piece of what is a larger section of the puzzle that gets overlooked. We’ve talked before about the need for funding for asset-heavy technologies. There needs to be greater financial and structural support for technologies like new membranes if we are going to be able to successfully finance energy transition.

There is a generous amount of discussion around the role of carbon dioxide and other GHG emissions in producing climate change. The majority of headlines surrounding climate change attribute it almost solely to GHG. Goals set by various climate authorities focus almost entirely on reducing the global carbon footprint and our CO2 equivalents. And when companies talk about sustainability, the pressure is almost entirely on reducing emissions. What seems to be egregiously overlooked is how water factors into our climate issues. As Earth’s largest natural resource, water is undoubtedly the single most important conduit by which the consequences of climate change develop, and solutions related to water are just as important, and may arguably be more important, to mitigating future changes to our planet’s environment.

In order to understand why this is, it’s important to dive into what makes water so crucial to almost everything around us. Water is already well known as a necessity for life on Earth. There is no lifeform on Earth (that we know of) that does not depend on water for its metabolic processes. But water serves other functions as well for the Earth, including being a:

Perhaps most illustrative of water’s influence is what happens to the environment with disruptions in the water cycle – namely, droughts. Prolonged scarcity of water can have devastating consequences to ecosystems, agriculture, livestock, and humans. Droughts often lead to food shortages, displaced habitats, and can induce secondary natural disasters like wildfires or flooding. Droughts are responsible for about 1/5 of the damage caused by natural hazards worldwide, costing trillions of dollars a year in damages and affecting more than 55 million people.

Droughts are part of the normal climate cycle in many regions of the world and can be caused by various natural events. But human-induced global warming is expected to increase the frequency and lengthen the duration of droughts via increasing the rate of evaporation in many regions and disturbing the atmospheric pressure differentials that drive seasonal storms. As a result, droughts are at once one of the least conspicuous but most serious consequences of climate change. And their intensification is happening already. Studies have shown a linkage between global drought patterns and increase greenhouse gas emissions can be seen as far back as the early 1900s.

So it seems that if we can “solve drought,” we can mitigate some of the most serious and immediate consequences of climate change. But solving drought is no easy task. The Earth has limited freshwater and a fast-growing population, which means we’re each fighting for an ever smaller allocation of this freshwater. As droughts proliferate to regions not previously used to drought and the “drought footprint” become more unpredictable, there will be more gaps between where freshwater is readily available and where freshwater is needed.

Luckily, technology can play a large part in closing these gaps. One set of solutions aims to increase freshwater availability and production by wastewater treatment, desalination, water transportation, and water collection/harvesting systems. The other set of solutions aims to increase the efficiency of water use, either through reducing the need for water via something like agricultural engineering or by reducing the amount of wasted water in operations via increased monitoring and enforcement of best practices. As the oil and gas industry knows very well, high demand for water combined with low water availability can dramatically stress a system. Having the foresight to implement innovative solutions to a water shortage ahead of time can prevent damaging effects to both our environment and our welfare. The key will be making these systems energy and cost efficient for mass deployment.

At TPH, energy technology is a broad umbrella. We typically include any technology with an impact on any type of energy at any point in the value chain. But when the rest of the world speaks about energy technology, there are often varying degrees of alignment with this definition. The “older” definition of energy technology refers primarily to alternative energy technology or “green” technology. The “newer” definition of energy technology refers primarily to oil and gas digitalization, Industry 4.0 technology, and other types of industrial software technology. There seems to be a very clear separation between the industrial tech world and cleantech world in how companies market/position themselves, the groups of investors interested in funding each group, and the types of strategics that end up as ultimate acquirors.

But as we’ve discussed before, this is a gap that is far too wide and unwarranted. Industrial tech is in many ways very “clean” and “green” and a good chunk of what is clean and green technology is in many ways Industrial 4.0-produced technology. Examples of the intersection include:

As one can see from the list, industrial technology can be impactful both from the production side and the consumption side. And while most conversations on “energy efficiency’ focus almost entirely on the consumption half of the equation, there is a wealth of technology being developed on the operational side that should be considered in equal measure.

Quantifying this impact is difficult. Reports vary in how much of an impact industrial technology can bring to our decarbonization pathways. Some cite up to a 15% impact on GHG emissions by 2030. Some talk about up to 50% impact by 2050. In fact, the number may even be higher. Historically, energy efficiency has been credited with decreasing emissions by more than 60% since 1980. One thing is clear: industrial advancement does make a meaningful and – maybe more importantly – immediate difference to our carbon footprint, and it’s a shame this solid connection does not get discussed more frequently.

It’s been hard not to notice that SPACs have emerged as the new “It” vehicle for the capital markets. The last few Bloomberg headlines this past month speak enough in of themselves:

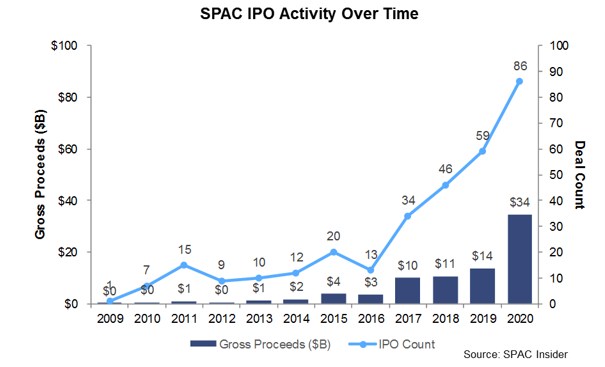

More than 80 SPACs have IPO-ed in 2020, a ~46% increase over 2019. ~57% of these have occurred just in the last two months. There’s clearly a hot market for these nontraditional investment vehicles – the question is: is this a temporary surge or are SPACs here to stay?

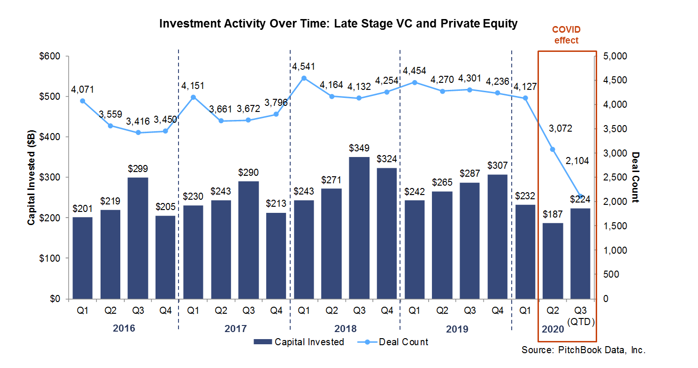

Much of the recent SPAC activity can be attributed to the widened gap in capital deployment that has formed between the public and private markets. COVID had the curious effect of both slowing down private capital and accelerating public capital, all in a very short amount of time. So while the S&P and Nasdaq continue to near record highs, late stage VC and PE buyout activity have slowed to near record lows. Figure 1 shows quarterly late stage VC and PE buyout activity and the clear disruption in the normal cycles of deal activity.

But it’s hard to isolate this as the sole cause for why SPACs are suddenly all the rage. While 2020 has clearly been a standout year for the SPAC world, SPACs have enjoyed a steady rise in the markets since about five years ago, with various ups and downs in the years before then. Figure 2 shows historical SPAC IPO activity over time.

SPACs have mainly served a niche market: taking companies public that would normally not be candidates for traditional IPOs. These include companies with odd growth cycles, companies that operate in areas where financing is hard to access, and companies with non-traditional assets. One reason for the rise in SPACs has been a rise in number of companies that fit these profiles. Because the time to exit has gotten longer, there are more late stage start up businesses than before, especially ones that would normally seek funding from private equity or venture capital and for one reason or another have limited access to that pool of capital.

Another reason has been the general rise in popularity of private investors, whose successes and reputation in the private markets have started to transfer to the public markets. We have seen the growing eagerness to participate in alternative asset classes via public vehicles manifest itself already, via alternative asset mutual funds, public private equity investors, REITS, MLPs, etc. SPACs seem to be the next evolution of this interest. For public investors, SPACs are a way to ride the private equity train while paying a discounted fare: being able to participate in private equity-like returns while maintaining the liquidity of being public.

But I think one final, perhaps less discussed reason, has been the slow realization over time that SPACs are becoming a more preferred vehicle to go public, especially ahead of market uncertainty. With a SPAC, a company can go public quicker (bypassing an arduous registration process), have more certainty around valuation, and have more visibility around its future investor base. The cons to going the SPAC route include significant dilution and less capital raised vs. a traditional IPO. But the popular practice of underpricing IPOs has lessened the dilution gap and the ability for SPACs to raise PIPE financing has lessened the new capital gap. The reasons for SPAC-ing begin to far outnumber the reasons for not.

So I think the question “Are SPACs here to stay?” can be answered with a resounding yes. And as energy tech investors, this is a very good thing. It's well known the difficulty with transacting hard asset technology companies with traditional investment vehicles. As SPACs grow in number and popularity, these very non-traditional investment vehicles can be the key to accelerating energy transition.

Carbon accounting is complicated

It’s hard to not run into debates over carbon accounting. Almost all of the 6 ‘W’s have a certain degree of contention around them. What environmental metrics do we report? Where and how do we report them? When do we report them – every year, every quarter, in real time? Who reports them and for what primary purpose – to provide a measuring post for our collective progress towards the Paris Accord, to shame the high emitters, or to scope out sustainability-related risks to a company’s financial performance (the most capitalist of aims)?

That’s why standards and frameworks are so important. Standards and frameworks aim to settle the “W”s. But the sheer diversity of reporting guidelines is most indicative of the fact that there is no “one standard.” A few of the most popular include: the GHGRP, SASB, GRI, CDP, CDSB, PRI, DJSI, TCFD…I’ll be the first to admit that keeping track of all of them makes my head spin.

Too many standards

A few efforts have been made over the years to align multiple standards and to clarify the similarities and differences between standards and frameworks. The CDP and GRI signed an MOU in 2013 to increase consistency between them. The CDSB published an Alignment Table in 2018 that sought to clarify which requirements are shared between standards. And most recently, SASB and GRI announced in July that they would be working together to share ways in which the two standards can be used with each other.

Even so, it’s not enough. The sheer complexity of the sustainability reporting universe creates a daunting task for anyone just beginning this journey. For larger companies, this may just be a matter of hiring a consulting firm to wade through the most up-to-date dialogue and painstakingly piece together a generally acceptable sustainability report. For smaller companies though, this could prove to be a prohibitive use of resources.

Just like Turbotax

The ease by which carbon accounting can be done is a determinant of reporting participation. Just look at our individual income taxes for example. In the US, the IRS’s returns received as a percentage of the overall population has increased from 42% to 47% over the last 40 years. For something that is a federal requirement, that is a substantial jump. Moreover, the number of people who have e-filed returns has increased from nearly zero in the 1980s to over 89% in 2019. TurboTax, the most recognizable and widely adopted tax prep software, charted its growth by focusing on ease of use and design. The role of software (and in particular, easy-to-use software) in aiding compliance to our taxation system is clear.

Because of the multiple standards, multiple reporting agencies, multiple formats, multiple goals, and continuous revisions and addendums that currently plague the carbon accounting world, there is an even greater need for a TurboTax-like software to ease the corporate reporting burden, systematically track data inputs and reporting frameworks/standards, and allow the opportunity for more companies to manage their carbon footprint. A company’s challenges in this process are certainly much different and more complex than an individual’s tax returns…which is why we expect that a popular solution will likely require an extraordinary understanding of company data and data management, a grasp of organizational structures, an intuitive onboarding process, comprehension of the nuances of each reporting standard, and patience, patience, patience.

While the COVID crisis has no doubt resulted in tragedy, both in human life and economy, the silver lining of it all is that the environment has benefitted, as evidenced by improvements in air quality, water quality, and possibly wildlife conservation. 3 months into our lockdown, the implications of these improvements on our environmental goals are apparent.

Our Paris Accord goals are achievable, but it will take massive sacrifice to get there

According to an article published by Nature, daily emissions globally are estimated to have fallen by ~17% as of April 2020. To put this into context, researchers estimated that lockdown emissions levels are roughly equal to those back in 2006. This is outstanding progress. Moreover, assuming some form of restricted activity extends through the end of the year, we are looking at ~7.5% decrease in global 2020 emissions, which is coincidentally very close to the number that UNEP recommends we cut emissions annually in order to meet the IPCC 1.5C goal. Said in another way, with the COVID crisis and near global economic meltdown, we are finally on track to reach our climate goals this year.

Though this highlights the ability to reach our goals via reduction in energy consumption alone, it also unavoidably inversely correlates economic impact with environmental impact. The reality is, to bring about the change we need ASAP, COVID has demonstrated that the economy is not likely to be left unscathed. The question for next year is: do we need to shrink the economy another 5%? Seems unconceivable, doesn’t it?

Of course, reduction in demand is not the only means that IPCC points to for overall emissions reduction. Technological development around energy efficiency, carbon neutral power generation, and carbon negative CCUS technologies are huge ingredients that are predicted to offset the need for a disruption in demand. But those are large structural developments that take time and resources. With clean technologies taking multiple decades to come to fruition and most power gen projects clocking in at around 3-4 years of development time, it’s hard to imagine that a truly “green recovery” won’t keep some form of this demand disruption as steady state.

Policy and structural incentives will have to evolve to accommodate progress

Although the environment has generally benefitted from COVID, the same can’t be said for environmental policy. With so much of the demand for carbon reductions gone, prices for environmental offsets have cratered and as a result, cap and trade programs have suffered. This brings to light what will continue to be an issue: once we start getting cleaner, how do we stay cleaner? In times of carbon decrease, caps will need to be artificially increased to accommodate the lower value of carbon. That will mean that though we tout cap and trade as a largely market-based form of regulation, frequent government intervention will be needed when we make progress to ensure that these programs continue to incentivize us in the right direction. And in times like these, when businesses are already suffering, artificially increasing the price of carbon will hurt businesses financially.

Something that could prevent this over-reliance is genuinely increasing the value of carbon. Finding more uses for carbon keeps prices up even in times when we have less of it (and maybe especially in times when we have less of it). What COVID has shown is that focusing our attention on developing technology around carbon use is our most sustainable form of regulation.

Takeaways

So the environmental takeaways from this seemingly surreal time in our life: 1) Decreasing demand to reach our goals is possible and likely necessary. We might have to commit to some level of this disruption in our day to day going forward to reach our climate goals. 2) A large decrease in carbon emissions has unintended consequences on the very mechanisms put forth to achieve them. Increasing the value of carbon should be one of our first priorities to avoid this. 3) Though this crisis is indeed a crisis in every sense of the word, it’s brought forth important learnings that will hopefully guide a smarter green strategy going forward.

It’s actually fairly hard to track down public company GHG emissions data. The GHGRP (Greenhouse Gas Reporting Program) only releases data reported at the facility or regional level, not at the company level. Data at the company level is buried in individual, non-standardized 100-page long climate reports, often in varying flavors of charts, tables, and graphs. Scouring them all manually is a slog. Scraping them automatically is a college thesis-worthy data mining exercise.

Luckily, we do have the CDP, or the Carbon Disclosure Project. CDP’s database aggregates voluntarily disclosed emissions data from a questionnaire sent to thousands of companies. From that questionnaire, the CDP rate companies a score from A – F for their climate change transparency, performance, and leadership.

Of the ~180 companies A-scoring companies that made the list, 28 were financial institutions, 46 were consumer goods or retail trade companies, 37 were industrial services / industrial process / industrial manufacturing companies, and 30 were technology and telecom companies. Only 9 energy companies made the list – all utilities. No oil and gas companies.

The A-minus list does have a group of oil and gas players. Total, ENI, Repsol, Hess all made the CDP A-minus…and a larger handful more – Equinor, Suncor, Petrobras, Shell, ConocoPhillips – made the CDP B-list. Conspicuously absent from the list of “good” scores (defined as a B-minus or higher, which is generous by today’s high school standards) are the rest of the majors, most of the US independents, midstream companies, and oil service names. Out of the ~240 oil and gas companies scored in the database, ~160 have ended up with a big fat F. Most of these companies have ended up in this position due to lack of disclosure or response to CDP. Concho, for example, despite having a climate report, has an F in the system.

Is it fair to penalize companies that might have just accidentally thrown away their questionnaire in the mail? Or simply didn’t know what the CDP is?

As more and more of the energy industry’s future is tied to transition, the answer is increasingly yes. Just like how “good citizen” financial practice for publicly owned companies requires full transparency and adequate disclosure to investors, “good citizen” environmental practice for emitters calls for full transparency and adequate disclosure to the world. To do this in a meaningful way, participation in major disclosure initiatives like CDP is a requirement.

CDP tellingly describes its A-listers as “leaders” earning “leadership” points. As the CDP website states, “Our scoring measures the comprehensiveness of disclosure, awareness and management of environmental risks and best practices associated with environmental leadership, such as setting ambitious and meaningful targets.” CDP claims its high scorers are setting the gold standard for environmental leadership – which means that current environmental leadership is made up of largely non-energy companies.

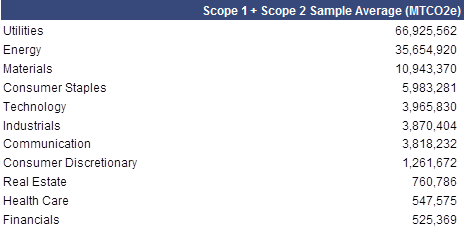

At the same time, a look at the average Scope 1 + 2 emissions numbers across sectors shows a reverse list (see Figure 1). Energy / utilities companies dominate in their high emissions numbers. An energy company averages emissions many times the emissions for a financial or technology company.

A high emissions number does not mean that the businesses are inherently bad. The energy industry is more prone to high emissions numbers than the technology or financial industries purely due to its proximity in the value chain to higher emitting industrial processes, but it makes up for that in its undeniably important role in human welfare. Reducing emissions while keeping up the responsibility of this role requires thoughtful environmental leadership from the players whose emissions matter the most. And that means full on participation in initiatives like the CDP.

Last time, we explored how the venture capital world came to dislike hardware and prefer software. Modern technology companies with hard assets continuously face difficulty finding funding and often receive heavily discounted valuations because of increased competition for VC capital with similar-stage asset-light businesses. Multiple aspects of an asset-light business align it better with the VC model: the shorter time to return, the more straight-forward (and frequently less technical) value proposition, the perceived lighter capital intensity, and the nimbler business model.

Add to that, the VC world has grown significantly since its inception, which has only increased the compounding effect of the “club mentality” that concentrates venture interest in popular investment areas. The more widely-attractive investment areas receive the majority of the interest because VCs often have to rely on the investment’s ability to attract other investor capital in the same round or subsequent rounds. As a consequence, the less popular and more niche investment areas struggle to attract attention.

Is it unfair for asset-heavy innovation to lack in capital funding because of characteristics inherent to their technology? Or a better question: is it unwise for asset-heavy innovation to lack in capital funding because of characteristics inherent to their technology?

As we are constantly reminded in this time of energy transition, investment in new infrastructure and hard assets is what is needed to bring about the necessary change. When we are putting together our innovation priorities to leave asset-heavy businesses at the bottom of the list, are we being mindful of what is or isn’t productive innovation? One could argue that the current VC model that optimizes for largest economic return with the least amount of capital in the shortest time possible does not equally optimize for largest benefit to society (or at least, to global productivity) with the least amount of capital in the shortest time possible. So, in many ways, the problem of funding asset-heavy businesses mirrors the problem of funding ESG investments. But that’s another article.

The goal of this article is to discuss the current and potential funding models for incentivizing asset-heavy innovation. Certain funds already are structurally more amenable to funding asset-heavy businesses. These include:

Corporate Venture Capital (CVC) Arms of Asset-Heavy Companies – CVCs have the benefit of a sole corporate LP whose strategic priorities are considered alongside economic return, so their “total return” is potentially greater than that received by a strict financial investor. CVCs also have the benefit of having access to larger company resources to evaluate new investments and should theoretically be better positioned to evaluate more engineering-heavy, niche technologies.

Internal Innovation in Asset-Heavy Companies – Sometimes the best innovation in asset-heavy industries is sourced from the incumbents themselves. Developing strong corporate innovation programs by establishing things like an internal pitch competition, innovation fund, incubator, or even a separate innovation / R&D group entirely can incentivize innovation in niche industries and allow whatever technologies come out of that process the wherewithal to scale in being part of a large corporate budget.

Similar to this concept is the idea of “funding” via time investment. The widely publicized 20% Rule at Google and the 15% Rule at 3M are examples of this. In each of those companies, employees are encouraged to devote 15-20% of their time during the workweek to innovation projects that could result in new products for the company.

Family Offices / Sovereign Wealth Funds – Family offices and sovereign wealth funds (SWFs), much like CVCs, have single LPs with often non-financial strategic goals. For family offices, this may be as simple as the family / individuals’ personal interest. For SWFs, this may include a country’s reputational and political impact or job creation. Both of these types of investors tend to look longer-term when evaluating investments, which allows room for certain asset-heavy investments that take longer to scale.

Government Agencies – Government agencies like DARPA have long since funded asset-heavy innovation, especially in the defense industry. With the goal to spur innovation within their home countries, they have similar incentives to SWFs but typically focus even less on financial return. Many of these agencies choose to fund via grants.

Theoretically, the overwhelming interest in asset-light investments and limited interest in asset-heavy investments from institutional VC investors should divert the overlooked asset-heavy investments into the capital above, and these capital providers should naturally increase their exposure to asset-heavy investments because of their lesser competition. Like in any free market scenario, the arb should get priced away. Problem solved, right?

Not so much. Overall funding in venture capital from the above institutions remains just a fraction of all VC capital while asset-heavy investment opportunities continue to grow in breadth and number, especially as heavy industries (like energy) look to focus on innovation. Moreover, corporate R&D budgets continue to decrease, and asset-light businesses like software continue to garner attention from these funds. So where will the new capital that’s needed for asset-heavy businesses come from?

As alluded to in Part 1, I believe there is an entirely new class of institutional VC funds that can emerge to strictly to invest in hard asset technologies. This is and will be necessary to balance out the equation.

What could that look like? Some suggestions:

Large Advisory Boards – Hard asset technologies often require significant engineering and technical expertise. The advantage that CVCs have in accessing a pool of technical resources could be replicated by an institutional fund having access to its own set of SMEs gathered solely for this purpose. The downside is, of course, potential cost of such a construct, and a reliance on third parties for evaluation of a technology.

Builder-led funds – This downside can be eliminated by just having the entire team composed of individuals with technical backgrounds and experience in building / scaling hard asset technologies. Builder-led funds are better able to understand the challenges and opportunities with hard asset technologies, offer meaningful support to their entrepreneurs, and attract like-minded LP capital.

Corporate Partnerships and LPs– Having corporate partners is somewhat like being the CVC for multiple corporates. In addition to having a built-in advisory board, this structure also lends itself to more flexible financial criteria as strategic fit with corporate partners can help drive an earlier exit or accelerate validation of the technology. In some cases, corporate partners pay a fee to the fund to essentially scout out new technologies for them. This offsets some of the required return.

Permanent Capital Funds – Non-traditional VC structures will be necessary to accommodate investments with longer time to maturity. Permanent capital funds are an example of one such structure. In a permanent capital fund, investments are held much like a mutual fund. The fund’s goal is to increase the collective value of all of the holdings. Periodic valuations by third parties establish the worth of each share or unit. Investors in permanent capital funds can buy / sell their stock to each other on a public or private exchange and the fund can periodically sell more stock for liquidity. In removing the requirement of an exit to generate return, permanent capital funds are able to accommodate longer term investments.

The point is: for funds that have the capital structure and mandate to support asset-heavy innovation, there should be an increased preference for asset-heavy investments. For institutional VC funds that may struggle to fit asset-heavy investments in their existing structure, there are plenty of ways to adapt.

To incentivize asset-heavy innovation, we will need to innovate the way we innovate.

I often hear the words “Sorry, I can’t invest in hardware” Or “we’re only interested in capital light businesses” nearly everyday while speaking to others on our energy technology effort. It’s a very common wall to run up against.

Out of the collective $167B raised in the US in 2019 for venture capital deals, $94B or 56% went to software. Within the $73B raised for non-software startups, 82% went to healthcare, services, and consumer goods. Only the remainder - 18% of the non-software pool and 8% of the entire $167B - went to what can be categorized as “hard assets” – startups that specialize in commercial products, IT hardware, energy equipment, and industrial equipment.

For startups that need the most capital to scale, we’ve allocated the least.

It wasn’t always like this

Modern venture capital traces its roots back to the 1940s. As Nicolas Colin details in his essay on the history of venture capital, the emergence of these financial entities came as a result of a technological fervor that began in WWII. The US, fueled by wartime tensions (and those that continued through the Cold War), had a newfound desire to fund scientific and technological breakthroughs. Money poured into R&D efforts at academic institutions to develop technology that would benefit the US military. As a result, we can thank the 1940s - 60s for inventions like radar, the jet engine, rocketry, penicillin, microwave, and the atomic bomb.

But a problem emerged within this innovation renaissance. Commercializing these emerging technologies was a struggle. Underwriters and lenders were used to valuing businesses that were either regular way retail businesses with existing customer bases or businesses with tangible assets that could serve as collateral. Technology businesses fit in neither of these categories. As Colin puts it, “[Tech businesses] couldn’t borrow from banks because their business model was unknown and they still had everything to prove. And they couldn’t raise capital from the public because no financier could value them.” So who would fund these new businesses? This gap in the market quickly became a boon for investment firms started by wealthy families, who saw the opportunity and could afford to take the risk. These first mover investors enjoyed much success in what was a virtually untapped market.

The next boom of venture capital after that continued to fund hard asset technologies. Semiconductors, transistors, microprocessors…and of course, personal computers. Venture capital-funded innovation back then was linked to the production of devices and electronics. But that soon changed when writing software for those devices established itself as a separate industry.

A match made in heaven

Venture capitalists soon found themselves more and more interested in this subspace of ICT, and for good reason. Software was perfect for the venture capital model. Institutional venture capital firms have an investment horizon of 5-8 years, typically make small investments in a large number of firms, and require big returns on a small number of investments in order to make up for the higher startup failure rates. All of this combines to make fast-scaling, low capital cost investments the perfect target for venture capital.

Moreover, the mass proliferation of the venture capital model combined with the lengthening time to exit means that more and more of the future value of a startup becomes concentrated in the ability of that startup to raise subsequent private capital rounds. The modern venture capitalist has to weigh factors that have less to do with the underlying technology and more to do with how this company might be viewed by others. What is the risk that this company might not be able to raise more capital in the future? Would x firm down the street understand and believe in the technology enough to able to invest with me at a later date? Are others in investor space generally looking at this type of technology? How easily sellable is this technology to the investor community?

This line of thinking plays into why venture capitalists invest in “clubs,” like easily understood technology, and like staying within generally accepted areas of interest. This translates well to software. Software often has a straight forward value proposition, its proliferation is embraced by many investors regardless of technical background, and its history of fundraising success provides assurance that there will be a healthy number of investors that look at this type of technology. Software’s popularity in the VC community has in itself cemented its preferential status over other types of technologies.

An evolution waiting to happen?

Unfortunately, this line of thinking also plays into why it’s such an uphill battle to encourage more investment in hard asset technologies. Understanding the superiority of one technology over another in this space often requires scientific or technical knowledge, which presents a hurdle in limiting the number of investors that would have (or care to devote resources to) understanding the landscape. Differentiated hard asset technologies also tend to be nichier areas that aren’t widely marketed as “hot spots” for VCs. The perceived lack of club-worthiness, high capital intensity, and longer time to scale raises the perceived risk for an incoming investor and makes it difficult for him/her to value the business.

Which is precisely what makes them a gold mine. As we saw in the history of venture capital, the lack of ability by incumbent investors to value to certain types of businesses led to the emergence of a whole new class of investors for those businesses. These investors saw the opportunity and invented a new financial entity to handle a different risk profile.

The current venture capital model has evolved to invest in software and asset light businesses. But that’s no reason why investors should shun hard asset technologies. As we see everyday in etech, the number of hard asset technologies increase by the day as the world moves from consumer-led digitalization to industrial-led digitalization. These technologies will increasingly need capital to move innovation forward. And I believe they will find it in the venture capitalists that evolve their fund structures to accommodate them, much as they did once before in history.

Next time we’ll explore what that might look like…